Hon Greg Hunt MP, Minister for Health, Australia government stated that, “Good health is essential to our happiness and wellbeing. Australians overall are among the healthiest and longest living people in the world.”

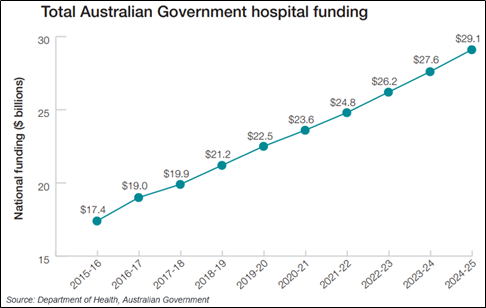

As per August 2019 report published by Department of Health, Australian Government, Australia’s health system is ranked second in the world by The Commonwealth Fund. This rank is based on efficiency, measures of quality, access to care, and the capacity to lead long, productive and healthy lives.

It’s a known fact that Australia is positioned as sixth highest around the world in the parameter of current life expectancy which is 82.5 years. The mortality rates of indigenous child have decreased by 35 percent since 1998. There are more than 94 percent of Australian children who are fully immunised by the age of 5.

Digital information in Australia’s heath care system has the capability to aid in saving lives and provide efficient health related services for the natives. The Australian Digital Health Agency leads the development of National Digital Health Strategy to improve health and support a sustainable health system.

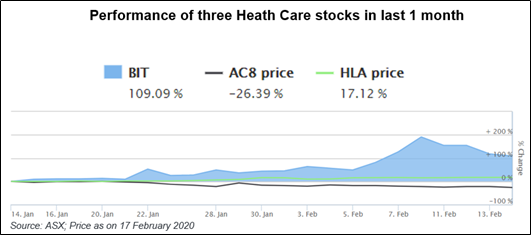

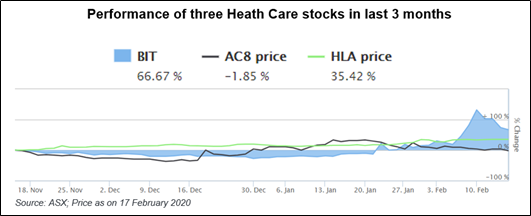

Let’s view the three small cap stocks in health care sector- BIT, AC8 and HLA and understand their recent developments:

Biotron Limited (ASX: BIT)

Tests to cure Coronavirus:

BIT is involved with research, development and commercialisation of medicines aiming at substantial viral ailments with unfulfilled medical requirements.

On 6 February 2020, it mentioned about its activity of evaluating several likely compounds to cure coronavirus. The process includes the new strain named as 2019-nCoV.

A significant increase of 22 percent in the Company’s stock price was seen on the date of this announcement as compared to the previous closing price.

Financial performance:

On 24 January 2020, the Company came out with its financials for quarterly results FY 2020 for the period closed 31 December 2019, and following are the key highlights from the same:

- Net cash from financing and operating activities were $5.036 million and $ 1.231 million, respectively.

- Cash outflows on research and development activity was $932,000. Also, BIT has given a ballpark figure of $936,000 for the next quarter.

The stock delivered a positive return of 1 percent on the date of result announcement as compared to the previous closing price.

Substantial change in stock price:

BIT has witnessed a significant price change from a low of $0.06 to a high of $0.084 on 22 January 2020, which was questioned by ASX. In response, the Company mentioned about certain events / announcements which could be the possible reasons for the fluctuation in the price, mentioned as below.

- Two of the Company’s non-executive directors, Mr Robert B. Thomas and Stephen A. Locarnini have increased their shareholding in BIT by off market purchase.

- BIT’s announcement related to it representing its latest clinical trial data during the Conference on Retroviral and Opportunistic Infections, scheduled in USA, next month in March 2020.

- Also, Biotron has successfully completed clinical trial for BIT225-009 Phase 2 HIV-1, thereby enhancing BIT’s intellectual property position. New patent applications have been filed for Biotron anti-HIV-1 compounds and expanding the use of BIT225.

- The Company has also been engaged in an international contract research organisation to finalise the chronic toxicology studies of BIT225.

Stock information of BIT:

On 18 February 2020, the stock of BIT ended the day at $ 0.115, a plunge of 14.815 percent as compared to previous closing price. The outstanding shares of the company were noted of approximately 701.93 million, with a market capitalisation of nearly $94.76 million. While the 52 weeks low and high price of the stock was noted at $ 0.05 and $ 0.185, respectively.

