The industrial sector - one of the significant contributors to the GDP of a nation, provides market for both producer and consumer goods from other sectors. It not only provides employment to both skilled and unskilled labour but also helps on conserving foreign exchange through provision of a wide range of products and in turn reduction in imports.

Moreover, as the manufactured goods can be exported resulting in higher foreign exchange reserves, these can then be used to import essential capital goods and stimulate capital formation which boosts the country’s economic growth.

Let’s look at the following four large ASX-listed industrial stocks.

Atlas Arteria (ASX: ALX)

Atlas Arteria is a developer and operator of toll roads, with the aim to create community benefits like reduction in travel time, lower fuel consumption and carbon emissions as well as promote time certainty. Presently, the Atlas Arteria Group consists of four businesses including:

- A 25% interest in the APRR toll road group in France and the smaller ADELAC business which connects to APRR in southeast France, together comprising a 2,318 km motorway network located in the East and South East of France.

- Full economic interest in 22 km Dulles Greenway, a toll road located in the Commonwealth of Virginia, the US.

- Full ownership in the Warnow Tunnel in the north-east city of Rostock, Germany.

Regulatory approvals Update: Recently on 17 February 2020, Atlas Arteria announced that the Group has finally obtained anti-trust clearance from the European Commission and foreign investment control clearance from the French Ministry of the Economy.

With satisfaction of all precedent conditions, the APRR transaction is expected to be completed by early March 2020, whereby Atlas Arteria would acquire a further 6.14% indirect interest in APRR and ADELAC, implement the new shareholder agreements with co-investors in the APRR structure and end all remaining management agreements with the Macquarie Group.

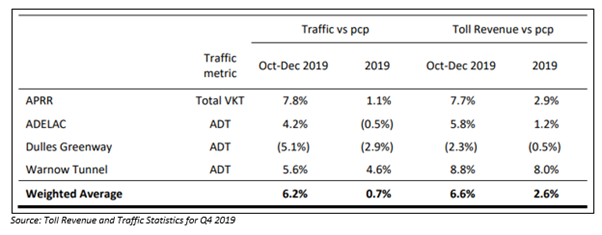

Q4 2019 Highlights: On 29 January 2020, Atlas Arteria announced its December 2019 quarter (Q4 2019) toll revenue and traffic statistics whereby the Weighted average toll revenue increased by 6.6% relative to the prior corresponding period (pcp) and the weighted average traffic increased by 6.2% compared to pcp.

The results demonstrate stronger quarterly traffic at APRR relative to the softer conditions in Q4 2018 that were impacted by the Gilets Jaunes (Yellow Vests). For the 12 months ended 31 December 2019, weighted average toll revenue and traffic increased by 2.6% and 0.7% respectively, compared to pcp.

Breakdown of the toll revenue and traffic performance for each business is tabulated below.

Stock Information: Atlas Arteria’s market cap stands at AUD 7.43 billion. On 18 February 2020, the ALX stock settled the day’s trade at AUD 8.415, down 0.41%. ALX has delivered positive returns of 10.89% in the past three months and 7.78% Year-to-date.

Phoslock Environmental Technologies Limited (ASX: PET)

Phoslock Environmental Technologies Limited, headquartered in Sydney, Australia, is a global environment company specialising in provision of engineering solutions and water treatment products for contaminated rivers, lakes as well as drinking water reservoirs. The company’s international presence covers Australia, China as well as the UK. Besides, it has representatives including licensees, distributors and agents in about 10 other countries.

Phoslock® is PET’s patented water treatment product that permanently inhibits multiplication of Harmful Algal Blooms (HAB) which is harmful for both marine and human life. In fact, countries like Brazil, Australia, North America, Europe, UK, and China have all certified Phoslock® to be used in drinking water too.

Other products offered by PET include Zeolites Specialised types of Bacteria.

On 17 February 2020, Phoslock Environmental Technologies released an important update on China & new Brazil Project.

