Highlights

- Commodity prices have witnessed significant strength in recent times amid global events causing disruptions in the supply chain.

- Lithium’s demand has been on the rise with an accelerating shift toward the electrification of transportation systems worldwide.

- The global environment remains highly uncertain given the recent Russia-Ukraine war and the sanctions that followed.

- Although there are positive demand forecasts in place for lithium, the environment remains uncertain due to supply chain issues.

In recent times, there has been an escalation in global efforts to develop lower-emission sources-based energy and transport systems. Such developments are anticipated to maintain the strength in prices for the base and critical metals, especially lithium.

Other significant economies like China have already instituted measures to expedite economic growth in light of the slowdown caused due to the COVID-19 pandemic. Besides the pandemic and evolving variants of COVID-19, severe weather conditions have also disrupted the output and export of bulk commodities.

More recently, a lot of other key events have impacted the resources and energy sector worldwide, the most significant being the Russia-Ukraine war. It was not only the war that significantly impacted the global commodities market but also the increasing number of sanctions that Russia is witnessing.

Strengthening lithium prices

Several commodity prices have escalated to new records amid the bullish demand and supply factors. The global recovery is anticipated to continue in the current year but at a pace slower than last year, affecting the persistence of supply chain disruptions in 2022.

Strength in lithium prices is buoying the recovery of Australian producers with the continuing lithium hydroxide production.

Source: © Malajscy | Megapixl.com

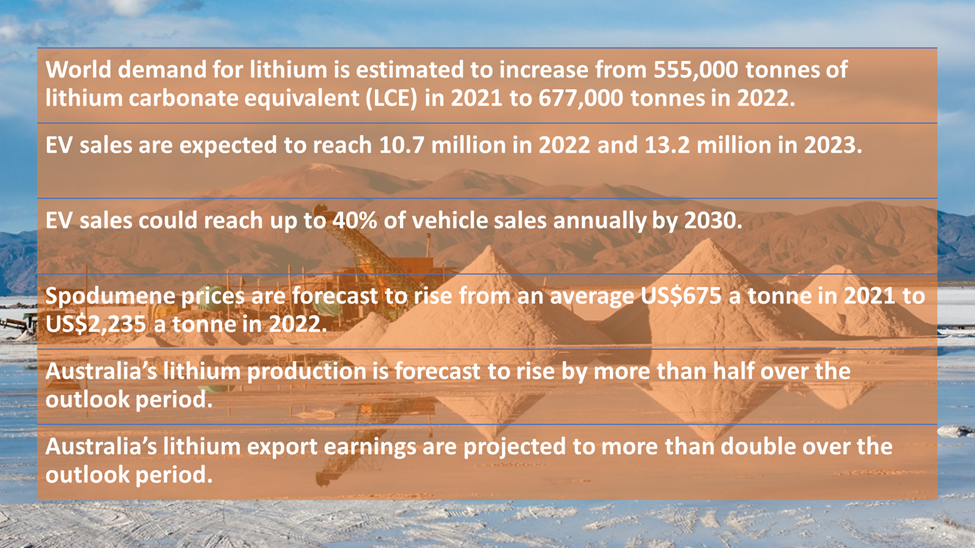

Demand for lithium has been on the rise with an increased shift towards the electrification of transportation. Sales of electric vehicles (EVs) have been on the rise as significant EV producers reported strong growth amid the recovery in supply chains and improvement in demand.

Since 2019, the worldwide market share for passenger EVs has quadrupled, and future sales of global passenger EVs are anticipated to maintain the growth momentum.

Governments making strategic moves

In light of the increasing demand for EVs, demand for lithium is expected to increase by more than 40% over coming two years. Major demand for lithium comes from Asia, notwithstanding the expansion of new battery manufacturing capacities across Europe and the US.

The rising demand for lithium has resulted in numerous project expansions and the starting of new projects as Europe and North America seek to decrease their dependency on lithium imports from China. In key strategic moves, the US Government is offering grants worth over US$3 billion to support the processing of critical metals like lithium.

Source: © Xura | Megapixl.com | Data Source: Resources and Energy Quarterly June 2022

Besides this, CA$3.8 billion have been allocated by the Canada Government to support the development of a domestic critical metals supply chain. Argentina is also anticipated to receive around US$4.2 billion in investment over coming five years.

What’s the risk?

However, everything is not only on the favourable side of the lithium market. There are events that affect its outlook, including challenges that automakers are facing in the supply chain environment and the cut to China’s EV subsidy program.

Numerous EV manufacturers are experiencing hiccups in the supply chain, which is affecting delivery timeframes for EVs. Besides this, increased prices for lithium and other battery metals like nickel, graphite and cobalt are adding to the pressure on battery costs.

Although the subsidy program in China was expected to end in 2022, reports say that the Government might extend the program to next year.

Bottom Line

The overall outlook for lithium does depend on various factors that range from domestic factors like local government policies to global factors that impact the larger picture and for the long term. As of now, demand for lithium stays strong as there is a significant growth potential for EV manufacturers to acquire further market share amid the transition to sustainable transportation.