Generally speaking, computer bots are those programs designed to automate certain processes, so that the user doesn’t have to manually deal with them. In the case of crypto trading bots then, they will automatically trade crypto on your behalf.

According to a survey conducted by crypto researcher Adam Conchran, less than 40% of users rely on such bots, but it’s interesting to note that more than 80% of all traded money was moved by trading bots, especially by those bots used by institutional traders.

Trading bots, therefore, can help you move in a direction to earn better, while making your job easier at the same time. But, it’s hard to choose a crypto trading bot with so many on the market.

In this article, we’ll take a look at and compare the two popular trading bots, Traity and Cryptohopper. Read on to learn in detail about the two bots.

How Do Trality and Cryptohopper Work?

Like other trading robots, Trailty and Cryptohopper bots will analyze the crypto market trends and make trading decisions on your behalf. However, instead of completely relying on them to do their thing, the best course of action for users is to first set up the bot’s trading strategy by manually adjusting trading parameters.

It’s possible for both experienced and beginner traders to make a profit by using such automated trading platforms, despite needing to adjust the system according to the user’s strategy. However, conducting a sufficient amount of research is a prerequisite for successful trading for all investors, and regardless of whether we’re talking about manual or automated crypto trading.

Let’s now take a look at the specificities of each of these trading bots. Due to their differences, they will appeal to a different group of users.

How does the Trality bot work?

Trailty is not your run-of-the-mill trading bot. Instead, it can be viewed rather as a complex tool allowing you to create your own, deeply customized bots.

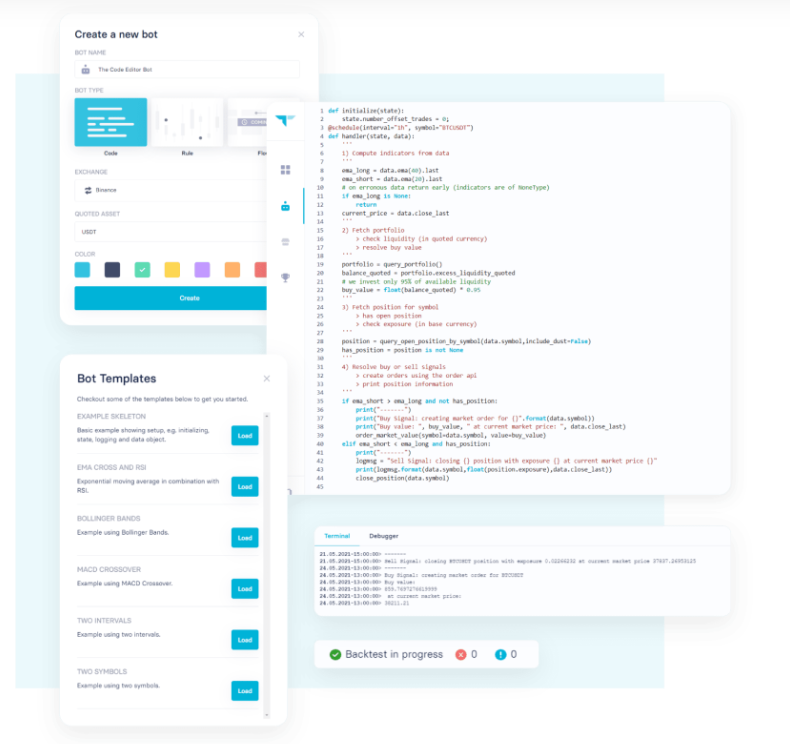

Image source: Trality website

Trailty comes with two essential systems. The first one is the Code Editor feature, designed for (very) experienced users. This feature is based on Python and requires both coding and cryptocurrency knowledge, but, in turn, it allows you to create extremely sophisticated bots. Also, it provides many templates that should help you get started.

The second feature is called Rule Builder, and it is a simplified version of Code Editor that comes with a graphic interface. Users are supposed to match pre-set algorithms based on Boolean principles, in order to make automated scripts.

