The S&P/ASX 200 Index closed high at 6,595.9, edging up 0.42% by 27.4 points on 14 August 2019. Letâs look at the following diverse sector companies that have disclosed key announcements of late.

Agricultural Land Trust

Sydney, Australia-based Agricultural Land Trust (ASX: AGJ) operates as a real estate investment trust focused on the ownership of an agricultural land for the purpose of generating rental income and capital appreciation for clients in Australia. The companyâs market capitalisation stands at around AUD 4.88 million with ~ 97.51 million shares outstanding. The AGJ stock last traded on 7 August 2019 at AUD 0.050 and has delivered positive returns of 61.29% in the last six months and 19.05% YTD.

Recently on 14 August 2019, One Managed Investment Funds Limited (OMIFL), as responsible entity of the Agricultural Land Trust, announced that it had signed an agreement, subject to certain conditions being met, to issue further debentures to the existing debenture holders with a face value of up to $50 million. The Debenture Holders, lender and OMIFL are related parties. If additional debentures are issued, the Trust would on lend the proceeds of the debentures via its sub-trusts.

In addition to the above, the repayment date of the Trustâs $ 10 million loan has been extended to 28 February 2020 and the repayment date of Debenture Series 5 and Debenture Series 8, to 7 April 2020, with all other terms and conditions remaining the same.

Lifestyle Communities Limited

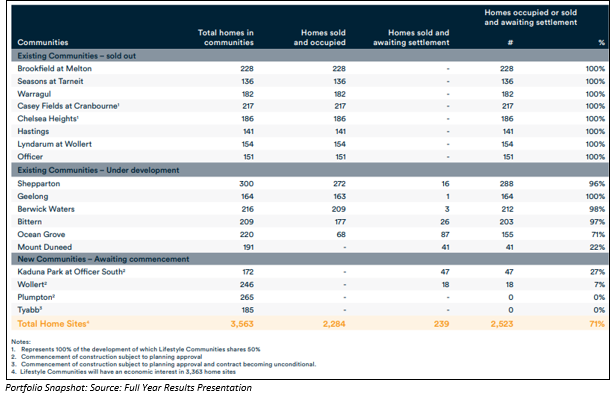

Headquartered in Melbourne, Victoria, Lifestyle Communities Limited (ASX: LIC) owns, develops, and manages reasonably priced independent living residential land lease communities. The company presently has 18 housing land lease communities in planning, development or under management. Lifestyle Communitiesâ market cap is around AUD 690 million with ~ 104.55 million shares outstanding. On 16 August 2019, the LIC stock closed on ASX at AUD 6.600, unchanged as compared to its previous close.

In addition, LIC has delivered positive returns of 28.16% in the last six months and 24.76% YTD.

The company, on 14 August 2019, released its Full Year Results for the twelve months to 30 June 2019 (FY19), posting the underlying profit after tax of $ 41.1 million, up 21.6%, while valuation gains lifted statutory profit after tax to $ 55.1 million. Besides, a fully franked ordinary dividend of 3.0 cents was also announced (Record Date: 5 September 2019; Payment Date: 8 October 2019) taking the total dividend for the year to 5.5 cents per share, from 4.5 cents per share in the prior year.

For Lifestyle Communities, FY19 saw the addition of 337 new home settlements now providing 2,285 settled homes within the communities. Lifestyle Communities' portfolio continues to grow organically through recycling capital.

Pengana Private Equity Trust

Pengana Private Equity Trust (ASX: PE1), incorporated in Australia, is a diversified portfolio of global private market investments, managed by one of the largest and most diversified independent asset managers in the world, Grosvenor Capital Management (GCM). The Trustâs market capitalisation stands at around AUD 229.63 million with ~ 164.02 million shares outstanding. On 16 August 2019, the PE1 stock price settled the dayâs trading at AUD 1.350 with approximately 80,812 shares traded. The Trust debuted on the ASX on 30 April 2019.

Monthly Performance Report â On 14 August 2019, the Trust disclosed its Monthly Performance update for July 2019, when its Net Asset Value (NAV) grew by +1.7 % to $ 1.3351 per unit, predominantly driven by returns in the short duration credit portfolio as well as a reduction in the AUD/USD exchange rate.

During the month, PE1 closed on its third private equity primary fund investment, a US$2.9 million commitment to H.I.G. Middle Market LBO Fund III, L.P. while GCM Grosvenor Multi-Asset Class Fund II (MAC II) executed 2 new investments, bringing the portfolio to 16 investments diversified across asset classes and industry sectors. Also, around mid-July, GCM Co-Investment Opportunities Fund II (GCF II) funded its 9th co-investment in Advisor Group, Inc.

Adveritas Limited

Adveritas Limited (ASX: AV1) operates as a software company engaged in the provision of innovative online and mobile marketing solutions that leverage big data to drive business performance to customers in Australia. Adveritasâ ad fraud prevention software, TrafficGuard, is its 1st SaaS. Adveritasâ market capitalisation stands at around AUD 16.68 million with ~ 158.9 million shares outstanding. On 16 August 2019, the AV1 stock price settled the dayâs trading at AUD 0.105 trading unchanged as compared to its previous close.

The company announced on the same day that it had received firm commitments to raise over $2.8 million (before issue costs) through a placement of 13,000,000 Shares to n new and existing institutional and sophisticated investors at an issue price of 10c per fully paid ordinary share. The issue price represents a premium of 13.6% to the last traded price of Adveritas Shares on 9 August 2019. Certain Directors would also participate in the placement for a total of $ 1,300,000.

The proceeds of the placement would be directed towards expanding the Companyâs sales and marketing efforts and for general working capital purposes.

On 16th the company reported its preliminary final report for year ended 30 June 2019. The revenue from continuing operations were up by 100% at $643,579 as against nil revenue in the previous corresponding period, the revenue from discontinuing operations were, as expected, down by 96% at $564,386 as against $15,483,256 in the previous corresponding period. The companyâs net loss improved as it came in at $6,548,570 as against a loss of $7,429,794 in the previous corresponding period. The company did not declare any dividend. The cash and cash equivalent for 2019 stood at $2,046,991 as against $4,231,884 in 2018.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.