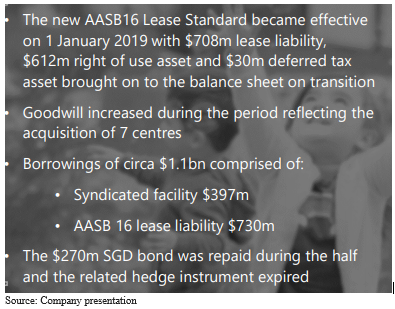

AASB 16 requires a lessee to recognise liabilities and assets for all leases of more than 12 months, unless the underlying asset is of low value. It requires companies to bring the most of operating leases onto balance sheet. Implementation of this standard brings in more transparency about the company lease commitments. However, it poses a challenge in reporting the financials of the company.

A recent example of AASB 16 implementation shows its impact on the financials of G8 Education Limited (ASX: GEM), which adopted the new lease accounting standard on 1 January 2019.

G8 Education Limited (ASX: GEM) marked its presence in 2006. Located in Varsity Lakes, Australia, it provides developmental and educational child care services. The company recently announced its 1H CY19 financial results.

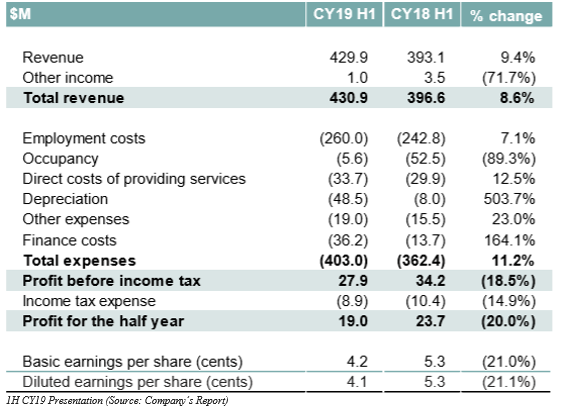

The companyâs Profit after tax has been reduced to 19 million when compared to $23.7 million in 1H CY18. This impact can be seen through increase in depreciation & finance cost and decrease in occupancy cost.

Financial Performance for 1H CY19

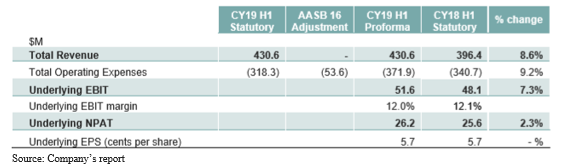

- Revenue was reported to be 9% higher at $430.6 million when compared to the previous corresponding period

- Underlying EBIT increased by 7% to $51.6 million.

- PBT of $27.9 million was 18.5% below the last yearâs Underlying PBT figure.

- NPAT dipped by 20% to $19 million.

- Total expenses also increased to $403 million when compared to last yearâs $362.4 million.

Operational updates

- The company witnessed improvement in wage performance. The company expects further efficiency gains to compensate for further rises in ECT wages owing to projected regulatory change next year.

- GEM reported H1 occupancy rate of 71.3%, up by 1.5 percentage points.

- 5 greenfield and 2 brownfield centres were reportedly completed in 1H CY19.

- $16 million total CAPEX reported during 1 HY CY19, with forecasted CAPEX of $35-40 million in CY19.

Cash Flow Position

Operating cash inflows of $63.1 million were reported during the period. While, investing and financing cash outflow amounted to $48.2 million and $25.2 million, respectively. Cash and cash equivalents at the end of the half year stood at $45.2 million.

Capital Management

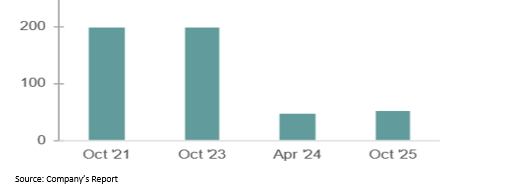

- Singapore bonds amounting SGD 270 million were repaid using syndicate debt facilities.

- Net debt is forecasted at its peak; at this point the company is expected to have enough cash of ~$110 million.

- Debt is expected to amortise throughout CY2020 post completion of the greenfield pipeline.

- Current borrowing costs are expected to reduce on H1 level of ~$13 million post repayment of SGD corporate bonds.

Strategic Progression

- 500 centres completed in April 2019 which matches with the expected numbers.

- Rollout of Xplor Parent and Educator apps as expected.

- Centralized enquiry has been made to enrolment process.

Dividend Update

The company has recently declared dividend amounting to 4.75 cents for its ordinary fully paid securities, payable on 3th October 2019. The distribution was reported for the period of six months, ending on June 30, 2019.

Outlook

ASX: GEM believes that its 2H CY19 does not have the benefit of CCS stimulus which commenced on July 1, 2018. The occupancy growth is expected to be in the mid 1% pts. The national market leading curriculum program is expected to roll out in August 2019. The customer engagement has been extended to 500 centres with 85% enquires to be solved in an hour and on track to compete refurbishment of 80 centres in the current year. Wages performance Year-to-Date is in lieu with the expectation and further efficiency gains are being expected.

