According to the Australian Bureau of Statistics (ABS), the trend estimate for total mineral exploration expenditure in the quarter ended 31 March 2019 increased to $ 573.9 million, up 1.7% by $ 9.4 million from the previous quarter (11.9% higher than the estimate for corresponding quarter in 2018) with the most significant contributor being Western Australia (up 2.6% or $ 8.8 million). In the seasonally adjusted terms also, the estimate for mineral exploration expenditure edged up 3.9% reaching $ 581.7 million in the concerned quarter. This is indicative of expanding exploration and development initiatives in the metals and mining sector with the trend estimate for metres drilled rising by 2.0% during the March 2019 quarter.

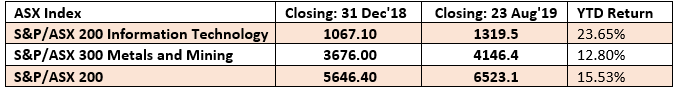

Also, S&P/ASX 300 Metals and Mining Index has generated a positive return of 12.80% year-to-date (YTD), close to the S&P/ASX 200 Index that has delivered 15.53% YTD. The Index performance so far demonstrates that the mining stocks are catching up with the ever-shining technology sector stocks with the S&P/ASX 200 Information Technology Index leading with a high positive return of 23.65% YTD.

Some of the small cap (AUD 500 million- AUD 2 billion) companies from Australiaâs metals and mining sector that have delivered the highest YTD returns so far include Nickel Mines Limited, Champion Iron Ltd, Lynas, Ausdrill and Mount Gibson Iron. While from the Information Technology sector, the small cap top performing stocks include Phoslock Environmental Technologies Limited (ASX: PET), Rhipe Ltd (ASX: RHP), Dicker Data Limited (ASX: DDR), Megaport Ltd (ASX:MP1), Infomedia Ltd (ASX: IFM).

Letâs look in detail at four of the aforementioned mining stock companies that have been performing well and contributing to the overall boost in the sector index, thus providing a lucrative investment opportunity for the new investors to consider and high returns to the existing shareholders.

Nickel Mines Limited

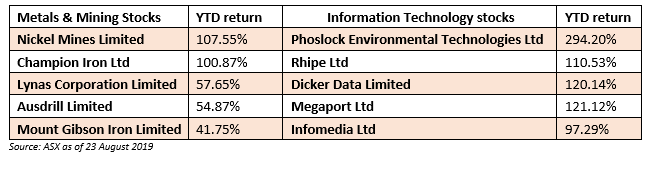

Nickel Mines Limited (ASX: NIC) is an emerging player in the global nickel industry, aspiring to produce the most profitable nickel units worldwide in partnership with Chinaâs Tsingshan Holding Group, the worldâs largest stainless-steel producer. The company holds an 80% interest in Hengjaya RKEF nickel (HNI) mine, located in Morowali Regency, Central Sulawesi, Indonesia, in addition to a 60% interest in 2 Line RKEF Plant producing nickel pig iron (NPI) and a 60% interest in the Ranger (RNI) nickel Project. With a market capitalisation of around AUD 916.01 million and approximately 1.67 billion shares outstanding, the NIC stock closed the dayâs trading at AUD 0.555 on 23 August 2019, edging up 0.909% by AUD 0.005.

On 15 August 2019, Nickel Mines informed that it had completed the second acquisition of the Ranger Nickel Project, currently in a commissioning phase, increasing its ownership from 17% to 60%. Under the terms of a collaboration agreement with Shanghai Decent Investment (Group) Co., Ltd, a company of Tsingshan Holding Group, Nickel Mines may increase its equity interest to up to 80% in the project in three phases.

