S&P/ASX 200 Resources index at the time of writing was trading at $4580.50 (August 19, 2019 14:27 (UTC+10)). In the last three trading sessions, the index has fallen by 3.42% from August 14, 2019 at $4742.70 to the present. Three important resources stocks with recent updates are BlueScope Steel Limited (ASX:BSL), Northern Star Resources Ltd (ASX:NST) and Alumina Limited (ASX:AWC).

BlueScope Steel Limited (ASX:BSL)

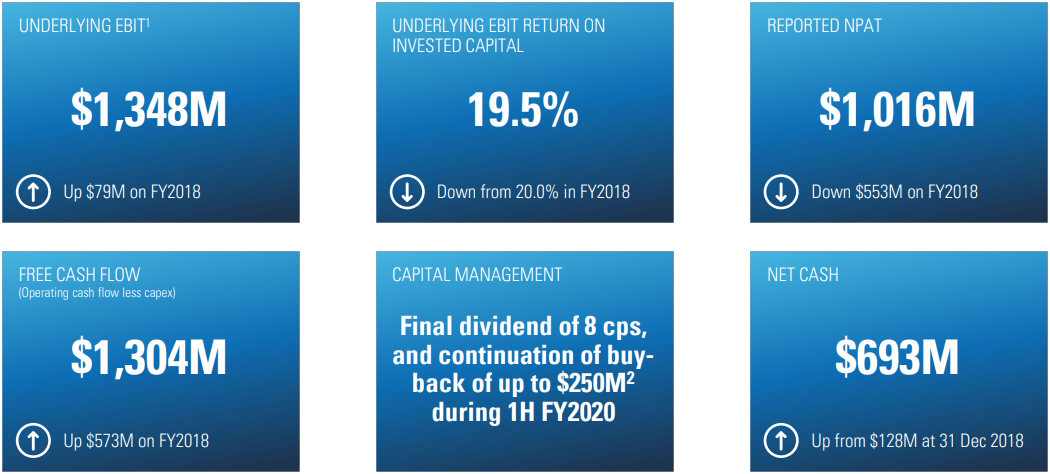

BlueScope Steel Limited (ASX:BSL) operates in the iron and steel industry. The company on August 19, 2019, published FY2019 results wherein it highlighted that its net profit after tax (NPAT) for the period was reported at $1,015.8 Mn, and its underlying NPAT was reported at $966.3 Mn, up 17% up as compared to FY2018.

Mark Vassella, BSL Managing Director and CEO, stated that the underlying EBIT for the period was reported at $1,348.3 Mn, up 6% up as compared to FY2018. This was their third successive full year underlying EBIT above $1.1 Bn. The company delivered another strong performance in FY2019 with underlying pre-tax ROIC of 19.5%, down marginally from 20% in FY2018 . Its operating cash flow, after capital and investment expenditure, was very strong at $1.3 Bn. The successful combination of underlying earnings growth, and the companyâs on-market share buyback resulted in underlying earnings per share growth by 22% year over year.

Mr Vassella further stated that their performance was underpinned by a strong balance sheet and very disciplined capital investment ethos â one that balances annual shareholder returns and long-term profitable growth. The company finished FY2019 with net cash of $692.7 Mn, of which around $150 Mn was related to timing benefits in working capital. It has reassessed its optimal capital structure and targetsa revised capital structure with group net debt at around zero, which is in contrast to their previously stated target of net cash in the range of $200 Mn to $400 Mn. The companyâs management will be proactively and prudently managing the balance sheet towards the net debt target. In the short term, the company will continue with its previously announced H1FY20 buy-back of up to $250 Mn, and the Board of Directors has approved the payment of a final unfranked dividend of 8 cents per share with record and payment dates on September 12, 2019 and October 16, 2019, respectively. With an estimated cost of US$700 Mn, commissioning of the expansion project has been targeted for mid FY2022, with full ramp-up around 18 months later. Its portfolio includes a reinvigorated and resilient integrated Australian business, which includes the iconic COLORBOND steel brand, delivering returns throughout the cycle; global leadership and footprint in coating and painting for building and construction markets; and operations in the worldâs two largest construction markets, China and the US, and in high growth markets in ASEAN and India. After careful due diligence, the Board has approved the expansion of North Star business at Delta, Ohio, subject to anticipated receipt of necessary area permits and local and state incentives.

Outlook for H1FY20:

The company expects weaker commodity steel spreads in North Star and ASP, leading to an underlying EBIT around 45% lower than H2FY19, which was $499 Mn.

FY2019 Key Financial Metrics (Source: Company Reports)

On the stock information front

On August 19, BlueScope Steelâs share traded at $11.180 down 8.361% from the last close price, with the market capitalization of ~$6.27 Bn. Its current PE multiple is at 3.830x and its last EPS was noted at $3.185. Its 52-week high and 52-week low stand at $18.670 and $10.305, respectively, with an annual average volume of 3,763,436. In the last one year, it has generated an absolute return of -28.65% whereas in the last six months and three months it generated return of 0.08% and -4.91% respectively.

