The S&P/ASX 200 Index was trading at 6,507.1 on 23 August 2019 (AEST 02:56 PM), moving up by 5.3 points (+0.08%), while the S&P/ASX 200 Financials Index was trading at 6,140.6, down 9.1 points or 0.15%. Letâs look at the following insurance companies in Australia with recent updates inlcuding the latest financial results for each.

Insurance Australia Group Limited

Insurance Australia Group Limited (ASX:IAG), based in Sydney, Australia, is one of the leading general insurance companies in Australia as well as New Zealand. The Groupâs businesses underwrite an estimated $ 12 billion of premium every year, selling insurance under distinct and well-known brands including NRMA Insurance, SGIO, SGIC, CGU, Swan Insurance and WFI, to safeguard homes, lifestyles and businesses of a large number of customers. Insurance Australia Groupâs market capitalisation stands at around AUD 18.12 billion. On 23 August 2019 (AEST 02:59 PM), the IAG stock was trading at AUD 7.890, edging up 0.638% by AUD 0.050 with ~ 2.72 million shares traded.

Recently on 12 August 2019, Mr Peter Harmer, Insurance Australia Groupâs Managing Director and CEO, announced to have appointed Mr Peter Horton to the position of Group General Counsel. His tenure would commence by the end of 2019. Mr Horton is currently serving as the Executive Manager Legal, Governance and Risk at TransGrid.

The company declared a dividend of AUD 1.1508 on its security named IAGPD - CAP NOTE 3-BBSW+4.70% PERP NON-CUM RED T-06-23 with a record date of Friday, 6 September 2019 and payment date of Monday, 16 September 2019.

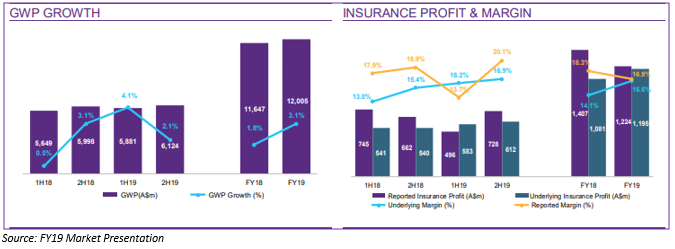

FY19 Investor Report: Insurance Australia Group delivered a successful financial year ended 30 June 2019 (FY19) with a sound performance by Australian business in personal insurance and improvement in commercial, while New Zealand maintained its strong profitability and sound growth. During the year, the gross written premium (GWP) increased by 3.1% to AUD 12.005 billion and there was higher underlying margin of 16.6%.

Outlook: Going forth, the Group expects GWP growth for the financial year 2020 (FY20) to be at a âlow single digitâ level, following recent divestments in underwriting agencies, which would reduce the GWP by more than $ 100 million. Moreover, the Group forecasts its insurance margin to be in the range of 16-18%. Pre-tax costs of up to $ 50 million in fee income line is also anticipated, demonstrating accelerated investments across data, AI and innovation technologies, and related new ventures.

Suncorp Group Limited

Suncorp Group Limited (ASX: SUN), based in Queensland, Australia, offers a range of financial services including life and general insurance, retail and business banking, superannuation and funds management services to over 9 million customers across New Zealand and Australia. Suncorp Groupâs market cap is ~AUD 17 billion with ~ 1.3 billion shares outstanding. On 23 August 2019 (AEST 03:00 PM), the SUN stock was trading at AUD 13.460, down 0.148% with ~ 917,236 shares traded. SUN has also generated positive returns inlcuding 9.52% YTD and 3.03% for the last six months.

Recently, the Group disclosed its Responsible Business Report 2018-19, throwing light on its approach, progress and future priorities to increasingly establish itself as a resilient and sustainable company highly valuing the interest of customers, shareholders and stakeholders. One of the key highlights from the year is that the Group paid out dividends totalling AUD 0.78 per share during FY19, recorded a consumer net promoter score of more than 5.0, maintained gender parity specifically in the leadership roles and achieved a 6% reduction in greenhouse gas emissions.

FY19 Results: In addition, Suncorp Group also released its annual report for FY2019, posting a 1.5% increase in cash earnings on the prior corresponding period (pcp) to $ 1.1 billion and a net profit after tax (NPAT) of $ 175 million, including a $ 910 million after tax non-cash loss on sale of the Australian Life Business netted against an $ 11 million after tax profit on the sale of general insurance distribution business, Resilium.

