BlackEarth Minerals NL (ASX:BEM), incorporated in 2016 and based in West Perth, Western Australia, is a minerals development company, focused on the identification, evaluation and, if warranted, acquisition of resource projects and assets in the global markets. Its mining strategy is focused towards a low-cost, high-value product, for which demand is growing and the outlook is positive. BEM, which became a publicly listed company in 2018, intends to take advantage of expected shortage as well as higher prices of graphite in the coming years.

Leadership â Mining Professionals:

BEM is led by a highly experienced and distinguished Board of Directors, together with a senior management team, holding extensive expertise of a minimum of 20 years in the resources sector:

Madagascar and Western Australia Assets:

The companyâs portfolio of quality graphite (the most important raw material in the lithium-ion battery) assets in focus include-

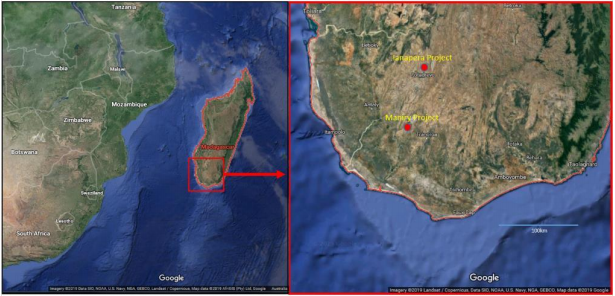

Madagascar Projects: BEM has a major focus on Madagascar, which is the fifth-largest producer of graphite in the world and a major graphite supplier to countries including the United States, China and India. In 2019, the African nation produced 19 per cent of total graphite output to date, up from 11 per cent in the previous year.

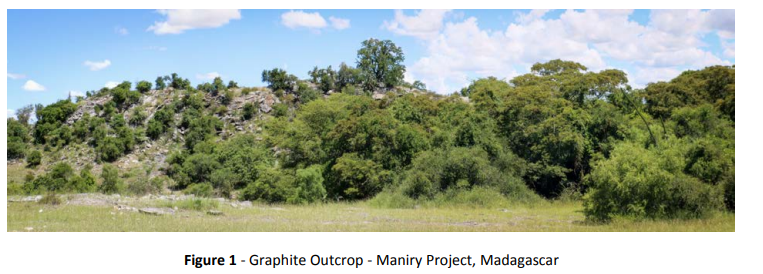

- Maniry Graphite Project - Covering an area of ~ 143 square kilometres, the Maniry project in the southern region of Madagascar is the companyâs 100 per cent owned asset and its flagship project. Total indicated and inferred resources at the project are estimated at 20 million tonnes @ 6.5 per cent TGC. Currently, the company is progressing with a feasibility study for the project. It plans to complete the study in 2020, with project commissioning expected in 2021. The potential is huge as released an Exploration Target for the area of 260-380Mt at 6-8%TGC

Ianapera Graphite Project - Located approximately 60 kilometres north of the Maniry graphite project, the Ianapera project covers a 31-square-kilometre area and comprises of high-grade exposures of graphite within a broader graphite trend. BEM holds a 100 per cent stake in the proje The Exploration Target released to the market highlights a high grade 20-34Mt at 10-20% TGC.

Ianapera Graphite Project - Located approximately 60 kilometres north of the Maniry graphite project, the Ianapera project covers a 31-square-kilometre area and comprises of high-grade exposures of graphite within a broader graphite trend. BEM holds a 100 per cent stake in the proje The Exploration Target released to the market highlights a high grade 20-34Mt at 10-20% TGC.

Maniry & Ianapera Projectsâ Location (Source: Companyâs Report)

Western Australia Projects: BEMâs projects in Western Australia are in the early exploration phase. With a simple mine plan, the company focuses on early high grade and low waste movement in order to achieve a maximum financial return.

- Donnelly River Project in Western Australia - The project, with E70/4824, 4825 and 4972 exploration licences, is located in the far southwest of Western Australia. In this project, graphite occurs in several graphitic horizons that have a maximum width of 11 metres.

- Greenhills Project in Western Australia - Comprising four exploration licences, the Greenhills project is expected to hold graphite that is often described as âflakyâ.

- Northern Gully Project in Western Australia - The project, comprising of a single exploration licence â 66/95, requires exploration for the discovery of an economic graphite deposit is warranted.