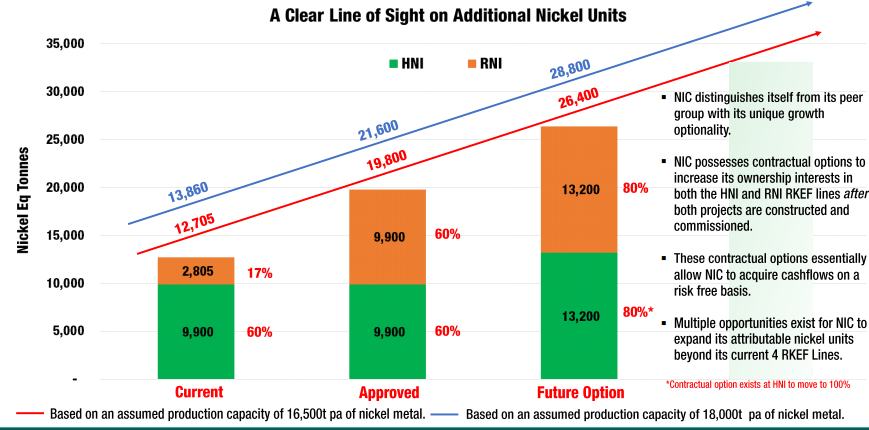

The company has a unique growth optionality and possesses contractual options to increase its ownership interests in both HNI and RNI RKEF lines after both projects are constructed and commissioned. Nickel Mines also has compelling economics with a clear line of sight on strong EBITDA and free cash flow growth.

Source: Presentation to Investors

Champion Iron Ltd

Rozelle, Australia-based Champion Iron Ltd (ASX: CIA) is a metals and mining sector player, engaged in the acquisition, exploration and development of assets for iron ore deposits. The company is currently advancing its iron resources in the south end of the Labrador Trough, Quebec, Canada with Its flagship asset being the Bloom Lake iron ore project.

Bloom Lake Project; Source: Companyâs Website

Champion Ironâs market capitalisation stands at around AUD 992.21 million with approximately 435.18 million shares outstanding. On 23 August 2019, the CIA stock price settled the dayâs trading at AUD 2.270, down 0.439% by AUD 0.010 with ~ 417,705 shares traded. In addition, CIA has delivered positive returns of 100.87% YTD and 46.96% in the last six months.

Recently on 16 August 2019, Champion Iron announced that its subsidiary Quebec Iron Ore Inc., the operator of the Bloom Lake Mining Complex, had successfully completed the previously announced agreement with Caisse de depot at placement du Quebec for a preferred share offering of C$ 185 million in addition to a fully underwritten US$ 200 million credit facility with the Bank of Nova Scotia and Societe Generale.

Besides, the company also informed that it had completed the transaction with the government of Quebec, through its agent Ressources Quebec Inc (RQ), to acquire RQâs 36.8% equity interest in QIO for a total cash consideration of C$ 211 million. The transaction is expected to be highly accretive to the companyâs operational and financial metrics.

For the first quarter ended 30 June 2019 of the fiscal year 2020, Champion Iron reported a net income of $ 74.2 million, comparted with $ 20.7 million in the prior corresponding period. Its revenues improved to $ 277.9 million from $ 150.7 million in the same period a year ago, while cash flow remained positive at $ 91.9 million.

Lynas Corporation Limited

Lynas Corporation Limited (ASX: LYC) is an integrated producer and supplier of rare earths from mine to customer with its flagship asset being, the Mt Weld, Western Australia, which is known as one of the highest-grade rare earths mine in the world. The company also owns a Mt Weld Concentration Plant, where the rare earth oxides are initially processed. Lynas Corporation has a market capitalisation of around AUD 1.67 billion with ~ 691.06 million shares traded. On 23 August 2019, the LYC stock price settled the dayâs trading at AUD 2.270, down 6.198% by AUD 0.150, with ~ 8.75 million shares traded. In addition, LYC has delivered positive returns of 57.65% YTD and 39.48% in the last six months.

On 22 August 2019, Lynas Corporation informed that it had received the renewed Lynas Malaysia operating licence, subject to conditions including - cracking & leaching would be relocated to Western Australia and Lynas would build a Permanent Deposit Facility (PDF) for WLP residue.

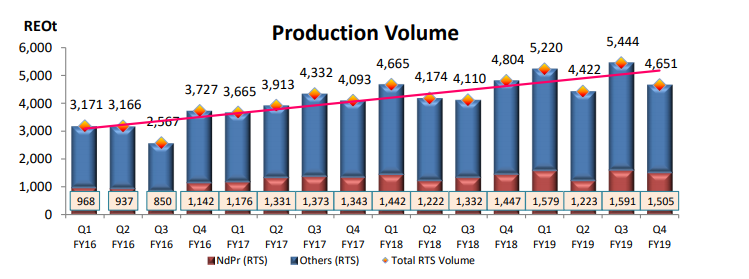

As per the companyâs quarterly report for the period ended 30 June 2019, Lynas Corporation reported an operating cashflow of AUD 37 million, despite a low market pricing for NdPr. The NdPr production was kept at ~1,500 tonnes in a softer market scenario during the reported quarter.