Key points of China Update –

- Beijing office now back at work.

- Receipt of government approval for restarting the factory.

- Ramp up of production from the next month.

- Inventory outside of China to not last ahead of mid- 2020.

- No treatments planned for China until late March/April and the company expects no effect on its FY2020 sales guidance.

Brazil Project: The company also informed that it has secured a new contract from CEDEA through its Brazilian licensee, to treat one of the main drinking reservoirs in the Rio de Janeiro city. The application has commenced and would continue for the next three months, with an estimated value of over $ 2 million. This underpins a strong growing confidence of increasing number of local and government authorities in multiple countries, that are using Phoslock® to clean human drinking water.

Stock Information: The stock of PET zoomed up 10.81% at market close on 17 February 2020. On 18 February, the stock settled at AUD 0.805, down ~2%.

Brambles Limited (ASX: BXB)

Brambles Limited is a global support services group which offers pallet and plastic container pooling services and information management services.

1H20 Results: On 17 February 2020, the company released its results for the half-year ended 31 December 2019, reporting Revenue and earnings growth in every region, strong cash flow generation and US margin improvement.

Some of the key highlights from the half-year are:

- Sales revenue increased 7% (at constant currency) to USD 2,397.6 million with the growth rate being at the upper side of Brambles’ prescribed guidance range, reflecting increased price realisation as well as robust volume growth across the business.

- The Underlying Profit and operating profit of USD 435.5 million included a USD 12.4 million benefit from AASB 16. Excluding AASB 16 impact, a 2% increase in Underlying Profit was recorded at constant currency.

- Return on Capital Invested remains strong at 18.2%, while the company Board also paid out an interim dividend 2020 of AUD 0.1338 (9.0 US cents), representing a payout ratio of 50% in line with last year.

As for the FY20 outlook, Brambles anticipates sales revenue growth in mid-single digits and the Underlying Profit growth to be in line with sales revenue growth (given constant foreign exchange and including the impact of AASB 16).

Stock Information: Brambles has a market capitalisation of ~ AUD 20.29 billion with ~ 1.54 billion shares outstanding. On 17 February 2020, the BXB stock settled the day’s trade at AUD 13.140, edging up 3.87%.

Today, on 18 February, the stock closed at AUD 12.930. It has delivered positive returns of 12.89% YTD and 6.92% in the last three months.

Sydney Airport (ASX: SYD)

Sydney Airport is the operator of the airport located in Sydney, Australia. The Group is also engaged in development and maintenance of the airport infrastructure and leasing of terminal space to airlines and retailers.

US private placement bond issuance: On 17 February 2020, the Group announced to have delivered a ground-breaking AUD 600 million multi-tranche US private placement bond issuance.

- 15-year EUR 50 million (AUD 81 million) maturing June 2035.

- 15-year USD 50 million (AUD 77 million) maturing June 2035.

- 20-year AUD 220 million maturing June 2040.

- 20-year AUD 100 million maturing June 2040 (sustainability-linked).

- 30-year AUD 120 million maturing June 2050.

- New maturities spanning 2035 to 2050.

The Total portfolio average maturity has been extended 10 months to mid-2026 and it is the third issuance into the US private placement market. The currency exposures has been 100% hedged over the life of the bond.

Besides, there is a four-month free delayed settlement with funding in June 2020. It is the first sustainability-linked bond in the US private placement bond market and the first sustainability-linked bond with two-way pricing across bond markets globally.

Sydney Airport CFO Greg Botham quoted, “We are very pleased to proactively strengthen our balance sheet with this ground-breaking deal. The continued issuance of our longest ever bonds at attractive pricing followed an extensive debt investor update throughout the US, with strong demand across three different currencies. This strong demand demonstrates the confidence in Sydney Airport’s underlying operating performance and long-term growth.”

Stock Information: Sydney Airport has a market cap of ~ AUD 18.98 billion, On 18 February 2020, the SYD stock closed the trading lower at AUD 8.370, down 0.36%.