Eclipx Group Limited (ASX:ECX) is engaged in diversified financial services organisation, providing complete, corporate and consumer backed finance, fleet management services, online auctioneering and associated services, and medium term vehicle rentals to the Australian and New Zealand markets. In Australia, the group operates under 10 primary brands: FleetPlus, FleetChoice, FleetPartners, CarLoans.com.au, Right2Drive, Eclipx Commercial, areyouselling.com.au, Onyx, GraysOnline.com and Georgie. In New Zealand, the group operates under five primary brands, which are FleetPlus, CarLoans.co.nz, Right2Drive, AutoSelect and FleetPartners.

Today, on July 5, 2019, Eclipx Group Limited announced the sale of both GraysOnline and AreYouSelling to Quadrant Private Equity for $60 million and the appointment of Jason Muhs as Acting CFO.

The company, on June 7, 2019, announced issuance of new securities, including 845,411 Retention Options (November 2019), 845,411 Retention Options (May 2020), 156,250 Retention Rights (November 2019) and 156,250 Retention Rights (May 2020).

Retention Options Each Retention Option is a right to acquire a fully paid ordinary share on a one-for-one basis at the exercise price (or to receive the cash equivalent value), subject to a vesting condition based on continued employment until the applicable vesting date.

November 2019 Retention Options

- Vesting date: 15 November 2019

- Exercise price: $1.20

- Exercise period: Commencing on the day following the vesting date and ending on 15 May 2021

- Expiry date: 15 May 2021 May 2020 Retention Options

- Vesting date: 15 May 2020

- Exercise price: $1.20

- Exercise period: Commencing on the day following the vesting date and ending on 15 May 2021

- Expiry date: 15 May 2021

Retention Rights Each Retention Right is a right to acquire a fully paid ordinary share on a one-for-one basis for nil consideration (or to receive the cash equivalent value), subject to a vesting condition based on continued employment until the applicable vesting date.

November 2019 Retention Rights

- Vesting date: 15 November 2019

- Exercise period: Commencing on the day following the vesting date and ending on 15 May 2021

- Expiry date: 15 May 2021 May 2020 Retention Rights

- Vesting date: 15 May 2020

- Exercise period: Commencing on the day following the vesting date and ending on 15 May 2021

- Expiry date: 15 May 2021

If a change of control transaction involves more than 50% of Eclipx Groupâs issued shares, all unvested Retention Options and Retention Rights will vest in full, subject to the Board determining that a different treatment should apply. The Retention Options and Retention Rights were offered to certain Executives of Eclipx as a retention mechanism, following the appointment of new CEO, Julian Russell, on May 13, 2019. The Retention Options provide an exercise price of $1.20, being the same strike price as options issued to Julian Russell.

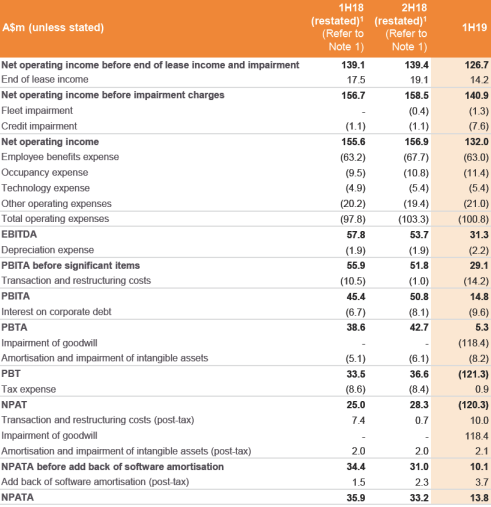

H1 FY19 Key Highlights: The net operating income for the period decreased by 15% to $132 Mn as compared to $155.6 Mn in the previous corresponding period. The companyâs EBITDA, including goodwill impairment was $31.3 Mn as compared to $57.8 Mn in the pcp. The net profit after tax & amortisation (NPATA) decreased by 62% to $13.8 Mn as compared to $35.9 Mn in the previous corresponding period. Non-cash impairment to goodwill associated with the Consumer businesses (including Right2Drive) and GraysOnline was reported at $118.4 million (no income tax benefit attributable thereto). The companyâs statutory loss after tax for the period was $120.3 million, which consists of $118.4 million of non-cash impairment.

In its Core Fleet and Novated business, stable EBITDA was reported at $40.7 million, a decrease of 3% as compared to the previous corresponding period. Its net profit after tax and amortisation for H1 FY19 was reported at $24.1 Mn, a decrease of 13% as compared to the previous corresponding period. Its total assets under management or financed was reported at $2.1 billion, an increase of 7% as compared to the previous corresponding period. Its total vehicles under management or financed was reported at 103,414, an increase of 6% as compared to the previous corresponding period.

The companyâs H1 FY19 performance was adversely impacted by a number of factors including: (1) Full provisioning of the viewable credit exposure in the commercial equipment finance; (2) Increased provisioning in Right2Drive associated with delayed debtor collection and process errors on invoicing; (3) Continued softness in the Grays industrial and insolvency markets; (4) Margin compression in AreYouSelling, resulting from the disposal of aged vehicle stock; (5) Reduction in end of lease income resulting from changes in the mix of vehicles sold; (6) a non-recurring non cash impairment of goodwill associated with Grays and Consumer (including R2D) of $118 Mn; and (7) Adoption of new accounting standards (AASB 9 & 15) from October 1, 2018.

H1 FY19 Income Statement (Source: Company Reports)

As per the companyâs balance sheet, the cash and cash equivalents at the end of the period were $94.1 Mn. The trade and other receivables at the end of the period were $171 Mn. The inventory (incl motor vehicles) and PP&E and other assets at the end of the period were reported at $31.6 Mn and $18.1 Mn. The total assets at the end of the period were $2,743.2 Mn. Under liabilities section, trade and other liabilities, borrowings under warehouse and ABS, borrowings under corporate debt, provisions and other liabilities at the end of the half year period were reported at $129.8 Mn, $1,497.9 Mn, $350.2 Mn, $13.5 Mn and $39.9 Mn, respectively. The total liabilities at the end of the period were $2,031.3 Mn. The net assets at the end of the period were $711.9 Mn as compared to $900 Mn in the previous half year period. The reduction in net assets can be attributed to the goodwill impairment of $118 Mn, adjustments related to the adoption of AASB 9 & 15, prior period restatements relating to revenue recognition in Right2Drive and the suspension of the ECX DRP as part of the MMS merger, culminating in the payment of a final dividend of $25 Mn in H1FY19.

On the stock information front, at market close on July 5, 2019, the stock of Eclipx Group was trading at a price of $1.550, up 20.623%, with a market capitalisation of ~$410.73 Mn. Its annual dividend yield has been noted at 12.45%. Today, it reached dayâs high at $1.650 and touched dayâs low at $1.260, with a daily volume of 7,353,867. Its 52 weeks high and low price stands at $3.245 and $0.540, with an average volume of 5,194,114 (yearly). Its absolute returns for the past one year, six months and three months are -59.97%, -46.01%, and 54.82%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.