Highlights

- Carbonxt Group has extended the closing date of its Share Purchase Plan to 3 April 2025.

- The Kentucky plant commissioning marks a major milestone towards revenue growth for the company.

- The Kentucky plant is set to meet rising demand with prices rising in the market for Activated Carbon.

- Expansion plans include a 200% capacity increase and a 50% stake in NewCarbon Processing LLC.

- The commissioning phase aims for full-quality production within two months.

ASX-listed Carbonxt Group Limited (ASX:CG1) has announced an extension to the closing date of its share purchase plan, initially announced in February 2025. The new closing date is 3 April 2025.

In addition, the company released a presentation highlighting significant progress in its cleantech business. The company is focused on completing its Kentucky plant, which will help meet increasing market demand and enable cost-reduction initiatives.

Kentucky Plant Commissioning Set to Drive Revenue Growth

The Kentucky plant has been mechanically completed and is now in the commissioning phase to meet the growing market demand. This milestone marks a significant step toward revenue growth, with cost-reduction initiatives completed in the current business aimed at enhancing profitability. Tightening environmental regulations have led to rising demand, opening doors to a multi-million-dollar U.S. market, with a focus on air and liquid phase technologies. In addition, it provides access to the larger water treatment market.

The company is also protected against the threat of trade tariffs with all of its manufacturing capacity in the U.S.

The company’s expansion plans include nearly 200% increase in capacity, alongside raising its stake in NewCarbon Processing, LLC to 50% from its current 40%. The commissioning phase is ongoing, with full-quality production targeted within two months. Initial product samples will support long-term offtake deals, while initial outputs will be sold on the spot market or integrated into Carbonxt’s product lines.

Extension of Share Purchase Plan

Carbonxt has extended the closing date of its Share Purchase Plan (SPP), initially announced on 17 February, to 03 April 2025. The closing date was earlier set on 14 March 2025. The SPP aims to raise up to AUD 2.0 million at AUD 0.06 per share, and the funds are intended to support the working capital and continued development of the Kentucky facility.

The SPP follows the successful completion of two capital raises in the fourth quarter of 2024. In September 2024, Carbonxt completed an AUD 3.02 million placement at AUD 0.065 per share, attracting significant demand from high-net-worth investors and family offices. This was followed by an AUD 1.0 million placement in December 2024 at AUD 0.06 per share.

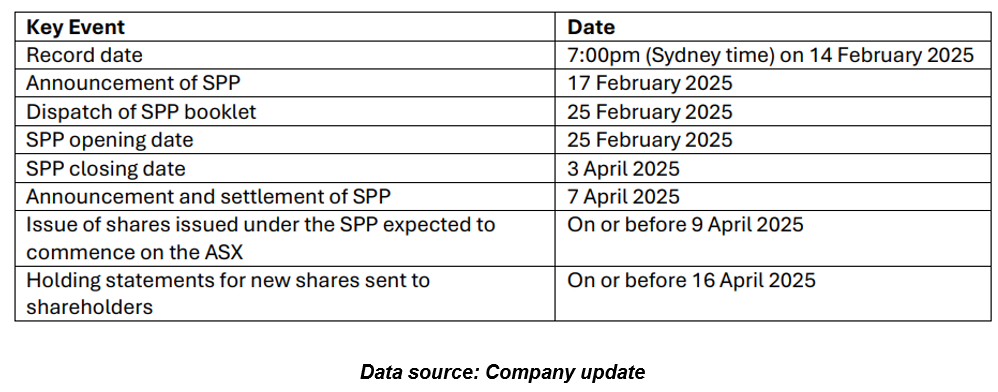

The revised SPP timetable is as follows:

The share price of CG1 was AUD 0.055 at the time of writing on 27 March 2025.