And now let's find out how Cryptohopper bot works

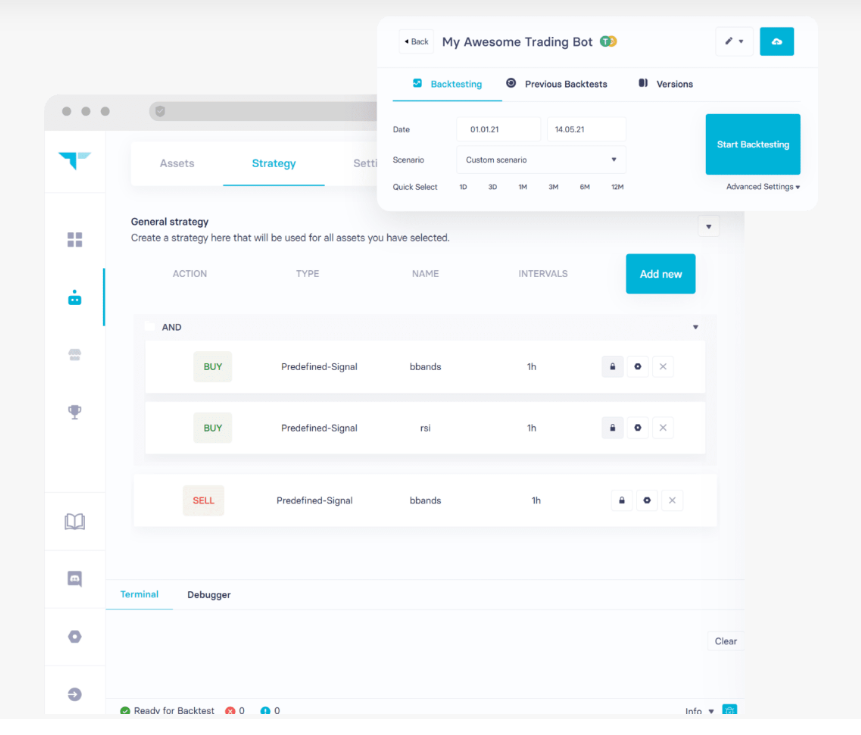

After connecting your trading account with Cryptohopper and choosing the preferred market strategies, this bot will begin its automated trading procedure.

Cryptohopper can be fully or semi-automated. If you’re running it in a fully-automated mode, there are three notable features to keep track of: the Bear Market keeps an eye on negative trends and dropping prices, and may exit a trade if it determines that’s the best decision. Conversely, the Bull Market looks out for rising prices and makes decisions accordingly. Finally, the Consolidation Periods feature is deployed in the times of market consolidation.

As for the semi-automated mode, it requires some coding knowledge in order to set the optimal if/then instructions, along with the corresponding triggers. There’s also a graphical interface to help you out with this.

Image source: Cryptohopper

What are the pros and cons of these apps?

Let us now examine the pros and cons of these two trading bots. Upon conducting a Trality Trading Bot review we can identify the following pros and cons:

- Trailty is completely free.

- The in-browser Python editor comes with plenty of important libraries, as well as an auto-complete option and a useful debugger that will help you to locate and fix issues.

- The Rule Builder feature allows the user to set up bots with minimum hassle, in an elegant and functional graphical environment.

- Backtesting is supported. This mode uses past market data along with your own settings in order to see the results the testing bot would have made. By studying the results obtained in this way and by identifying the same market conditions in the present time, you can set a new strategy that will almost certainly work.

- Because Trailty is cloud-based, it allows trading at any given moment, 24/7.

-

- The Code Editor is not suited for beginners, and the Rule Builder feature is too limited options-wise.

- Trailty supports only four crypto exchanges: Kraken, Binance, Coinbase Pro, and Bitpanda.

- Futures trading is not supported.

As for the Cryptohopper crypto bot review, the pros and cons are as follows:

- The free Paper trading mode provides users with a simulation based on the current market data, designed to test your strategy in a safe environment.

- The option for mirror trading allows you to emulate the bot settings created by experts.

- Cryptohopper is equipped with the ability to analyze the market conditions and then buy and sell crypto based on your input settings, such as volatility and trend indicators, and the momentum and volume oscillators.

- Supports backtesting.

- If the trailing stops feature is used, your assets will be automatically sold in the case of a market crash. As the value of an asset grows, the sell orders also get raised, hence the word “trailing” in the name of this feature.

-

- Some trading bots are free, but for this one, you’ll need to pay a monthly subscription.

- This isn’t an open-source trading bot, which means that you cannot alter its source code.