Northern Star Resources Ltd (ASX:NST)

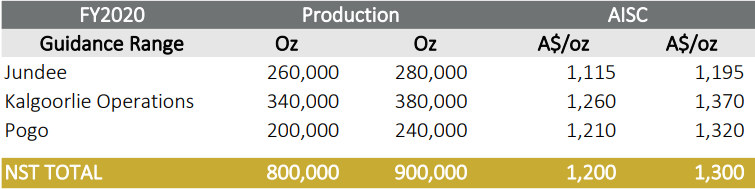

Northern Star Resources Ltd (ASX:NST) is involved in exploration, development, mining and processing of gold deposits. The company recently published an investor presentation where it highlighted that it among the top 25 global gold producers with mines in Western Australia and Alaska. Its FY20 guidance has been estimated at 800koz-900koz at an All-In Sustaining Costs (AISC) of $1,200/oz - $1,300/oz. Over the past eight years, it has been successful at Reserve and Resource growth per share. As per the report, NSTâs share price performance of 107% ranks 3 out of 36 in the peer group and is significantly better than the median of 10%. The top 10 performing companies have exhibited the higher production growth, consistent operational results and larger reserve and resource delineation, over the past 3 years. The top performers tends to have lesser All-In Sustaining Costs, less sovereign risk jurisdictions, high dividend yield and trade at a premium.

NSTâs FY19 performance stood at 840,580 oz gold at an AISC of A$1,296/oz, where the Australian operations achieved the top end of production guidance at 639koz sold. The FY2020 group production has been estimated at 800,000-900,000oz at AISC A$1,200-A$1,300/oz, where the growth capital non-sustaining of $116 Mn for Pogo, Jundee and Moonbeam growth. The exploration spends of $76 Mn for Pogo, Jundee and South Kalgoorlie.

FY2020 Production Guidance Data (Source: Company Reports)

On the stock information front

On August 19, Northern Starâs share traded at $11.880 down 2.463% from the last close price, with a market capitalization of ~$7.79 Bn. Its current PE multiple is at 38.060x and its last EPS was noted at $0.320. Its 52-week high and 52-week low stand at $14.055 and $6.725, respectively, with an annual average volume of 3,737,940. In the last one year, it has generated an absolute return of 74% whereas in the last six months and three months it generated return of 25.18% and 28.48%, respectively.

Alumina Limited (ASX:AWC)

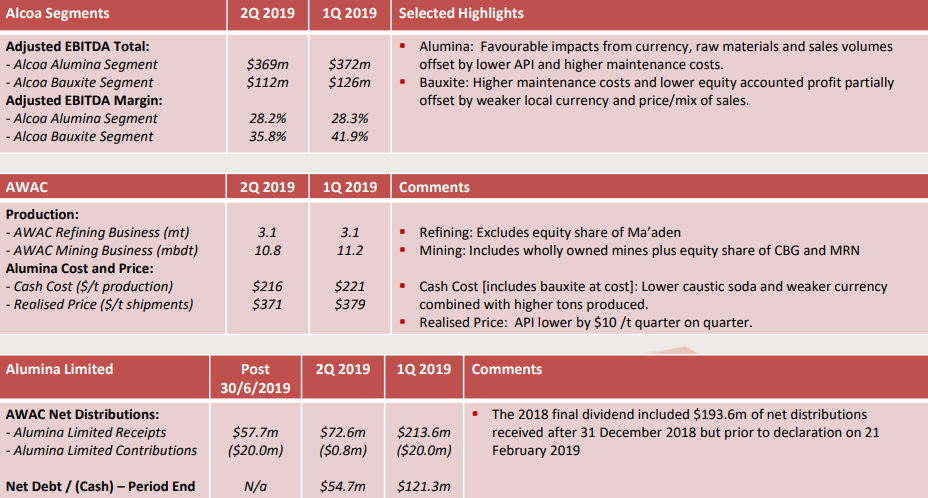

Alumina Limited (ASX:AWC) is involved in , alumina refining, bauxite mining and aluminium smelting. In the operating entities forming Alcoa World Alumina and Chemicals (AWAC), AWC has 40% interest. The company recently announced that the Vanguard Group and its controlled entities, have become a substantial holder to the company with voting power of 5.007%. In another update, Mike Ferraro, Alumina Limited CEO commented on Alcoa Corpâs second quarter 2019 earnings release. The performance from both the segments was steady as lower API pricing was neutralized (partially) by enhancement in alumina production and rationalizing in the cost of raw materials. Due to the adequate supplies in the market and ramp up in the production from Alunorte and increase in supply from the other refineries, the API pricing has fallen since the end of the quarter. Due to the impact of an annual tax payment of over $300 Mn and lower alumina spot prices in June, distributions from AWAC were reduced.

AWC Quarterly Key Highlights (Source: Company Reports)

On the stock information front

On August 19, Alumina Limitedâs share traded at $2.190, with the market capitalization of ~$6.31 Bn. Its current PE multiple is at 6.990x and its last EPS was noted at $0.313. Its 52-weeks high and 52- week low stand at $3.200 and $2.120, respectively, with an annual average volume of 12,320,570. In the last one year, it has generated an absolute return of -20.94% whereas in the last six months and three months it generated return of -17.67% and -9.50%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.