Highlights

- ASX-listed fintech company, Findi Limited, offers customised, flexible, and scalable payment services in India.

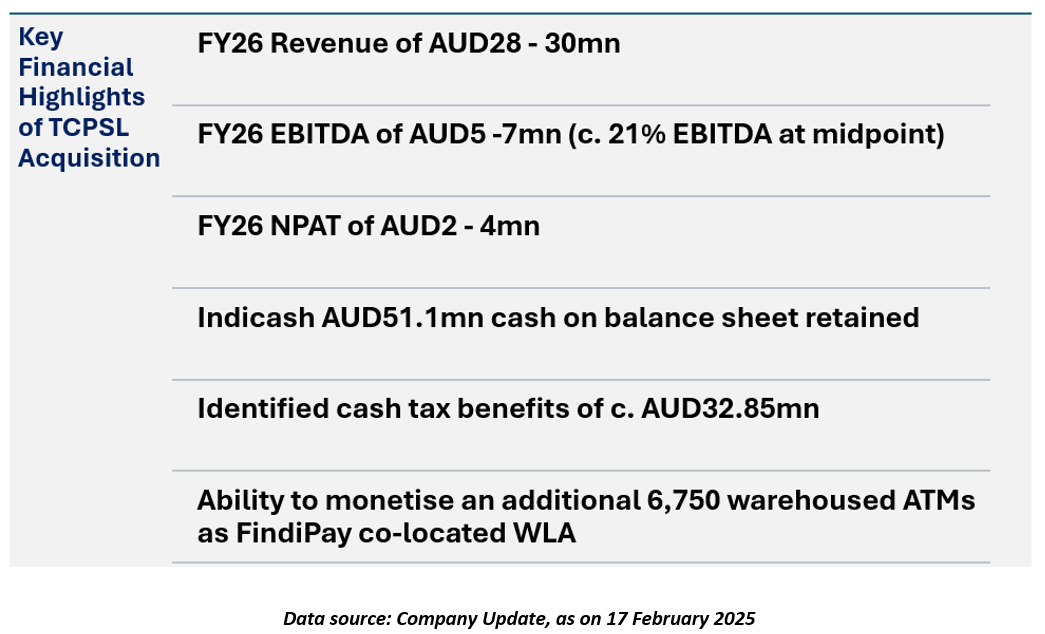

- Findi’s acquisition of TCPSL is expected to generate FY26 revenues of AUD28 -30mn and NPAT of AUD2- 4mn.

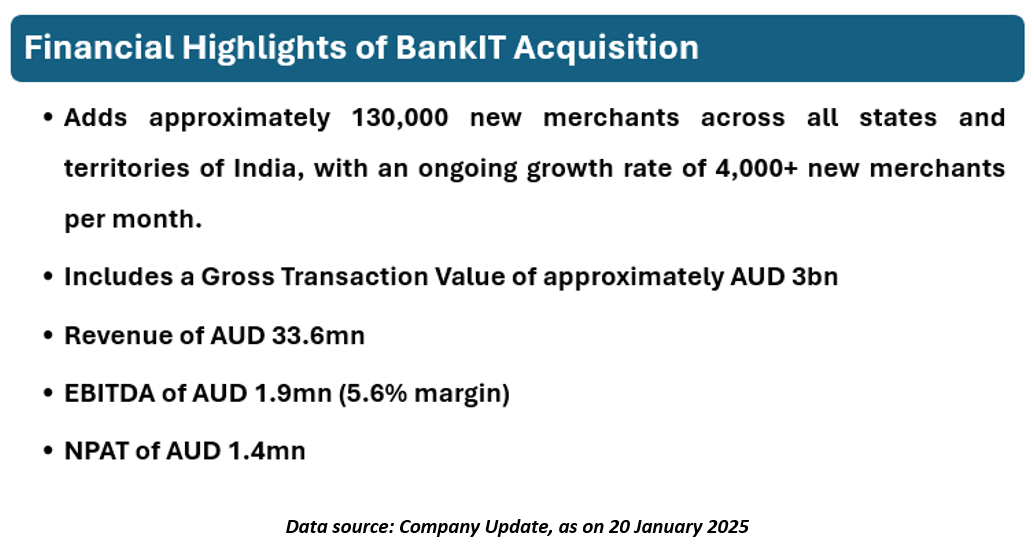

- The acquisition of BankIT contributes around 25% of consolidated revenues from digital payments post-completion.

