Australian Agricultural Company Limited (ASX:AAC) traces its roots back to 1824 when it was established as a land development company through assistance from the British Parliament. Over the years, the Company has grown to become a leading producer of beef. Its products are consumed domestically as well as internationally.

Australian Agricultural Company has a portfolio of brands, which includes Master Kobe, Kobe Cuisine, Darling Down Wagyu, Wylarah and Westholme.

Strongest Positive Operating Cashflow in 3 Years

AAC has reported full-year results for the period ended 31 March 2020, registering an operating profit of $15.2 million, primarily due to international Wagyu beef sales and emphasis on cost reduction.

Despite seasonal costs, the business generated its best positive operating cashflows in the past three years. For FY20, the Company reported a statutory EBITDA profit of $80.1 million against a loss of $182.7 million in FY19.

Total sales, which include meat and cattle sales, were $334.14 million in FY20 compared to $364.08 million in the previous year. Net profit after tax for the period was $31.31 million compared to a loss of $148.4 million in the previous year.

During the year, the Company continued to progress the roll out its branded beef strategy. It suffered setbacks related to flooding and drought events but was able to safeguard flagship herds and hassle-free supply chains.

In FY20, there was an increase of ~20% in Wagyu meat sales with an increase in prices as well. Wagyu brand has a presence in almost all sales channels, globally, and AAC experienced strong demand across all regions with a softer trading condition in the last month of the year due to COVID-19.

Westholme, a premium category, delivered strong sales growth against the previous year, underpinned by the launch of the brand in key cities across the world. AAC has a strong presence in the retail sales category as well. With a focus on cost optimisation, the Company reduced its operating expenditure by $31 million.

Live cattle market regained footing in FY20 following steep price falls in the previous year, which also included write offs. As a result, the value of livestock improved in FY20, resulting in a favourable impact of $254.6 million that improved statutory EBITDA profit compared to the previous year.

The value of pastoral properties improved by $63.6 million in FY20, driven by portfolio quality and resilience. This means a more than 9% increase over the previous year end. There was an increase of 12% in the market value of non-Wagyu and Wagyu cattle compared to the previous year end. But the increase in market value was offset by strategic destocking conducted by the Company, while these declines in stocks were mainly to the trading livestock and not to signature herds.

On COVID-19 response, the Company reduced costs, emphasised on stocking retail channels, and redefined sales & marketing prioritised. And, it is also focusing on retail market penetration.

In FY20, the retail sales channel accounted for around 40-50% of the total meat sales, and now the Company intends to speed up the supplies into the retail channels, including online, global supermarkets and gourmet butchers.

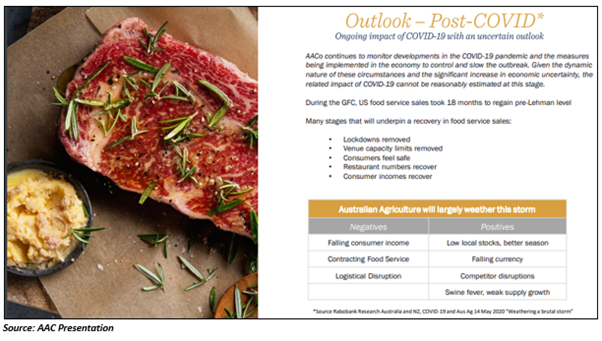

On FY21 outlook, the Company continues to monitor the pandemic and public health measures across the world, and the impact of COVID-19 on earnings remains uncertain. The pandemic has impacted food service business across the world, and the overall impact is yet to be realised.

Recently, the Company’s four beef plants were placed under suspension by the Chinese authorities. It is working with the concerned stakeholders to respond to the consequences faced by these plants.

It was understood that China sales constituted approximately 15% of the total meat sales in FY20, of which over one-third of export sales to China were not impacted by the suspension. The Company has a worldwide presence that may enable the business to sell in other countries, thus minimising the impact of suspended facilities.

Divestments

AAC also notified to have entered transactions with Tavistock and other parties to restructure the interest in IT companies, where AAC and Tavistock have minority interests. The Company intends to divest all of the stakes in Atlas Labs, Surge, Pyxle and Trabeya.

Investments in these businesses were made to fulfil the skillset gaps across the Company as co-investing delivered cost advantages, but the in-house capabilities of AAC are well-developed to operate without these investments.

As a result of divestments, AAC would receive a consideration of $2.6 million, meaning a book loss of $0.4 million. However, the transaction means a net positive cash return of approximately $0.4 million on invested cash.

April Letter to Shareholders

AAC is looking for opportunities at the backdrop of COVID-19 crisis. Management has defined sales and marketing focus of the business. The Company has implemented social distancing norms at the workplace and restricted movement from site to site in Queensland and Northern Territory.

Since food services business is experiencing closures, AAC has improved its focus on retail sales channels. Executive team and Board have considered taking a pay cut of 20% over the next three months.

It would temporarily stand down employees from its sales and marketing teams. The Company’s corporate staff is working four days a week since 1 May 2020 and will continue to work until 31 July 2020.

On 21 May 2020 (AEST 12:39 PM), AAC was trading at $1.090, down by 1.802% from the previous close. Since the beginning of the calendar year, the stock is up by 0.45%. Over the last five days, it is up by 9.36%.

(All currencies in AUD unless or otherwise stated)