On 14 May 2019, Diatreme Resources Limited (ASX: DRX), an Australian Stock Exchange Listed emerging silica sands explorer and developer announced the maiden Indicated Resource estimation of the company for its Galalar Silica Project, which is located near the worldâs largest operating silica sand mine at Cape Flattery.

The company has previously announced the exploration target for the Galalar Silica Project.

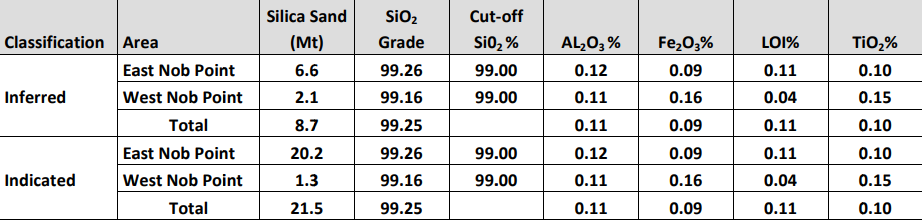

The company mentioned that Ausrocks Pty Ltd assessed the mineral resource independently and with newly identified satellite deposit at West Nob point, the Maiden Indicated Resource is estimated to be at 21.5 million tonnes, which accounts for more than 99 per cent of silicon dioxide.

The newly estimated resources are complemented by 8.7 million tonnes of Inferred Resource, due to which, the total estimated resource of the project stands at 30.2 million tonnes with more than 99 per cent of silicon dioxide.

Diatreme undertook bulk testing previously, and the results signified the projectâs ability to produce a premium-grade silica product with silica sand at 99.9% of silicon dioxide, which includes the iron content below 100 parts per million and is 125-600 micron in size. The quality of the premium-grade mentioned above meets the requirement for high-end glass and solar panel manufacturing, which in turn, could attract high premium prices.

The final product demonstrated excellent recovery rates during the testing, and the results further indicated towards the potential of obtaining secondary, high-value heavy mineral sands during mining, which further adds to the projectâs value.

As per the IMARC Group, the global silica market is heading towards a US$10 billion annual revenue by 2022, with an estimated CAAGR (compounded annual average growth rate) of 7.2%.

As per the companyâs estimation, the total Inferred Category Mineral Resources stand at 8.7 million tonnes with a grade of 99.25% of silicon dioxide, 0.11% of aluminium oxide, 0.09% of iron oxide, 0.11% of the lithium-oxygen index and 0.10% of titanium dioxide.

The total Indicated Mineral Resources stand at 21.5 million tonnes with a grade of 99.25% of silicon dioxide, 0.11% of aluminium oxide, 0.09% of iron oxide, 0.11% of the lithium-oxygen index and 0.10% of titanium dioxide.

The mineral resources include the resources from both the East Nob and West Nob point of the project.

Source: Companyâs Report; Tenement location and Nob Points

The resource differentiation as per the location of east and west nob points are as:

Source: Companyâs Report; estimated Total Resources (location wise)

Source: Companyâs Report; estimated Total Resources (location wise)

Observation, Parameters and Assumption led to the classification of mineral resource to Indicated Category (JORC 2012) by the independent consultant- Ausrocks Consulting Mining Engineers includes of:

Target material in-situ density being at 1.62t/m3, with a cut-off grade material of greater than 99% of silicon dioxide, and factors like Topography, Topsoil Thickness, Top and Base estimation of Resources, etc.

The company undertook a bulk product (350kgs) testing program in an independent state-owned lab in China, confirmed the findings, which includes; high recovery rate (78-79%), simple separation requirement, particle size (0.71-0.125mm) and high value (Silicon dioxide of 99.66-99.77%) with respect to the potential exportable silica product.

The shares of the company, by the end of the trading session, closed flat at A$0.012.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.