Australia has a robust health care system, cooperatively operated by the federal, state and local governments, and is labeled as one of the best across the globe. Health care space in Australia is a dynamic sector with the potential to generate significant returns, amidst significant clinical trials, new product/drug developments, medical technology and cannabis related treatment discovery by the companies.

Health care remains among the top few sectors and has time and again proven to be one of the safest sectors in Australia by investors, despite uncertain and a fluctuating stock market coupled with domestic and global geo-political concerns.

The sector seems be getting exclusive spotlight amidst Chinese coronavirus outbreak, with several players across the globe engaged in conducting clinical trials and testing potential treatment technology.

Amidst the reporting season wherein companies are posting mixed earnings and guidance result considering bushfire and coronavirus impact on businesses, we are highlighting two ASX listed health care stocks and their performance for the first half of 2020.

Mayne Pharma Group Limited (ASX:MYX)

An ASX-listed specialty pharmaceutical company Mayne Pharma Group Limited (ASX:MYX) is into applying its drug delivery expertise for the commercialisation of generic as well as branded drugs. The company offers a robust portfolio of generic and branded pharmaceuticals for the multiple therapeutic applications including oncology, cardiology, women’s health as well as dermatology. The oral drug delivery technology of the company has been established for a variety of therapeutic products.

On 21 February 2020, Mayne Pharma updated the market with its half year results (for the period ended 31 December 2019). The highlights from the half yearly presentation of the company are-

Financial Highlights-

- Mayne pharma reported sales of approximately $227.2 million, down by 17% on prior corresponding period (pcp) and this is due to competition on key generic products.

- The company declared reported EBITDA of nearly $34.6 million and underlying EBITDA of ~$47.4 million.

- The net loss after tax of the company was reported to be approximately $17.5 million.

- Mayne reported a positive operating cash flow of approximately $46.2 million with strong cash conversion.

- The annualised significant spend base reduction of the company was nearly $20 million to further right size organisation and optimise global infrastructure as well as product development priorities.

- To provide additional flexibility for the E4/DRSP transaction, the company has restructured debt facility.

Operational Highlights-

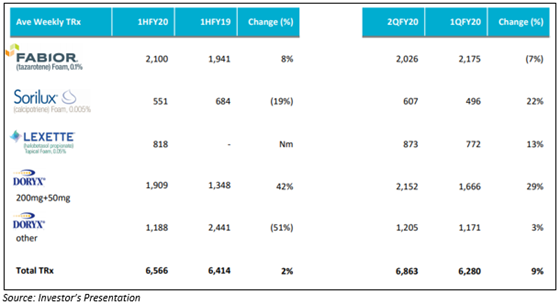

- In the second quarter of FY2020, specialty brands performance improved with sales increasing by 50% in the first quarter of FY2020.

- Solid revenue growth delivered by Metrics Contract Services and has global supply agreements with two top ten global pharma companies.

- The company licensed novel oral contraceptive E4/DRSP in the United States.

- Generic NUVARING® complete response letter (CRL) submitted to the Food and Drug Administration with launch expected in the calendar year 2020.

- The company launched two topical generic dermatology products and has two in-licensed to launch in the calendar year 2020.

- Trifarotene phase 2 program started in patients with lamellar ichthyosis.

E4/DRSP oral contraceptive update-

- Mayne revealed that the New Drug Application (NDA) submission is targeted for the first half of the calendar year 2020 with potential approval anticipated in the first half of the calendar year 2021.

- The company mentioned that it is finalising the selection of brand name and logo for the contraceptive subject to the Food and Drug Administration (FDA) approval.

Dermatology and women health product portfolio-

Mayne Pharma is planning to expand dermatology and health product portfolio for women. The number of dermatology and women’s health (WH) products in the US market would increase in the upcoming years. The company launched gTRIANEX® TBC in February 2020.

Mayne has improved dermatology prescription performance in the second quarter of the financial tear 2020

TOLSURA in the United States-

- Mayne’s TOLSURA® is now approved on eight major hospital networks and is under active review in another eighteen hospitals.

