Highlights

- Cooper Metals has revealed results for an independent consultant’s prospectivity review of Ardmore tenement.

- The results have highlighted strong structural control on Cu-Au mineralisation in the area and detected new Cu-Au targets for systematic field exploration.

- Total 11 Cu-Au targets have been identified in the review, confirming surface Cu-Au mineralisation returning rock chip results.

- So far, CPM has outlined over 50 Cu-Au targets within its 1,600sqkm Mt Isa East Project area

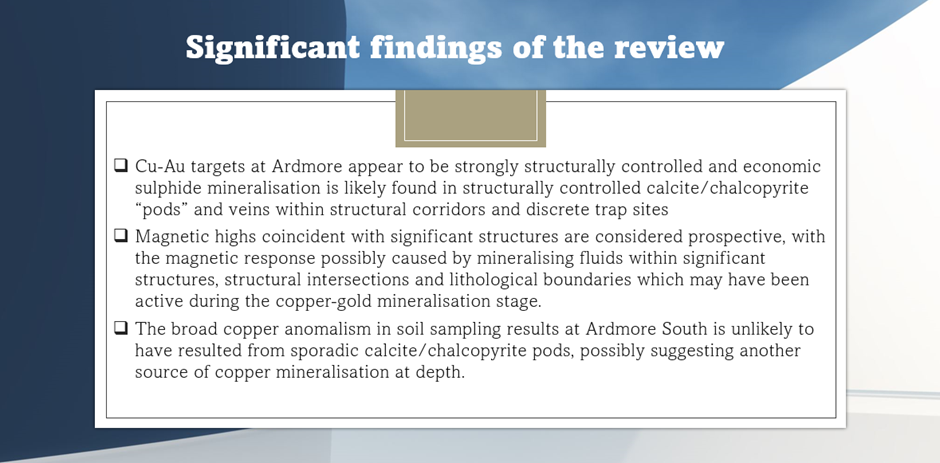

In the latest announcement, mineral explorer Cooper Metals Limited (ASX: CPM) has released the results of an independent prospectivity review of the Ardmore copper-gold tenement. The review results have brought to fore multiple high-priority areas for follow-up exploration.

The review has identified numerous areas primarily of high magnetic response, related to prominent structures and lithological contacts for further exploration. For some areas, initial rock chip sampling was done that delivered up to 17.1% Cu and 0.79g/t Au (MER249) from target AR003 near the regional Fountain Range Fault. Notably, most of the target areas are untested but a geochemical program is underway.

Source: Company update

Source: Company update

Also, the company has announced assays for the reverse circulation drilling program conducted at Ardmore South. The results have confirmed the presence of broad areas of Cu anomalism in most drill holes.

A total of 13 RC drill holes over 1,745m were drilled at the prospect for testing the 500m long north-south striking strong induced polarisation (IP) chargeability anomaly and coincident Cu-Au anomalism identified in soil and rock chip samples.

Stock jumps over 14%

The company shares were spotted trading 14.285% higher at AU$0.160 post the ASX announcement on 20 July 2023. The company has a market cap of AU$6.47 million.