June 2019 Quarter Results:

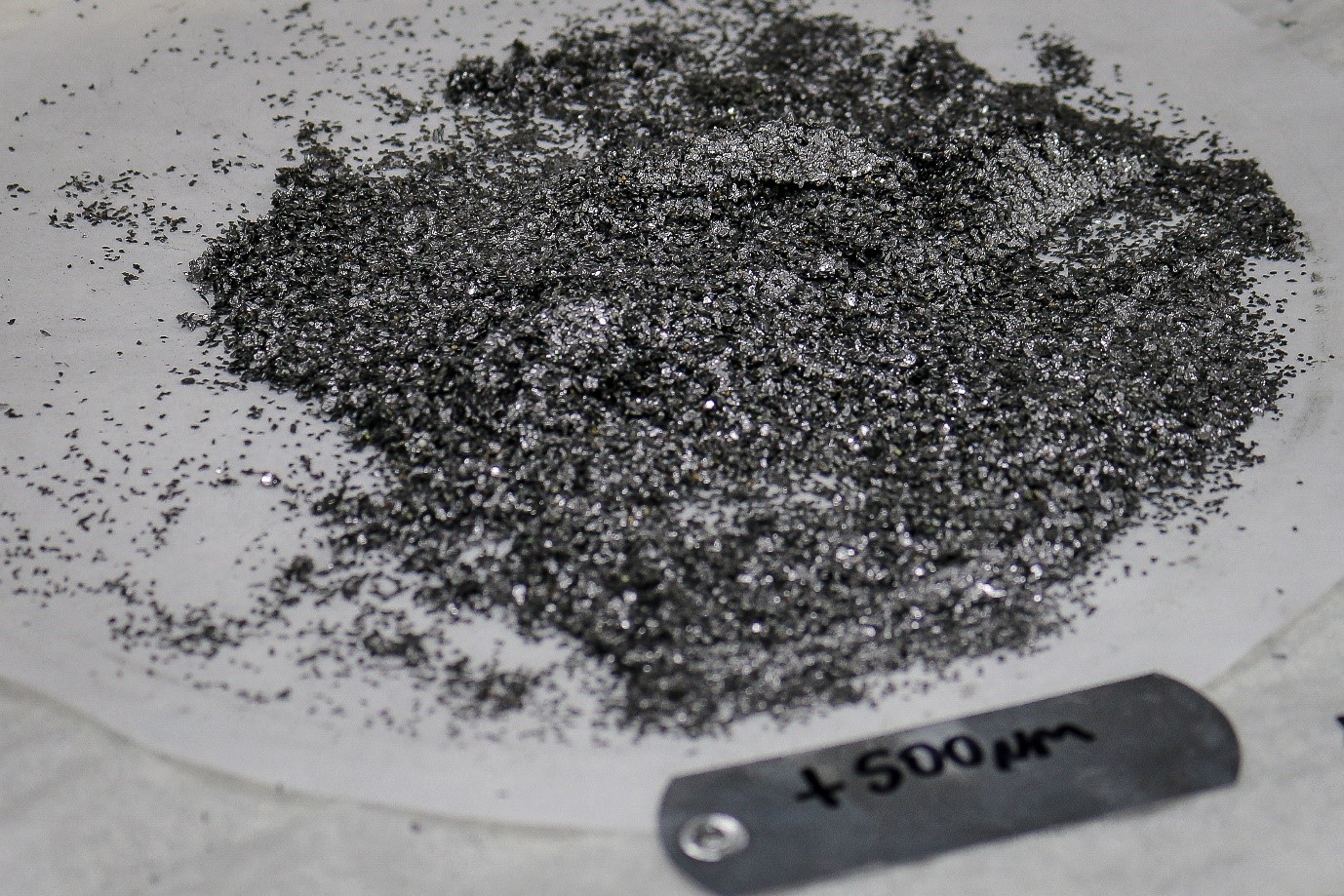

During the quarter ended June 2019, the company continued to fast-track the development of its Madagascar-based graphite project, Maniry, in collaboration with the government officials in the Africa nation. Metallurgical test work at the project performed during the reported period by German independent graphite specialist, NGS Trading and Consulting highlighted the suitability of the project concentrate for manufacturing high demand expandable graphite. The company also appointed Australia Mineral & Resources Pty Ltd as its strategic offtake advisor for the Maniry project, with the primary task of building awareness for BEM in China via positioning the project as a potential world-class supplier of high-quality natural graphite concentrate.

During the quarter ended 30 June 2019, the company used AUD 509,000 in operating activities, including AUD 404,000 in staff costs and AUD 358,000 in administration and corporate costs. At the end of the June quarter, BEM had cash and cash equivalents of AUD 1.36 million. For the quarter ending September 2019, the company expects cash outflows of AUD 643,000.

Community Engagement - Positive/Enduring Impacts:

Over the years, the company has established meaningful and effective engagements with community stakeholders, including local government as well as community leaders. Beginning 2008, the company has offered sponsorship as well as logistical support to non-government organisation ADFA (Australian Doctors of Africa), through its wholly owned Madagascar-subsidiary, BlackEarth Minerals Madagascar SARL.

Stock Performance:

The BEM stock last traded on 16 August 2019 at AUD 0.071, with around 85.6 million shares outstanding. BEM has generated a positive return of 10.94 per cent and 26.79 per cent in the last one month and three months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.