- The addressable market for TOLSURA® is approximately US$300 million and anticipated to broaden the therapeutic application through further clinical developments-

- The phase 2b study (ongoing) has the potential to support an expanded therapeutic use into other fungal infections such as coccidioidomycosis. The primary endpoint data for this study is anticipated to be published at IDWeek 2020, (October 2020).

- By the end of the financial year 2022, the company is targeting 25% of US prescription market share of itraconazole.

Stock Information-

MYX stock closed the day’s trade at $ 0.375, down by 6.25% from its previous close on 21 February 2020. With a market cap of approximately $671.63 million, the 52-weeks high and low price of the stock was noted at $0.850 and $0.365, respectively.

Monash IVF Group Ltd (ASX:MVF)

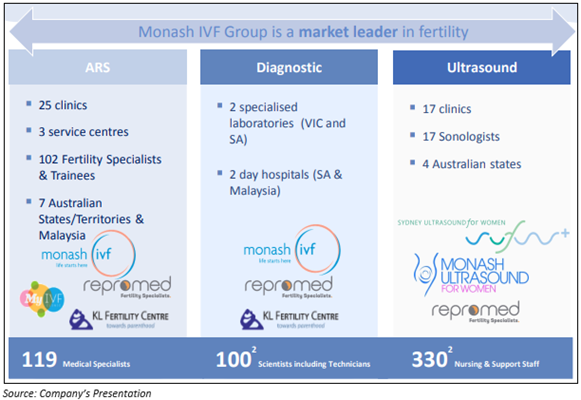

One of the world leaders in providing fertility solutions, Monash IVF Group Ltd (ASX:MVF) is a pioneer in offering development of assisted reproductive technologies (ART) and prenatal diagnosis. Additionally, the company also actively supports R&D in ultrasound and reproductive medicine, and it has many states of the art laboratories with cost-effective fertility treatment options in Australia.

Overview of the company as of 20 February 2020;

On 21 February 2020, Monash IVF Group updated its half yearly results on ASX, highlighting the financials and the outlook.

The quick highlights from half yearly presentation are-

- Monash IVF Group reported revenue of approximately $77.0 million for the first half of the financial year 2020.

- Adjusted EBITDA reported to be $16.8 million, 13.0% down as compared to H1 FY2019.

- The adjusted net profit after tax (NPAT) was recorded at $1 million.

- A fully franked dividend of 2.1 cents declared by the company.

ARS Australia Operational performance-

- Alternative and less invasive technology and method for ICSI anticipated to be available across MVF clinics in the early financial year 2021.

- Development of Sperm Selection device in partnership with Memphysys Limited (ASX:MEM) is progressing with final stages of testing moving to a Monash IVF clinical trial.

- With over 96% of specialists contracted across the group, all 24 Victorian fertility specialists of Monash are now contracted.

Diagnostics Performance-

- Sydney Ultrasound Transformation review progressing as total scans across the group increased to 39,525 by 2.3% from 38,633, after declines in the previous corresponding period.

- The company mentioned that NIPT continues to grow as volumes rise to 6,726 from 6,536.

- Monash IVF Group reported revenue growth of nearly $0.4 million derived from an upsurge in Day Surgery income, progress in genetics income as well as in ultrasound scans.

Outlook for the remaining year 2020-

- The company expects NPAT before non-regular items for the financial year 2020 (year ended 30 June 2020) will be in the range of $18.0 million to $19.0 million.

- New CBD fertility clinic in Sidney is expected to open in the fourth quarter of the fiscal year 2020.

- New fertility specialist’s recruitment, including a newly established fertility specialist in Sydney is planned in the late second half of the financial year 2020.

Stock Information-

MVF stock closed the day’s trade at $1.010 on 21 February 2020. With a market cap of approximately $ 238.14 million, the 52-weeks high and low price of the stock was noted at $1.535 and $0.922, respectively.