- ATM contract with Union Bank of India is expected to generate AUD 75 to 80mn in revenue and AUD 33 to 38mn in EBITDA over a 7+1 year period.

- Revenue expected under the upgraded SBI ATM contract falls between AUD 800 to 890mn and EBITDA of AUD 375 to 415mn over its duration.

ASX-listed fintech company Findi Limited (ASX:FND) has recently achieved significant milestones through strategic acquisitions and ATM contracts with leading Indian banks.

The digital payments and financial services company offers customised, flexible, and scalable payment services in India. With a major focus on sustainable and cash flow accretive earnings, Findi aims to achieve growth through its expanding ATM portfolio and innovations within the White Label ATM (WLA), digital payments, and banking sectors.

Findi Enhances Payment Connectivity with Key Acquisition

In March 2025, Findi announced that Transaction Solutions International (India) Pvt Ltd (TSI), Findi’s majority-owned subsidiary, has completed the acquisition of Tata Communications Payment Solutions Ltd (TCPSL). As a result, TCPSL is now a wholly owned subsidiary of TSI.

The completion of this acquisition marks a crucial strategic milestone for Findi’s ATM business, expanding its footprint with TCPSL’s 4,829 Indicash ATMs and a White Label ATM platform that includes a license, payments switch, and 3,000 additional ATMs to be deployed. This acquisition also grants Findi India’s first integrated White Label ATM payment switch, offering direct access to all debit and credit card banking facilities across Indian banks. Furthermore, the payment switch enables Findi to connect seamlessly with integrated payment devices like micro-ATMs, biometric payment systems, and UPI-based cash withdrawals.

Findi Expands Market Reach and Revenue with BankIT Acquisition

Findi’s growth strategy has been fast-tracked with the transformational acquisition of BankIT Services Pvt. Ltd. for AUD 30 million. Announced in January, this acquisition was made through Findi’s majority-owned subsidiary, TSI (India) Pvt Ltd.

BankIT, a new-age distributor of digital financial products and a key enabler for its partners, is focused on bridging the financial gap in India.

This strategic acquisition of BankIT accelerates Findi’s growth trajectory by two years, contributing around 25% of consolidated revenues from digital payments post-completion.

Furthermore, Findi Digital (FindiPay and BankIT) is now free cash flow positive, with BankIT retaining AUD 5.9 million in cash on its balance sheet.

Findi Expands ATM Footprint with Enhanced Agreements with SBI and Union Bank

Findi has strengthened its position in the Indian ATM market with key contract upgrades and new agreements. The company’s 10-year contract with the State Bank of India (SBI), has been upgraded by a 54% increase in the number of ATMs to be deployed and managed, raising the total revenue expected under the contract to between AUD 800 million and AUD 890 million and EBITDA to AUD 375 million to AUD 415 million over its duration.

In addition, Findi has secured a new contract with Union Bank of India for 900 additional ATMs, which is expected to generate AUD 75 million to 80 million in revenue and AUD 33 million to AUD 38 million in EBITDA over a 7+1 year period. This full deployment will contribute an additional AUD 10 million to AUD 11 million in annualized revenue and AUD 4.5 million to AUD 5 million in annual EBITDA.

With these developments, Findi is now focused on consolidating its recent acquisitions of TCPSL and BankIT while executing its strategies for WLA and Payments Bank. In addition, the proposed listing of Findi's subsidiary, TSI India, on the Bombay Stock Exchange, with aspirations for a market capitalisation exceeding AUD 1 billion, is expected to offer a significant liquidity event for Findi through a compulsory sell-down as part of the IPO process. The IPO of TSI India is planned for completion by the end of the calendar year 2026.

Findi's share price was AUD 4.080, up by 2% on 01 April 2025.