Highlights

- FND is raising AU$45 million to fund strategic initiatives.

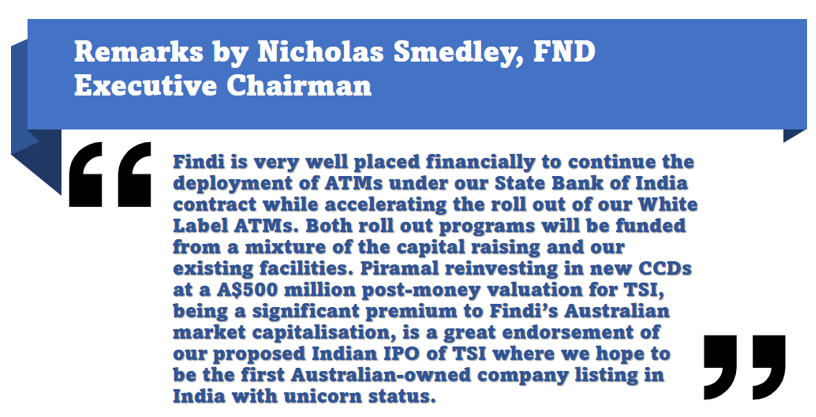

- TSI and Piramal Alternatives have agreed to a buyback of existing CCDs, with Piramal reinvesting at a post-money valuation of AU$500 million, ahead of its 2026 Bombay Stock Exchange listing.

- FND’s directors have committed AU$1.0 million to the placement, subject to shareholder approval.

- Funds will be used for restructuring CCDs issued to Piramal, expansion of SBI partnership and accelerating White Label ATM rollout post the TCPSL acquisition.

Findi Limited (ASX:FND) has announced a AU$45 million capital raise through an institutional placement and a share purchase plan (SPP).

The company has secured binding commitments for a AU$40 million placement, with the remaining AU$5 million to be raised through the SPP.

In parallel, FND’s subsidiary, Transaction Solutions International (India) Pvt Limited (TSI), has reached an agreement with Piramal Alternatives, an Indian investment group, to repurchase existing Compulsory Convertible Debentures (CCDs). Under this arrangement, Piramal will reinvest the original principal into new CCDs, valuing TSI at AU$500 million post-money.

Placement details

The placement will involve the issuance of approximately 10.0 million new shares, representing 20.3% of the company’s existing shares. The shares will be offered at a fixed price of AU$4.00 per share, reflecting a 12.3% discount to Findi’s closing price of AU$4.56 as of 13 March 2025, and a 15% discount to the five-day VWAP of AU$4.707.

The capital raise has attracted significant demand from new institutional investors, existing shareholders and other sophisticated investors. Additionally, the company’s directors have committed a minimum of AU$1.0 million to the placement, with their participation subject to shareholder approval.

The settlement of the shares issued under the placement is scheduled for 26 March 2025, with allotment and commencement of trading expected on 27 March 2025.

SPP details

Existing shareholders who held shares as on 19 March 2025 and have a registered address in Australia or New Zealand will be eligible to participate in the AU$5 million SPP at the same terms as the placement. A condition of the SPP stipulates that any shareholder who sells their shares during the SPP offer period will not be allocated new shares.

The SPP is set to open on 27 March 2025, and close on 11 April 2025.

Use of funds

A significant portion of the funds raised will be directed towards the restructuring of CCDs issued to Piramal, covering a termination coupon of AU$17.2 million. This amount includes accrued interest and an additional contractually obligated payment to ensure a 15% per annum Internal Rate of Return (IRR) of 15% on Piramal’s principal investment, calculated up to November 2026.

Further, the funds will support the expansion of Findi’s partnership with the State Bank of India (SBI). The company plans to deploy 2,293 additional ATMs under a new agreement with SBI, a 54% increase from the 4,219 ATMs awarded in October 2023.

Additionally, Findi aims to accelerate the rollout of White Label ATMs following its acquisition of TCPSL.

Piramal’s reinvestment and TSI’s call option

TSI has exercised its call option to buy back unlisted CCDs previously issued to Piramal. In November 2023, TSI initially raised AU$37.6 million through the issuance of CCDs, which were structured to convert into equity at a pre-IPO market valuation of AU$153 million (AU$190.9 million post-money). Under the agreement, TSI had the right to repurchase these securities at a committed 18% IRR.

Following TSI’s call option exercise, Piramal has agreed to reinvest AU$36.31 million into new CCDs, valuing TSI at AU$500 million post-money ahead of its anticipated 2026 listing on the Bombay Stock Exchange. This exercise will result in a one-time FY25 redemption payment of AU$17.2 million, covering a termination coupon payable to Piramal, which includes accrued interest and ensures an 18% per annum IRR on its principal investment.

FND shares surge

FND shares were trading nearly 17% higher at AU$5.32 per share at the time of writing on 20 March 2025.