EHR Resources Limited (ASX: EHX) is an ASX listed metals and mining company that owns an 18% earnings stake in its La Victoria Gold/Silver Project which is situated in North-Central Mineral Belt of Peru, and the company also has the right to earn up to 7% more. The area has a good infrastructure with access to electricity, road, water etc.

Eloro Resources Limited (TSX-V: ELO) is an exploration company consisting of gold and base metals projects in Quebec and Peru. It owns and operates the La Victoria Gold/Silver project, it owns an 82% earnings interest in the La Victoria Gold/Silver project, covering approximately 89 square kilometres.

On 27 May 2019, Eloro resources made an announcement in Toronto providing an update on the status of the planned drilling on the prospective San Markito Mineralised Zone at the La Victoria Gold/Silver project in Peru, to bring the Zone into an exploration and discovery focus.

On 28th May 2019, EHR Resources the company released the information provided by Eloro Resources to the ASX. The details of the same as as follows:

On 19th May 2019, a meeting was held with the residents of the communities that are located near the San Markito target area and representatives from Eloro Resources Limited in Toronto and the Peruvian Ministry of Mines presented to the residents a detailed information about economic benefits of mineral exploration and mining. The message was well received within the community, and community members agreed to provide the community land, on rent for the mining project.

Additionally, it was decided, that on 9th June 2019, a negotiation committee and an environmental monitoring committee would be set up to underscore the communityâs inclination to work with Eloro.

A general assembly would be called after both the parties get satisfied with the land rental contract terms and a single majority would be needed in the assembly to make progress and be able to rent the required land.

Technical Outlook

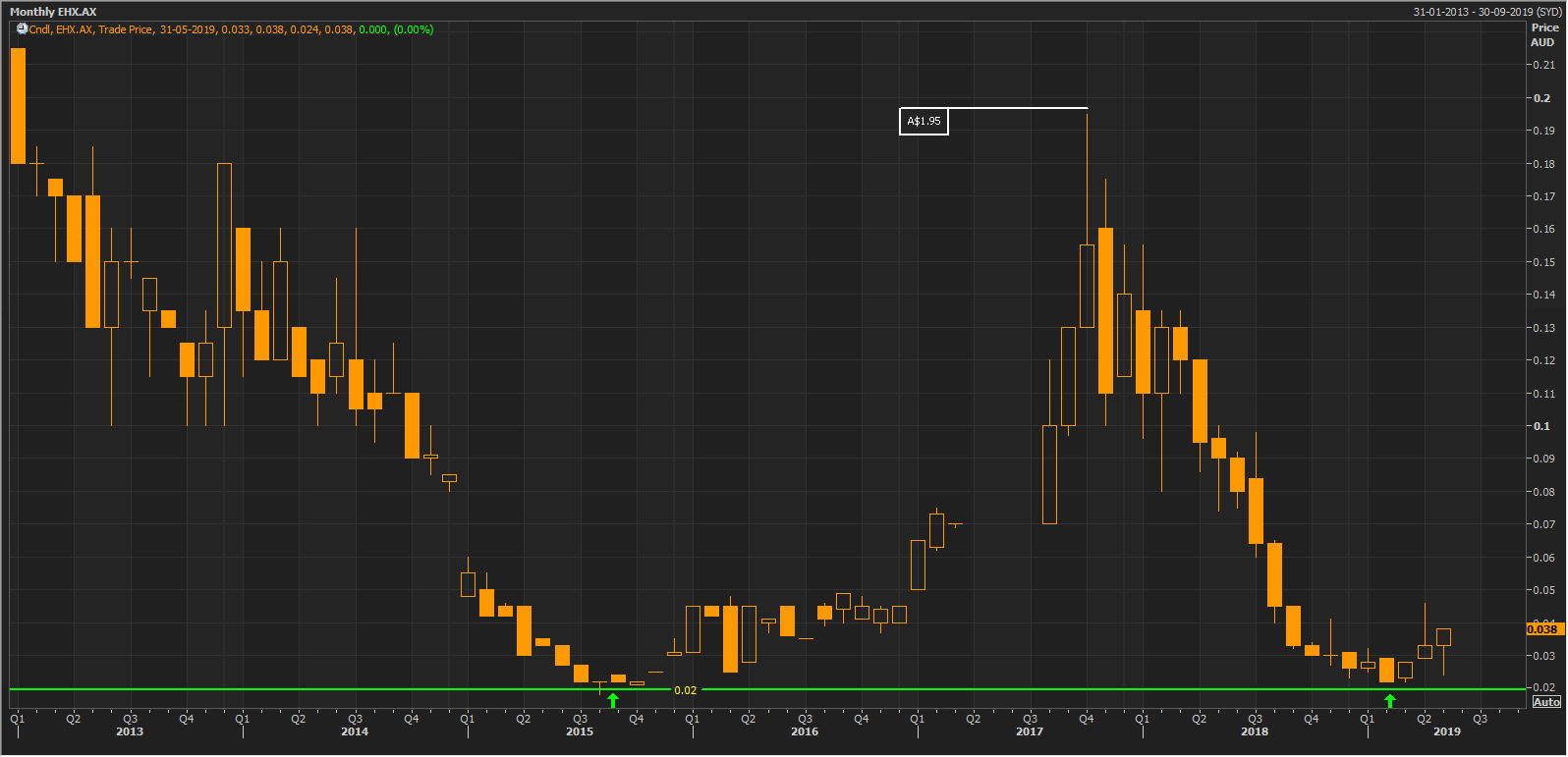

On the monthly chart, the stock had touched itâs second highest price level in its trading history at A$0.195 in October 2017. After this high, the stock fell sharply to the lows from where the rally had initially started, wiping out all the gains. From its peak the stock has corrected by 98% as of this writing (as on 29 May 2019).

Monthly chart of EHR Resources (Source: Thomson Reuters)

Monthly chart of EHR Resources (Source: Thomson Reuters)

But now there is a very prominent reversal taking place on the charts from the support levels which were earlier tested in 2015. The formation of any chart pattern or structure becomes more credible when formed in the higher time frame. As this is the monthly support level, it is doing its job quite fine, and the stock has already started building base and inching to reverse towards the upside.

This reversal could be an enormous considering the monthly chart reversal and the stock has an open field to reach the highs agin. There is strong support around A$0.02 (marked by green arrows) which is not expected to be breached, but if breached, the stock may fall to further lows.

Stock Performance

The company has a market capitalisation of A$4.81 million, and the stock had touched a 52-week high and low of A$0.098 and A$0.022 respectively. The stock is trading at A$0.030 on ASX (as at AEST: 12:27 PM, 29 May 2019), down by 21.053% as compared to its previous dayâs trade. The last one-year return of the stock is negative 50.6%, and the YTD return stands at 46.5%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.