Highlights

- Findi has secured contract expansion with SBI to deploy 2,293 additional BLAs.

- Additional BLAs are expected to generate AU$250-270 million in revenue and AU$125-135 million in EBITDA.

- For FY25, the company forecasts EBITDA of AU$30-32 million and revenue of AU$68-70 million.

- Regulatory approvals for the Indicash acquisition have been secured, with final settlement expected by month-end.

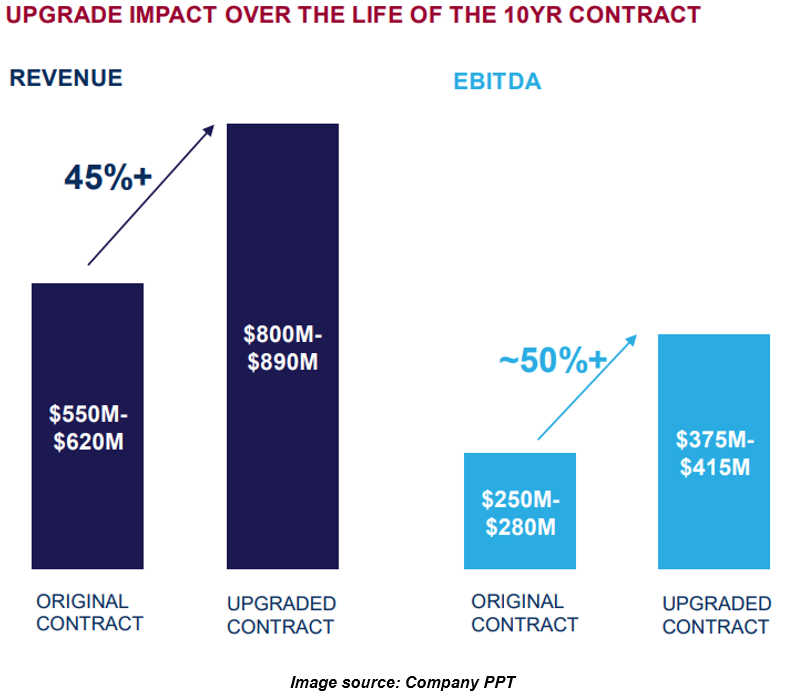

Findi Limited (ASX:FND) has announced an expansion to its 10-year contract with the State Bank of India (SBI), the country’s largest bank. Under this expanded agreement, Findi’s subsidiary, Transaction Solutions International (India) Pvt Ltd (TSI), will deploy additional 2,293 Brown Label ATMs (BLAs), increasing the total number of BLAs to 6,512, representing a 54% increase from the original contract signed in October 2023.

The additional BLAs are expected to generate revenue of AU$250-270 million and EBITDA of AU$125-135 million.

FY25 Revenue and EBITDA Guidance

FY25 Revenue and EBITDA Guidance

Findi expects an EBITDA of AU$30 million to AU$32 million and revenue between AU$68 million and AU$70 million for FY25.

The company has revised its FY25 revenue guidance due to a delay in securing the White Label ATM (WLA) license that will now transfer upon the completion of the acquisition of Tata Communications Payment Solutions Limited (TCPSL or Indicash).

The company has received regulatory approvals for the acquisition of Indicash, and the final settlement is anticipated by the end of this month.

Findi Secures Favourable Terms in New SBI Agreement

Findi has secured significantly better pricing under its new agreement with SBI compared to the previous third-party outsourcing arrangement. As a result, the company anticipates margin gains in the BLA segment over the next six months as the newly contracted SBI ATMs become operational.

The agreement has a seven-year term with a three-year extension option. The rollout of ATMs will commence in October 2025 and is anticipated to be finalised by March 2026. The capital expenditure (CapEx) for this expansion will be funded through Findi’s free cash flow and new bank facilities.

Rothschild Appointed for 2026 Indian IPO

Findi’s Indian subsidiary, Transaction Solutions International (India) Private Limited (Findi India), has appointed Rothschild & Co as its financial advisor for its planned 2026 IPO. Rothschild is a global leader in Equity Capital Markets (ECM) and IPO advisory.

Findi anticipates its FY26 revenue to more than double compared to FY25. This growth is expected to be driven by a mix of organic expansion in its core TSI business, rapid growth in its WLA operations, and capitalising on the momentum from its TCPSL and BANKIT acquisitions.

FND shares trade higher

FND shares were trading 4.82% higher at AU$4.78 per share at the time of writing on 17 February 2025.