Highlights

- Far East Gold will undertake an extensive diamond drilling program at the Idenburg Gold Project in Papua.

- The campaign aims to expand and upgrade the 540,000-ounce (4.1g/t) JORC-compliant inferred gold resource.

- 20 drill holes, covering 2,670m, will focus on the Sua, Bermol, and Mafi prospect areas, testing mineralisation along strike and at depth.

- 12 drill holes, covering 1,000m, will be drilled at the Kwaplu prospect area, targeting an untested gold-in-soil geochemical anomaly.

Far East Gold Ltd (ASX:FEG) is launching a large-scale diamond drilling program at its Idenburg Gold Project, located in Papua. The campaign aims to expand and upgrade the existing 540,000-ounce, 4.1g/t JORC-compliant inferred gold resource.

The program will involve drilling 20 holes covering 2,670m, focusing on the Sua, Bermol, and Mafi prospect areas to expand the resource and upgrade classifications from inferred to indicated and measured. The planned holes will test mineralisation both along strike and at depth. Additionally, composite material will be used for advanced metallurgical testing to improve the understanding of mineral recoveries.

In a parallel effort, 12 holes will be drilled over 1,000m at the Kwaplu prospect area, which hosts a large, untested gold-in-soil geochemical anomaly. This initial scout drilling program aims to assess the mineralisation potential of the area.

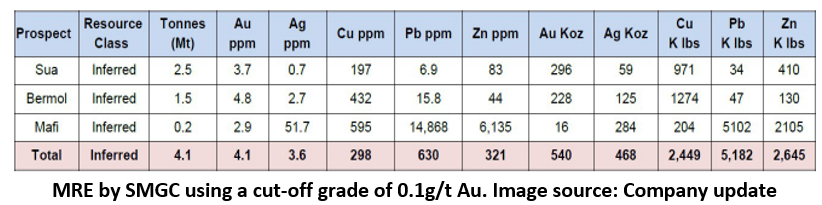

Idenburg Resource Estimate

Independent consultants SMGC finalised the maiden resource estimate for the Sua, Mafi, and Bermol prospect areas by utilising the historical drill data and newly acquired topographic surveys. Following a review of the historical geological database, SMGC confirmed that the mineralised zones meet the 2012 JORC Code standards for classification as a Mineral Resource.

Total inferred JORC-compliant resource estimate for Idenburg stands at 4.1 million tonnes at an average grade of 4.1 g/t gold and 3.6g/t silver representing 540,000 ounces of gold and 468,000 ounces of silver

Exploration Potential

The past exploration has only covered 30% of the total Contract of Work (CoW) area, leaving the majority of the property under-explored and presenting significant expansion potential.

SMGC has projected an exploration target ranging from 189,000 ounces at 1.0 g/t Au (lower range) to 7.2 million ounces at 6.1 g/t Au (upper range).

Sua Prospect Drilling Plan

Historical drilling (2005-2006) at Sua intersected gold-bearing zones in 18 out of 22 holes. Notable results include:

- KSD001 (4m @ 5.96 g/t Au from 41 metres depth)

- KSD002 (7.5m @ 13.6 g/t Au from 21 metres

- KSD004 (1m @ 33.8 g/t Au from 123 metres)

- KSD005 (9m @ 4.00 g/t Au from 80 metres)

- KSD008 (3.0m @ 35.0 g/t Au from 107 metres)

- KSD010 (3m @ 17.7 g/t Au from 55 metres)

- KSD021 (1m @ 23.0 g/t Au from 77 metres)

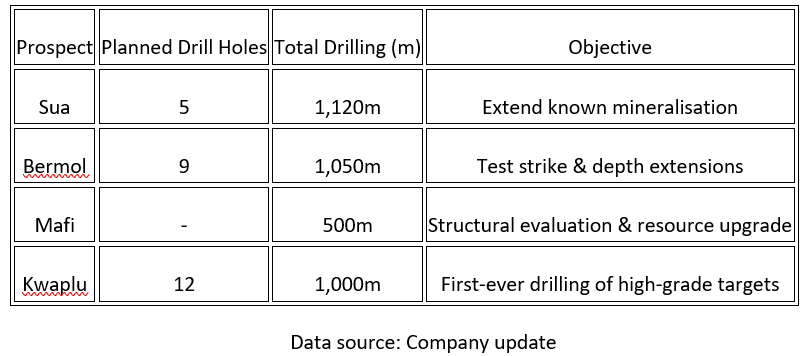

Planned drilling at the prospect will include five holes spanning 1,120m and will target lateral and depth extensions of known mineralisation.

Bermol Prospect Drill Plan

Previous drilling at the prospect defined a 600m-long, 300m-wide gold-bearing quartz-sulfide vein zone. The core area (400m strike) was partially tested, but extensions remain unexplored. Best historical results include:

- BRD001: 5m @ 5.40 g/t Au (from 16m)

- BRD003: 5m @ 4.15 g/t Au (from 46m)

Planned drilling at Bermol will include 9 holes totalling 1,050m, aimed at testing strike and depth extensions, with the goal to expand the current resources estimate.

Mafi Prospect Drill Plan

The 2000 drilling campaign (23 holes, 1,642m) at the prospect identified near-surface, mineralised quartz veins over a 100m x 400m area. FEG has planned 500m drilling, with exact drill locations to be determined by ongoing structural evaluations by Murphy Geological Services.

Kwaplu Prospect Drill Plan

Geochemical surveys identified a significant gold anomaly with soil assays up to 3.55 ppm Au over 125m. Rock float samples returned high-grade gold, including 7 g/t, 49 g/t and 260 g/t Au.

The drilling program will cover 12 holes totalling 1,000m, testing both high-grade rock sample areas and broader soil anomalies. Initial mapping and sampling will refine drill targets.

Planned Drilling Summary

FEG shares were trading at AU$0.14 per share at the time of writing on 27 March 2025.