The Business Improvement Program (BIP) delivered net benefits of $ 280 million while the Group also maintained a strong capital position.

QBE Insurance Group Limited

Sydney, Australia-based QBE Insurance Group Limited (ASX:QBE), is an insurance and reinsurance company, which offers underwriting services for different commercial and industrial insurance policies, as well as individual policies. The Group also manages Lloydâs syndicates and provides investment management services in Australia and overseas.

QBE has a market capitalisation of around AUD 16.1 billion with ~ 1.31 billion shares outstanding. On 23 August 2019 (AEST 03:02 PM), the QBE stock was trading at AUD 12.280, up 0.245% by AUD 0.030 with ~ 1.51 million shares traded.

Key Personnel Changes: Recently on 15 August 2019, QBE Insurance Group announced the appointment of Mr Todd Jones to the position of CEO North America, who would be succeeding Mr Russ Johnston, effective 1 October 2019. Mr Jones brings a wealth of experience with his recent engagement being with Willis Towers Watson where he served as Head of Global Corporate Risk and Broking, and prior to that, CEO for Willis North America.

FY19 Results: According to the Group results for the half year ended 30 June 2019, the statutory net profit after tax amounted to $ 463 million, up 29% from $ 358 million in the prior corresponding period (pcp), while cash profit after tax was ~$ 520 million, up 35% from $ 385 million in pcp. The cash profit return on equity was 13.4%, also up from 9.6% in pcp.

The Group also reported a 1H19 combined operating ratio of 95.2%, reflecting an improvement over the mid-point of the prescribed FY19 target range of 94.5%-96.5% and an improvement from 95.8% recorded in 1H FY18. As per QBE Insurance Group, the uptick in the underwriting profitability was underpinned by a further material reduction in the attrition claims ratio to 47.7% from 51.3% in FY18.

The 2019 interim dividend also increased 14% to AUD 0.25 per share (1H FY18 AUD 0.22 per share), reflecting the Groupâs confidence in the balance sheet and improved earnings resilience over the coming year.

AMP Limited

AMP Limited (ASX:AMP), offers life insurance, superannuation, asset management products, pensions, retirement planning and other related financial services across Australia and New Zealand to customers inlcuding individuals, small businesses, corporations and associated superannuation funds. With a market capitalisation of around AUD 5.77 billion and approximately 3.35 billion shares outstanding, the AMP stock was trading at AUD 1.670 on 23 August 2019 (AEST 03:03 PM), down 2.907% by AUD 0.050 with ~ 10.24 million shares traded.

Share Purchase Plan: Recently on 16 August 2019, AMP Limited launched a Share Purchase Plan (SPP) providing all its eligible shareholders with the opportunity to subscribe for up to AUD 15,000 worth of shares at a discounted price.

The SPP is a part of the capital raising announced by the company on 8 August 2019, where the company raised ~AUD 650 million of new shareholder capital through a placement of 406.3 million new AMP fully paid ordinary shares to institutional investors at AUD 1.60 each.

The eligible shareholders who take up the offer would receive AMP shares at a lower price of AUD 1.60 per ordinary share or a 2.5% discount to the VWAP at which AMPâs shares trade on ASX between 30 August 2019 and 5 September 2019 (rounded down to the nearest cent). The closing date for the SPP is 5 September 2019.

The funds raised would assist the company to execute its transformational strategy at the earliest to create a simpler, higher-growth and higher-return business, that is focused on customers.

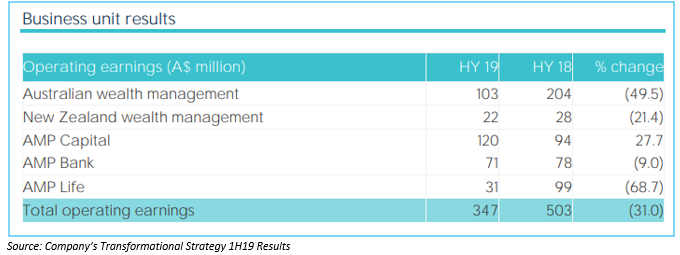

First Half FY19 Results: On 8 August 2019, the company disclosed its results for the first half 2019, posting an underlying profit of AUD 309 million, driven by earnings growth in AMP Capital and resilient AMP Bank performance. The company is undertaking a three-year AUD 1.0 billion- AUD 1.3 billion transformational investment program, to drive growth, reduce costs and de-risk the business. AMP Limited is also on track to complete client remediation program during 2021.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)