Source: Quarterly Activities Report

Lynas decided to reserve NdPr production for strategic customers during the concerned period, temporarily stockpiling any excess. Although, the decision restricted NdPr sales in the quarter, but is expected to support the growth of the companyâs strategic partners in the future.

The cash balance was around AUD 89.7 million as of the quarter end. Besides, new terms for the JARE loan facility were also discussed and announced to the market, providing the company with a strong foundation for growth.

Ausdrill Limited

Ausdrill Limited (ASX:ASL), now renamed to Perenti, is headquartered in Australia and offers both surface and underground mining services at scale with proven experience in operating some of the largest projects, globally. The companyâs market capitalisation is around AUD 1.2 billion with ~ 685.77 million shares outstanding. On 23 August 2019, the ASL stock price settled the dayâs trading at AUD 1.735, down 0.857% by AUD 0.015 with ~ 924,934 shares traded.

The ASL stock has delivered a positive return of 54.87% YTD.

Recently on 20 August 2019, Ausdrill Limited updated the market regrading adopting âPerentiâ as its new brand and identity. Meanwhile, the company would trade under âPerenti Globalâ. It would sit above the industry sector groups including underground mining, surface mining, and investments.

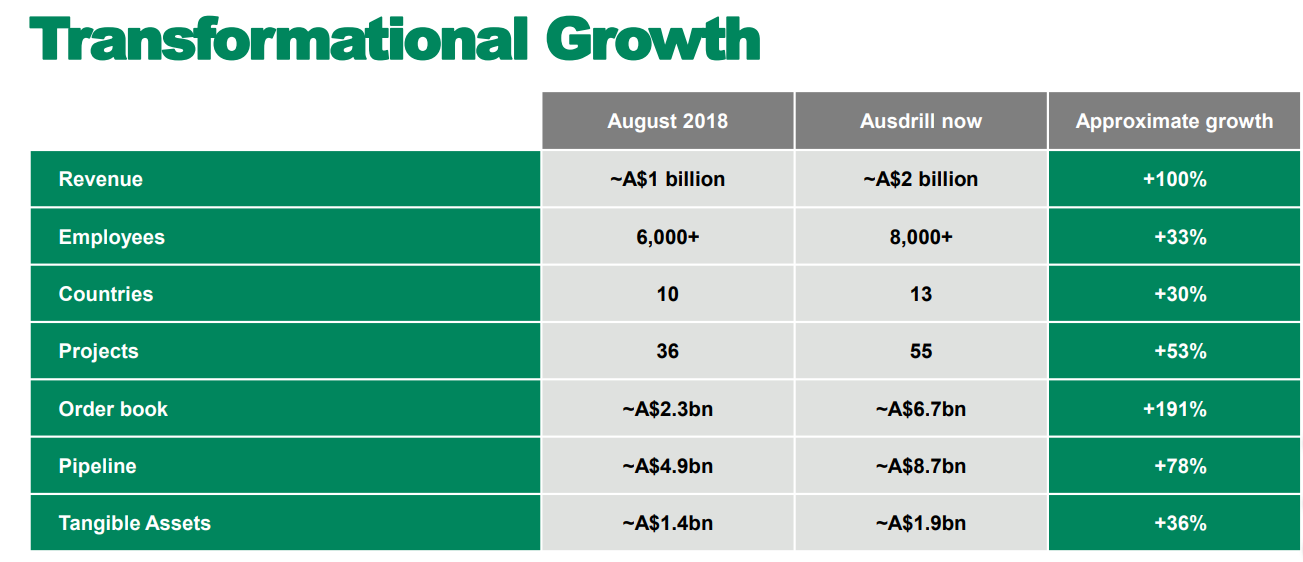

The past one year was transformational for the company as the revenue recorded got doubled following the acquisition of Barminco, formulation and adoption of a new strategy and implementation of a new operating model.

Source: Companyâs Diggers and Dealers Mining Forum Presentation

In the process, the company evolved from an Australian drilling company into a global mining services company. Thus, the new name better reflects the Groupâs status as a global diversified mining services provider.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.