Highlights

- 88 Energy has completed the wireline programme on the Hickory-1 well.

- As per the initial petrophysical interpretation, presence of several hydrocarbon bearing pay zones has been confirmed across all pre-drill targets.

- The company has calculated an estimated net pay from wireline data of about 450 feet over all pay zones.

- 88E is set to begin the post-well analysis of cores and wireline data.

- Several zones in Hickory-1 with similar reservoir characteristics to wells that have flowed on adjacent acreage will be flow tested.

Australia-listed oil & gas exploration company 88 Energy (ASX: 88E, AIM:88E, OTC:EEENF) has successfully completed the Hickory-1 wireline logging suite and sidewall coring programme.

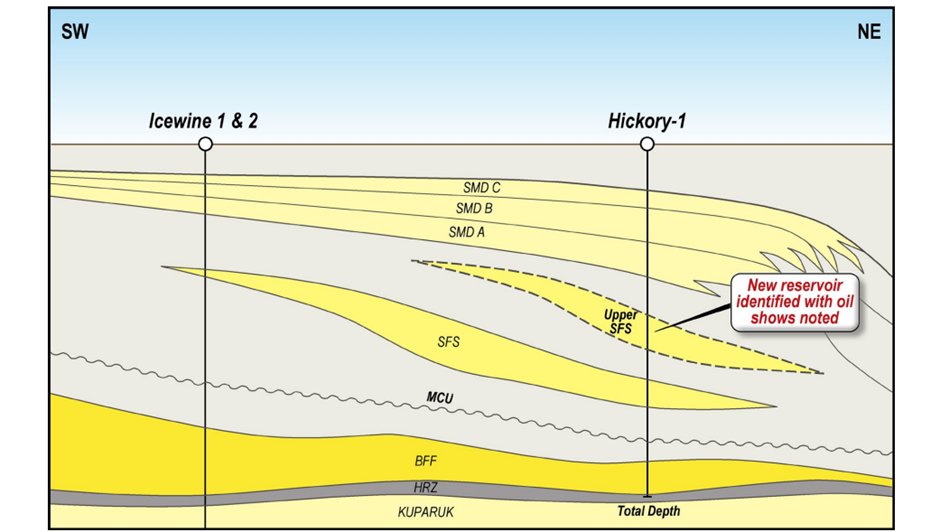

Upon completion of the programme, the preliminary petrophysical interpretation from LWD (logging while drilling) data of the presence of multiple hydrocarbon bearing zones across all pre-drill targets, as well as the new Upper SFS reservoir has been confirmed.

Data source: 88E ASX announcement

There were 5 runs under the sophisticated wireline logging and sidewall coring programme, namely the Triple Combo, NMR/XMR, Dielectric Scanner, Dipole Sonic and Side Wall Coring (SWC) tools.

The main goal of the wireline logging programme was to verify the preliminary petrophysical interpretation of different pay zones detected during drilling from LWD logs; and get data to optimally design and plan a targeted flow test of Hickory-1. As per the company, it has achieved both the objectives successfully.

After interpreting the wireline data, it has been confirmed that there is an estimated gross pay of more than 2,000 feet and a calculated net pay of about 450 feet across all zones in the well. Also, there lies an average total porosity across all pay zones of 9-12%, including key zones identified for potential testing in the SFS and Upper SFS with between 11-16% total porosity.

88E Energy revealed in the Pre release that pre-drill expectations were met or exceeded been fulfilled on reservoir quality (higher than expected porosity in SFS and BFF) and thickness (higher total gross reservoir, total net reservoir and total net pay).

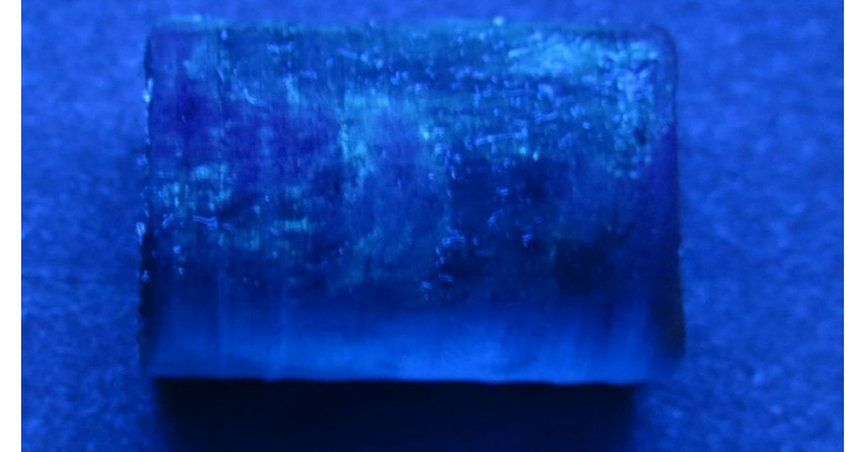

The company also performed side wall coring (SWC) across all reservoir intervals with samples recovered to surface. The retrieved SWC fluoresced under ultraviolet light in multiple cores over the SMD, SFS and BFF, and visible porosity was also confirmed in the SWC.

The company also performed side wall coring (SWC) across all reservoir intervals with samples recovered to surface. These core samples will now be transported to a lab in Anchorage for further analysis.

Also, a favourable potential for successful flow tests from multiple zones in the Hickory-1 well has been indicated in the preliminary petrophysical comparison of Hickory-1 prospective zones against the interval that flowed oil in Pantheon’s Alkaid-1.

Pantheon’s wells on the adjacent northern acreage – Alkaid-1, Alkaid-2, Talitha-A and Theta West-1 – have all flowed 35 to 40⁰ API oil from similar sandstones, with testing confirming reservoir deliverability of light, sweet oil.

Hickory-1 has intersected all primary and secondary targets, and the newly identified Upper SFS reservoir, prior to calling TD within the HRZ to preserve hole conditions.

Hickory-1 has intersected all primary and secondary targets, and the newly identified Upper SFS reservoir, prior to calling TD within the HRZ to preserve hole conditions.

88E’s path for further progress

Hickory-1 will now be cased and suspended in preparation for flow testing. The company is planning to conduct flow testing at the earliest in the winter season of 2023/2024.

During the process, the data obtained from the Hickory-1 drilling and wireline logging programmes will be evaluated thoroughly so as to plan the optimal flow test programme. A light-weight rig is expected to be employed for these operations in the next winter season, for which 88E is in talks with rig providers.

The Nordic Calista Rig 2 is currently running 7” casing ahead of suspending the well. The rest of the program is expected to completed in another 5-7 days before Rig-2 rigging down and being released from site. It will mark the closure of 88 Energy’s 2022/2023 winter drilling campaign.

Currently, 88E has centered its focus on demobilisation and safe completion of the current phase of the Hickory-1 well, along with early planning actions for the next phase of operations at Hickory-1 in Alaska.

“We are particularly encouraged by the fact that wells in the immediately adjacent northern acreage have flowed and recovered light oil to surface from all of the SMD, SFS and BFF reservoirs, which bodes particularly well for our planned testing programme next season,” says the company.