The death toll by coronavirus has increased to more than 1,000 and the World Health Organisation (WHO) has also proposed an official name for the illness caused by the new coronavirus as COVID-19. The acronym stands for coronavirus disease 2019. Australia has also confirmed about 15 cases of the virus and the fear is also transcending into the stock market.

Australia’s tourism sector has been adversely affected by the COVID-19 as China has banned international group travel to contain the virus in the country. Airport and airline companies like Sydney Airport (ASX: SYD) and Qantas Airways (ASX: QAN) have been affected by the virus outbreak and can be seen in their stock prices. In the last one month, SYD share price fell by 2.05% and QAN share price fell by 8.69%. The shares of SeaLink Travel Group Limited were worst affected and plunged more than 13% in the past one month.

Corporate Travel Management Limited (ASX: CTD) has stated that its too early to gauge the full impact of the coronavirus on the company’s operations in China. The company thinks the impact would be minor as:

- The number of transactions for travel to and from Greater China including Hong Kong is small as a percentage of total transactions generated by these regions;

- The Asian region is currently in Chinese New Year holidays and this period is historically the quietest time of the year for corporate activities in Asia.

Cochlear Limited (ASX: COH) has reduced the guidance outlook for FY20 from $290-300 million, to $270-290 million, a 2-9% increase on FY19 due to an expected impact from the novel coronavirus in China. The hospitals in Hong Kong and Taiwan are avoiding surgeries, including implants manufactured by the company, to limit the risk of infection from the coronavirus.

Flight Centre Travel Group Limited (ASX: FLT) has also indicated that it is very soon to calculate the virus’s overall impact and it already badly influenced FLT’s small corporate travel businesses in Singapore, China and Malaysia, which all together created around $625million in TTV in FY19, which is around 2.5% of the company’s TTV. It is difficult to calculate the virus’s impact on business or on corporate and leisure travel on a macro level at this initial stage, but it will affect travel arrangements to some extent in the near-term.

Blackmores scraps dividend after profit tumble

Blackmores Limited (ASX: BKL) is focussed on the sales, development and marketing of natural health products for animals and humans. These include herbal, mineral and vitamin nutritional supplements. The company has operations in Australia, New Zealand and in different parts of Asia.

Blackmores Limited has changed its outlook for the full-year result as several cost increases and operational challenges are expected to impact the business in the second half of 2020. Before looking at the outlook of the company, let’s see its results for 1HFY20.

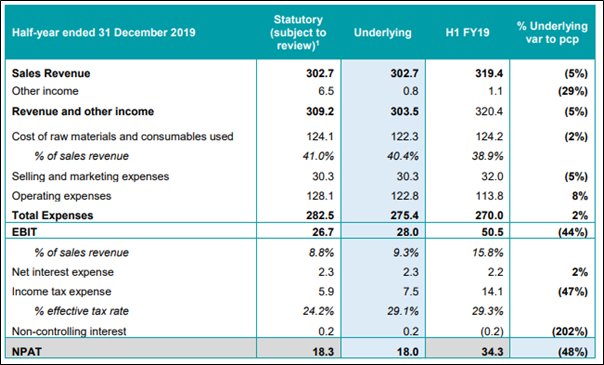

- The company reported first half revenue of $303 million and underlying NPAT of $18 million;

- Underlying EBIT decreased by 44% to 28.0 million and Underlying NPAT declined by 48% to $18.0 million;

- The company has made a decision not to pay an interim dividend in order to conserve cash for operations, as the outlook for the second half of the year has deteriorated.

Income Statement (Source: Company’s Report)

Revenue in the second half of the year is expected to be like that achieved in the first half, though the significantly higher costs associated with manufacturing and other factors will have a material impact on the FY20 result. Directors therefore anticipate full-year NPAT will be in the range of $17 million to $21 million.

While the epidemic has caused a heightened demand for crucial immunity products in Asia and Australia, the effect on the sales has been offset by supply chain interruptions throughout the area as a result of the infection. In China, local advisory for schools and businesses and for people to remain at home for at least the rest of February has led to a cycle of disruptions. Networks which depend on free flow of travellers (small business traders, duty free and tourists) have been impacted. Some e-commerce associates have withdrawn or altered February campaigns with a slowdown of China incoming and internal freight, which has rendered it hard to provide the local market requirement with the necessary products.

Future Growth Prospects

Despite certain challenges in the second half, the company is confident and optimistic about the future of the company. The company’s brand metrics are the greatest they have been in many years. It has the numero uno market position in Australia and several markets in Asia and is quickly assembling a much stronger team in China. Since the new management team has been in place, it has worked hard to develop a solid and credible plan for the business going forward. The company is building its capability in strategic revenue management which will help stabilise pricing across multiple markets and build back the margin it needs to invest in brands and innovation. The company is also exploring a number of new ventures and growth opportunities to help to deliver consistent and higher quality earnings for the company in FY21 and beyond, and looks forward to outlining some of these initiatives when it releases its full first-half year results on 25 February, 2020.

Stock Performance

The stock of BKL closed the day’s trading at $78.000 per share on 12th February 2020, down by 12.791% from its previous closing price. The stock has a market capitalisation of $1.56 billion as on 12th February 2020 with an annual dividend yield of 2.46%. The total outstanding shares of the company stood at 17.4 million, and its 52-week low and high is $63.640 and $126.990 respectively. The stock has given a total return of 7.54% and 5.96% in the time period of 3 months and 6 months, respectively.