AusCann Group Holdings Limited (ASX: AC8)

A cannabinoid-based medicines provider, AusCann Group Holdings Limited (ASX: AC8) has a global presence with an outstanding shares of approximately 317.05 million and a market capitalisation of nearly $ 85.6 million, as of 18 February 2020.

Activities which embarked a milestone for the Company in three months period ending 31 December 2019 are mentioned below.

Commencement of Clinical Evaluation:

The Company has successfully completed the manufacturing, development and testing of its proprietary hard-shell capsules for cannabinoid medicines, thereby, releasing the capsules for clinical evaluation, as notified on 18 December 2019.

A three-year agreement was signed with Aspen Pharmacare Australia to deliver cost-effective packaging services for the capsules. Whereas, the manufacturing is done by US-based company, PCI Pharma.

On 18 December 2019, a phenomenal increase of 50 percent in AusCann’s stock price was seen as compared to the previous closing price.

Releases low-dose form capsule

On 18 February 2020, AC8 notified the market on the conclusion of the manufacturing and testing of its patented CBD based hard-shell capsules in lower dosage presentation.

Product Development Site:

AC8 has moved its administration headquarters to the new facility based in Perth, Western Australia. The construction of the site was concluded as per the schedule, and was on budget, wherein $4.5 was spent till the date of the announcement. As notified on 25 January 2019, further capital spend has been deployed for R&D equipment and within the original budget of $6 million.

Change of 13.2 percent holding in AC8:

AusCann notified the market that a long-term investor Merchant Funds Management Pty Ltd have acquired 13.2 percent interest in AC8 from Canopy Growth Corporation.

Key Financial Highlights from Q2 FY 2020 Results for the period ended 31 December last year:

- At the end of the quarter, AC8 had a cash balance of $26 million

- Net cash outflows were of $6.405 million, primarily because of construction costs of $3.426 million.

- Cost of research & development was $0.979 million.

Going forward, the Company has forecasted the cash outflows of $4.678 million in the next quarter. Also, AC8 mentioned that its focus was on core R&D program which covers product manufacturing, clinical evaluation and commercialisation.

Stock performance of AC8:

On 18 February 2020, the stock of AusCann last traded at $ 0.300, with an upsurge of 11.111 percent as compared to previous closing price. The stock has given a return of -27.03 per cent and -41.94 per cent in the past six months duration and one-year period.

Healthia Limited (ASX: HLA)

HLA is an integrated group of health-based entities with a goal to improve people’s lives by providing world-class health related services to them.

Listed on ASX since September 2018, Healthia Limited (ASX: HLA) has successfully completed the IPO and raised $34.392 million. The stock has delivered a positive return of 28.43 per cent in the last one-year span and 9.62 percent since the inception of stock being traded on ASX.

Geographical expansion to North America:

iOrthotics USA LLC has extended its presence to North America with the introduction of a 3D printed orthotics manufacturing laboratory located in Astoria, New York. This facility will be operated by iOrthotics, which is 58 percent interest owned by HLA and the remaining 42 percent being owned by Hersco Orthotics Labs of Long Island City New York.

On 28 January 2020, the Company announced the expansion related news and the stock delivered a positive return of 3 percent as compared to the previous closing price.

Financial performance:

The Company released its FY 2019 annual report for the period ended 30 June 2019 with the key highlights as mentioned below.

- Revenue increased by 89.6 percent pcp, from $34.325 million to $65.084 million.

- Profit before income tax expense was $ 983000, however there was a loss after income tax expense of $283,000.

- At the end of the financial year, the cash and cash equivalents were of $2.538 million as compared to $0.166 million on pcp.

- As at 30 June 2019, the net debt was $17.9 million, an increase of 35.2 percent. Also, banking covenant requirement was below 50 percent.

4-tiered growth strategy:

HLA strategy is focused on four pillars, namely -

- Organic Growth

- Patient Focused Outcomes

- Vertical Integration

- New Acquisitions

Stock information of HLA:

On 18 February 2020, the stock of HLA last traded at $ 1.305, with a fall of 0.382 percent as compared to its previous closing price. The 52 weeks low and high price of the stock was noted at $ 0.78 and $ 1.33, respectively.