Highlights

- Cyprium Metals has executed an agreement with Nebari Natural Resources Credit Fund II, LP, securing a loan facility of AU$21.0 million.

- The latest development refinances the existing short-term Secured Loan Deed facility with Avior Asset Management No. 2 Pty Ltd.

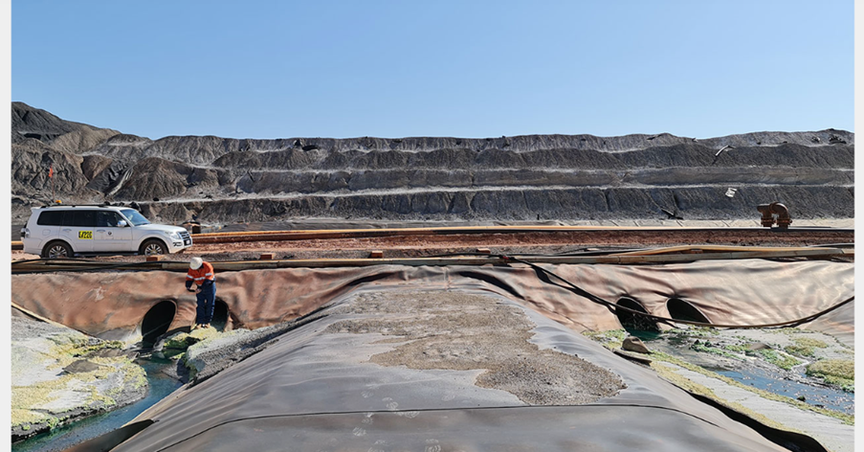

- The facility would be used to advance developments across the company’s Nifty project.

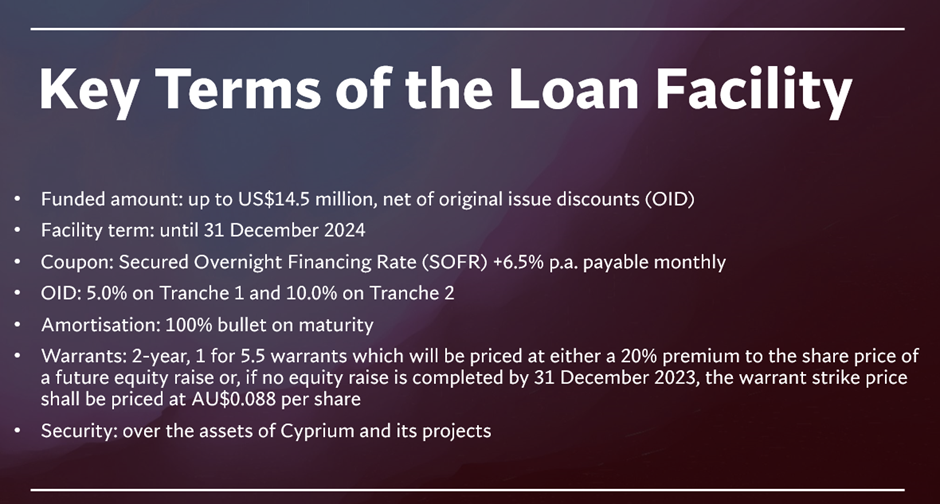

ASX-listed copper developer and explorer Cyprium Metals Limited (ASX: CYM) has executed loan documentation with US-based investment manager Nebari Natural Resources Credit Fund II, LP, securing a loan facility of US$14.5 million (AU$21.0 million).

The 18-month-long loan facility has refinanced the existing Secured Loan Deed facility with Avior Asset Management No. 2 Pty Ltd. The proceeds from the facility would be directed towards progressing the development activities at Nifty.

The funds will be issued in two tranches - US$7.5 million will be drawn at closing, while US$7.0 million will be drawn following the conditions precedent.

Data source: Company update

The company expects this facility to become a larger, longer term development financing facility over the upcoming period; however, this is subject to the completion of the Nifty life of mine study on the integrated copper oxide Heap Leach SX-EW starter operation as well as the larger scale sulphide open pit. The studies are likely to be wrapped up by the first quarter of 2024.

Remarks by Mr Donner, an executive with Cyprium