- Cryptohopper is not hosted locally, so if the developers ever pull the plug on it, you’ll have to obtain another trading bot (even though you’ve paid for this one).

So what are the differences?

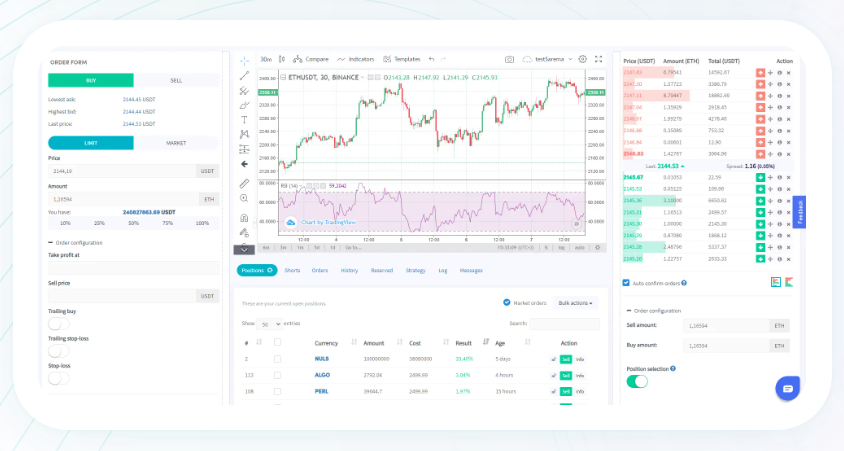

The first key difference between Trailty and Cryptohopper is in their fundamental purpose. Namely, while Cryptohopper is more or less a regular automated trading solution (albeit, of unusually high quality), Trailty more closely resembles a tool for creating your own, highly specific trading robots.

This logically brings us to the next essential difference between these two trading bots, which is their level of complexity.

While Trailty’s Code Editor is a potent tool for proficient users, inexperienced traders will have a very hard time getting any solid results. With this in mind, the developers have designed the simplified Rule Builder feature, but with it, they went too far in the other direction. Thus, the Rule Builder feature is inflexible and lacking in options.

This feature is unable to compete with automated trading systems specifically designed to be approachable to beginners as well, such as, for example, Cryptohopper.

Image source: Trality website

Image source: Trality website

Cryptohopper is, thus, more suited for beginners, because it puts the appropriate tools in the hands of such users, who can then utilize a far superior bot than the one they would’ve likely created by using Trailty’s Rule Builder feature.

Which of these bots to choose?

According to the key differences we discussed in the previous section of the article, you’ll first need to gauge your level of crypto proficiency before choosing the best crypto trading software for your automated trading needs.

In short, if you’re an experienced user and possess adequate Python coding skills, Trailty might be what you’re looking for. On the other hand, Cryptohopper is a powerful trading robot, with relatively little need for additional modification.

In addition, you should know that alternatives that might be more suited for some users do exist. For instance, this Trailty vs Bitsgap comparison arrived at the same conclusion regarding Trailty as we did, but also analyzed Bitsgap, an alternative to Cryptohopper that offers additional features. If you’re in need of a portfolio tracker or want to trade on multiple exchanges by using just one account, Bitsgap can also be looked at.

Conclusion

With so many trading robots out there, choosing the right one is tricky. As always, knowing your needs when it comes to automated trading is key to making the right choice.

No matter which bot you settle on, always have in mind that leaving it entirely to its own devices and expecting a steady profit is just a dream that will quickly turn into a nightmare once you begin using it in this way. You can never do enough research; both your trading robot and wallet will be grateful for it. Good luck and happy trading!

FAQ

What are crypto trading bots? They are programs that will automatically trade crypto according to your set instructions.

Are trading bots actually useful? Yes, they can be of great assistance and allow you to increase your profits in the long run.

What are Trailty and Cryptohopper? They are some of the finest trading bots on the market.

How much do Trailty and Cryptohopper cost? Trailty is completely free. A bare-bones free version of Cryptohopper exists, but it is recommended to choose one of the three paid versions, whose price ranges from $16.58 to $83.25 per month. The three paid versions differ in the number of positions and features which are included.

What’s the key difference between Trailty and Cryptohopper? Trailty is designed for experienced users, while Cryptohopper was created as a tool for beginners.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.