ROCE is expected to be on the higher side with the core portfolio delivering the organic growth and mature greenfield centres. The Outflows of development of remaining 12 centres is expected to be ~$30 million. The companyâs primary focus is completing its existing commitment of greenfield pipeline.

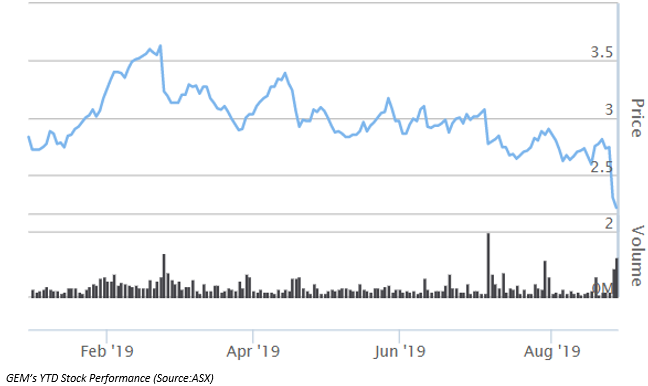

Stock Performance

GEM is currently trading higher on the ASX at AUD 2.420 (as at 01:00 PM AEST on 28th August 2019 with a rise of 9.50 per cent in comparison to the last closed price of AUD 2.21. The 52-week high and low value of the stock are recorded at AUD 3.635 and AUD 1.880, respectively.

Let us look at another education sector player and the recent financial update (FY19)

IDP Education Limited (ASX:IEL)

IDP Education Limited (ASX: IEL) provides international student placement services across the United states, Australia, Canada, UK & New Zealand. The company is a co-owner of Profiency test, IELTS (International English language Testing System) & also provides teaching services in English language.

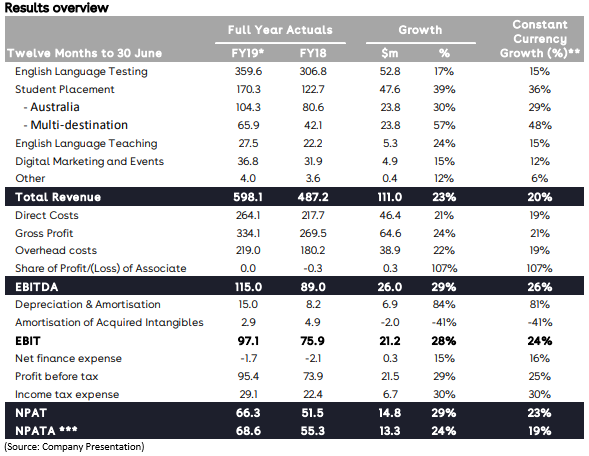

Financial Performance FY 2019

- Revenue was reported to be 23% higher at $598.1 million when compared to the previous corresponding period.

- EBITDA increased by 29% to $115.0 million when compared to corresponding period.

- EBIT of $97.91million was 28% higher the last yearâs EBIT figure.

- NPAT was reported to be 29% higher to $66.3 million.

- NPATA increased by 24% to 68.6 million.

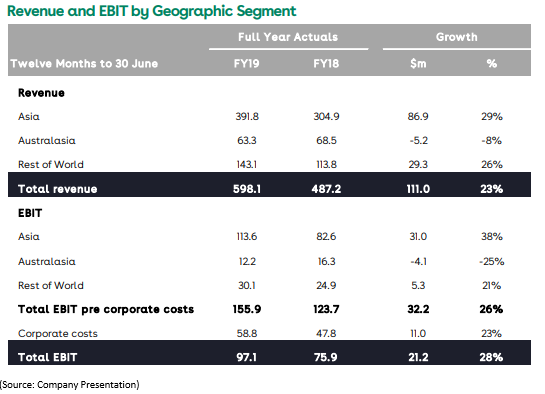

Segmental Earnings

- 73% of EBIT & 66% of revenue is represented by Asia.

- For Asia segment, major contributor of revenue growth was 39% revenue growth in India SP & IELTS.

- China SP revenue grew by 20% which is driven by growth in demand for the UK.

- Australia revenue is affected by decline in IELTS volume in Australia & New Zealand.

Strong Revenue & earning growth can be seen from the rest of the world, Canada, Nigeria & Middle East.

Stock Performance

IEL is currently trading on the ASX at AUD 16.170 on 28th August 2019 (1:44 pm AEST) with a fall of 0.308 per cent in comparison to the last closed price of AUD 16.220. With ~254.44 million outstanding shares , market cap of the stock stands at AUD 4.13 billion. The 52-week high and low value of the stock was at AUD 19.840 and AUD 8.450, respectively, at the time of writing the report.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.