In identifying the best stocks, Investors need to understand about Fundamental and Technical analysis. Under the Fundamental analysis, Investors usually follow a top-down approach which is popularly known as âE-I-Câ framework. Under the E-I-C framework, Investor begins with economic analysis followed by industry analysis, and company analysis.

In Economic analysis, investors must look for macros such as GDP, interest rates, unemployment rates, national income, price indices, etc. The interrelation among all the mentioned parameters helps to understand how the economy will perform in the coming times.

In Industry analysis, the investor should look at âPESTELâ impact over various sectors. âPESTELâ denotes factors including Political, Economic, Social, Technical, Environmental, and Legal. These factors are very important to estimate future industry performances, and hence investors can select the best performing industry depending on the industrial business cycle. The investor also needs to look upon Porter 5 forces for the industry to understand the threat of new potential entrants, rivalry among current competitors, bargaining strength of buyers, bargaining strength of suppliers, and the threat of substitute products/services.

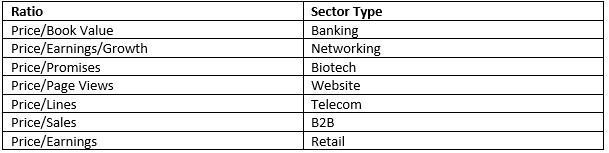

Along with the above factors, investors should look for industry valuation parameters such as industry PE, industry PB, industry growth rate, industry leverage ratio, etc.

Key Ratios for different sectors are as follows:

In the company analysis, an investor needs to understand the business model, 4Ps of Marketing (i.e., product, price, place, and promotion), 5 Câs of marketing (i.e., company, collaborators, customers, competitors, and context), Porter 5 forces for the company, etc.

Under quantitative factors, the investor should glance at financial statements such as balance sheet, income statement, cash flows, financial ratios, etc. to understand the financial health of the company in detail. The investor further needs to identify valuation of the stock based on Absolute valuation such as Discounted Cash Flow Model, Dividend Discount Model, SOTP (Sum-of-the-Part), etc. to find out the intrinsic value of the company and hence estimate whether the stock is undervalued or overvalued. Moreover, Relative valuation can be used to compare the company with its Peer group.

Additionally, the investor can also use technical analysis to understand the movement of the stock in the short to medium term by using various technical tools such as Relative Strength Index, Stochastic Indicators, Bollinger Bands, MACD, Moving Averages, etc.

In terms of stock, Cromwell Property Group (ASX:CMW) is a real estate company. The company reported a roller coaster ride in its net margin from the year 2015 to 2018. It represents business cyclicity in the real estate sector over the period of time.

![]()

(Source: Company Reports)

Under sector cyclicity, revenues of the companies are higher at the time of economic prosperity, whereas it remains subdued when the period is under recession. Businesses which are in the luxury segment faces the heat in the down cycle as the customer's priorities change to the most essential items. The major reason is the reduction in the purchasing power of the demography. The good example of cyclical industries is energy, real estate, discretionary retailers, financial services, etc.

Using the fundamental and technical analysis in conjunction, the investor can identify the cyclical stocks based on several factors including historical earning patterns, macroeconomic factors, PE ratio, company-specific factors that hints any cyclical trends, etc., which might have a favourable performance during the business cycles.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.