Summary

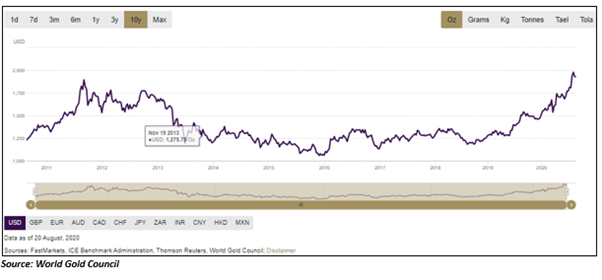

- Gold prices are continuing to make new records, primarily on the back of strong net-inflows in gold backed ETFs by sophisticated and institutional investors.

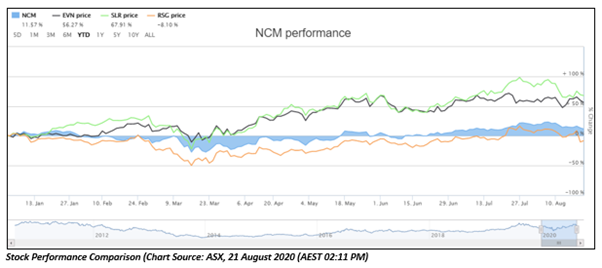

- In line with rallying gold prices, several ASX-listed gold sector players are also registering robust results.

- Newcrest Mining invested $1.3 billion to acquire mega Red Chris operations and increase exposure to the Fruta del Norte gold mine, with $1.2 billion raised via equity raising programs.

- Evolution Mining acquired Red Lake gold operations, while Silver Lake Resources delivered record production in June quarter and Resolute Mining reported increased gold production for the Syama Sulphide operations

With the onset of COVID-19 pandemic, gold prices have been scaling to record highs. Gold has worked as a safe haven, with the precious metal widely supported by sophisticated and institutional investors through strong net-inflows in gold backed ETFs as well as by global economies and central banks via bullion purchases.

Gold traded on 21 August 2020 (AEST 02:09 PM) at US$ 1,951 an ounce of gold, experiencing an increase of almost 29% since the beginning of 2020.

Good Read: Australian Gold-Backed ETFs – Massive Capital Influx, Impeccable Performance, And Record Values

Strong growth in gold prices has been substantiated by unprecedented interest in gold stocks, which have been performing well on the accounts of-

- Easy access to investment capital for exploration and development of gold projects

- Higher realised gold prices

In the purview of this article, we would discuss few trending gold stocks listed on the Australian Stock Exchange under the ASX200. The below discussed stocks trading on S&P/ASX 200 have been consistently delivering strong operating results.

Must Read: Your guide to Investing in Gold Stocks in a Market Crash - WAF, ALK

Newcrest Mining Limited (ASX:NCM), one of the largest gold miners on the ASX, reported a production of 2.2 million ounces of gold with an All in Sustaining Cost of $862 an ounce of gold during FY20. The company invested over $1.3 billion to acquire the Red Chris copper-gold mining operations and increased its exposure to the Fruta del Norte gold mine. Additionally, Newcrest spent $400 million towards the exploration and organic growth segments.

The company holds a stronger balance sheet, ensuring that NCM remains well positioned towards growth opportunities at the Havieron, Red Chris, and Wafi-Golpu projects. As part of the efforts to strengthen the balance sheet, Newcrest successfully raised $1.2 billion in equity via a placement to institutional investors and a share purchase plan.

The final dividend of US0.175 per share, fully franked is due for payment on 25 September 2020. For FY20, the company distributed a divided of US$0.25 a share, an increase of 14% against the previous year.

NCM stock was trading at $33 a share on 21 August 2020 at 02:21 PM, with a market capitalisation of $27.15 billion.

Read Here: Gold Rush and Gold Outperformers- Northern Star, and Newcrest Mining

Evolution Mining Limited (ASX:EVN), the new owner of Red Lake gold mining operations, recorded operating cash flow of $1,121.4 million with free cash flow of $541.8 million for FY20. The fully franked final dividend for FY20 stood at $0.09 a share, scheduled to be paid on 25 September 2020, taking the total dividend for the year to 16 cents per share, a 68% increase on FY19.

The gold miner produced 746,463 ounces of gold with an All-in Sustaining Cost of $1,043 an ounce of gold during FY20. In April of 2020, the company completed the acquisition of Red Lake gold operations from Newmont GoldCorp. The Red Lake operations produced over 27,428 ounces of gold with an All-in sustaining cost of $1,943 an ounce for FY20.

Evolution Mining has a highly ambitious plan for the upcoming 3 years with a target production in excess of 800,000 ounces of gold by FY23 with group AISC of 1,155 an ounce.

EVN stock was trading at $5.870 at 02:22 PM AEST on 21 August 2020, with a market capitalisation of $10.01 billion.

Read Here: Commodity Market Wrap- All That You Need to Know

Silver Lake Resources Limited (ASX:SLR) recorded a gold production of over 71,291 ounces gold and 494 tonnes copper with sales of 64,593 ounces gold and 416 tones copper with a sales price of $2,300/oz and an AISC of $1,344 an ounce during the June quarter.

Growth projects continued to progress and advanced to pre-development at Rothsay. With already secured mandatory permits, the box cut excavation program commenced in mid-July. The mine is anticipated to commence production of high-grade ore to Deflector in Q1 FY22, coinciding with the completion of upgrade of the process plant at Deflector.

Cash and bullion increased by $42 million during the June quarter to $269.4 million on 30 June 2020 with no debt, strengthening the balance sheet.

The gold producer targets production of 240,000 to 250,000 ounces of gold in FY21, on the back of strong production from the 2 key assets in Western Australia, at an AISC of $1,400 to $1,500/oz of gold.

SLR stock was trading at $2.320 a share at 02:23 PM AEST on 21 August 2020 with a market capitalisation of $1.98 billion.

The 22 July 2020 update of Resolute Mining Limited (ASX:RSG) highlighted a gold production of 107,183 ounces in June quarter and 217,946 ounces for the year-to-date period, with an AISC of US$1,033/oz and US$1,020/oz, respectively.

Gold production for the Syama Sulphide operations increased to 35,248 ounces, reflecting a growth of almost 64% against previous quarter, following the enhancement of metallurgical recoveries to 80% during the June quarter. The Mako gold operations registered a gold production of 43,478 ounces during the quarter, with life of mine extended by 2 years. The prefeasibility study for the Tabakoroni Sulphide operations advanced during the June quarter and is likely to be finalised in the September quarter.

Resolute Mining marked the successful implementation of the COVID-19 response plan with no impact to gold production. The cash and bullion stood at US$88 billion with listed investments of US$35 million and Promissory Note of US$35 million, as on 30 June 2020.

RSG stock was trading at $1.152 a share at 02:23 PM AEST on 21 August 2020, with a market capitalisation of $1.25 billion.

Must Read: Resolute Mining Extends LOM for Mako Open Pit; Elevated Gold Spot a Key Driver

(Note: All financial information pertains to Australian currency unless stated otherwise.)