Amidst the turbulent market scenario rocked by the effects of bushfire and Coronavirus, the thought of confidently investing might send you a red alert signal. However, when you are still reeling with the low-interest rates offered by the financial institutions, the investment perplexity is even more heightened, especially in the financial stocks. The lack of trust among the investors concerning a bank and other financial institution’s intentions can be regarded as the Achilles heel for the finance-related stocks.

While the investment in the financial stocks is augmented by the high dividend yield, the rising capital requirement, the need to increase the profitability margin and the growing amount of bad debt can cool down the investor’s motivations.

The interest rate held by RBA at the record low of 0.75% appears to be affecting the profitability of the financial institutions through the interest revenue. The effect of high personal debt in Australia seems to be weighing strongly on the expense intentions of the people. Despite the low-interest rate, the capital expenditure in Australia has been low due to the excessive debt scenario. Although the high property rates bolster the financial sector, the other areas are still lagging.

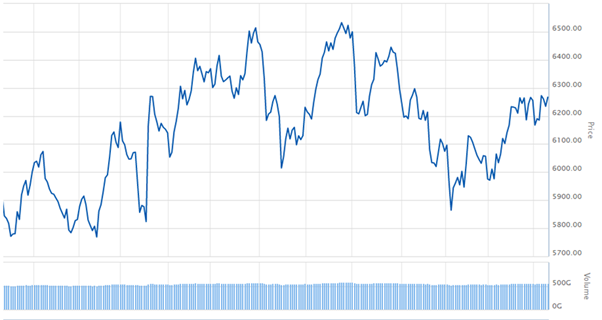

However, considering the movement of S&P/ASX 200 Financials, the year 2020 appears to show growth for the financial sector. The index after witnessing the drop of 8.52 % from 6532.457 on 24 September 2019 to 5975.351 on 31 December 2019, has recovered in 2020. In the new year, the index has moved up by 4.88%.

As on 12 February 2020. (Source ASX)

In the middle of the prevalent sceptic setting, the results announcement seems to be positively catalysing the bullish sentiments for the two financial stocks on ASX. The following are the two financial stocks that are doing well today in the Australian Stock market:

Centuria Capital Group (ASX:CNI)

Source: ASX

The property funds manager, Centuria Capital Group, recorded the immediate substantial growth in its shares after its HY20 announcement. Centuria Capital encompassing around $6.2 Billion in assets under management as on 30 June 2019 caters to investors wealth management needs in property bonds.

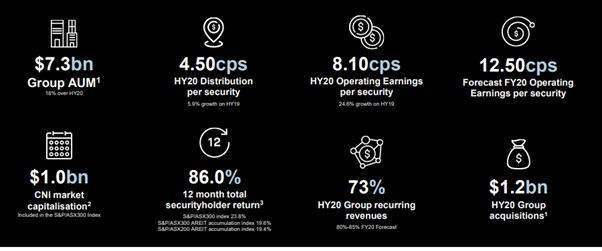

The result announcement highlighted that the Assets Under Management witnessed a significant growth of around 23% in FY19 amounting to the total value of $6.4 Billion. The strong growth in AUM alongside the proposal to acquire Augusta Capital Limited would further augment the AUM to $9.2 Billion. The Operating NPAT for the company recorded the stupendous growth of 53.91% from $21.7m in HY19 to $33.4m in HY20. Operating EPS increased from $6.5 per share in HY19 to $8.1 per share in HY20.

Centuria operates through three segments, which include Property Funds Management, Investment Bonds and Co-investments. The company recorded the growth of 90% in the operating profit of Property Funds Management which constitutes the most significant division for the company. The total AUM amounting to $7.3 Billion for the group incorporates $6.4 Billion Real Estate AUM, $0.9 Billion Investment Bonds AUM and $0.6 Co-Investments.

The steady growth of the group, AUM to existing $7.3 Billion, is supported by the $1.2 Billion of gross acquisitions and $0.2 Billion of revaluations. The company hinted about further organic acquisitions that the investors are expecting to increase the future AUM prospects for the company positively.

The market today seems to be mirroring the Centuria HY20 results as the shares record a sudden rise in the price by 1.992% in the two consecutive trading sessions. AUM and operating profit growth trends are reflecting in the share price, which has climbed by $0.050 in the last trading session from the closing price of $2.510 as on 11 February 2020. The stock today opened at $2.520, whereby reaching the day hight at $2.60 and day low at $2.50. The 52 weeks high and low for the company is $1.30 and 2.60 respectively.

Insurance Australia Group Limited (ASX:IAG)

The shares of Insurance Australia Group met with positive outlook today as the shares climbed by 0.146% on 12 February 2020. Insurance Australia Group with the market capitalisation of $15.88 Billion, is the largest General Insurance company present across Australia and New Zealand. It is an Umbrella organisation that hold many key insurance brands. Some of its brands include NRMA Insurance, SGIO, SGIC, etc. in Australia and NH, State, Lumley insurance, etc.

The Gross Written Premium (GWP) acknowledged the growth of 1.4% from $5,881m in 1H19 to $5,962m in 1H20. The GWP conforms to the guidelines of ‘low single-digit’ growth strategy. While the insurance profit for the company moved up by 1% in 1H20, the underlying insurance margin recorded the surging by 70 bps. The company, however, reported the dwindling in its net profit after tax by 43.4% as the profits shrunk from $500 million in 1H19 to $283 in 1H20. Although the company recorded a drop of 16.7% in its dividend, the diluted cash EPS and Cash ROE grew by 19.3% and 230 bps respectively. The company expected to complete its India Divestment by 2H20.

The announcement regarding the distribution of the dividends further seems to ignite the investor’s emotion, increasing the total value of the shares traded. The dividend would be reportedly paid on 16 March 2020. The dividend distribution would take place at 70% franked for the period ending 15 March 2020.

Headquartered in Sydney, the company shares showed the fluctuating performance in the past year. Last Christmas Bell appears to be ring grimly for the shares of the company as its share price plummeted. Comparing the dividends per share for 1H19 and 1H20, the latter period has encountered a decrease of 16.7%. The investors may not positively receive this dwindling in their passive income.

However, the shares of Insurance Group Australia moved from $6.870 recorded in the previous trading session to $6.880 on 12 February 2019. With the opening price at $6.80, the stock reaches the day high with the price of $7.060 and day low at $6.810. The 52 weeks high and low for Insurance Australia Group is $8.740 and $6.810 respectively.