The below-mentioned stocks have revealed strong FY19 results today (20th August 2019). Both stocks have reported impressive operational and financial performance with significant growth in revenues and profits. Letâs take a look at the results of these stock.

Kogan.com Ltd (ASX:KGN)

Kogan.com Ltd (ASX:KGN) is a portfolio of retail and services businesses which earns most of its revenue and profit through the sale of goods and services to the Australian consumer.

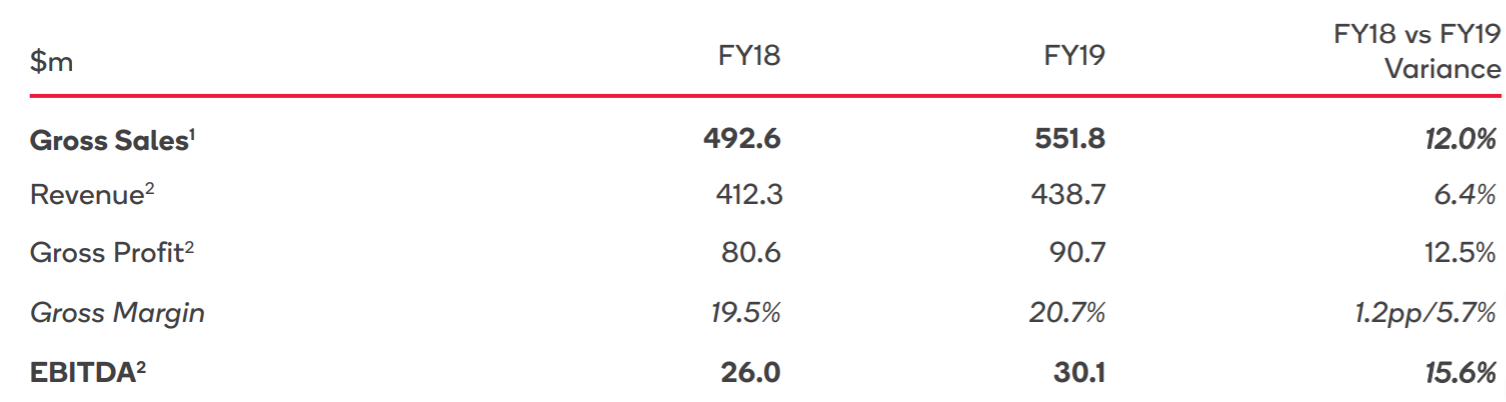

Strong FY19 Results: On 20th August 2019, the company released its full year results for FY19 in which it reported double-digit growth in gross sales, gross profit and its EBITDA. The gross sales of the company increased by 12% to $551.8 million while its revenue grew to $438.7 million in FY19. The increase in revenues was majorly driven by 41.6% growth in Exclusive Brands revenues.

Following the release of the FY19 results, the companyâs shares witnesses an uplift of 7.634% in its share price during the intraday trade.

The companyâs EBITDA increased by 15.6% to $30.1 million in FY19 as compared to $26.0 million in FY18.

FY19 Results Comparison with FY18 Results (Source: Company Results)

FY19 Results Comparison with FY18 Results (Source: Company Results)

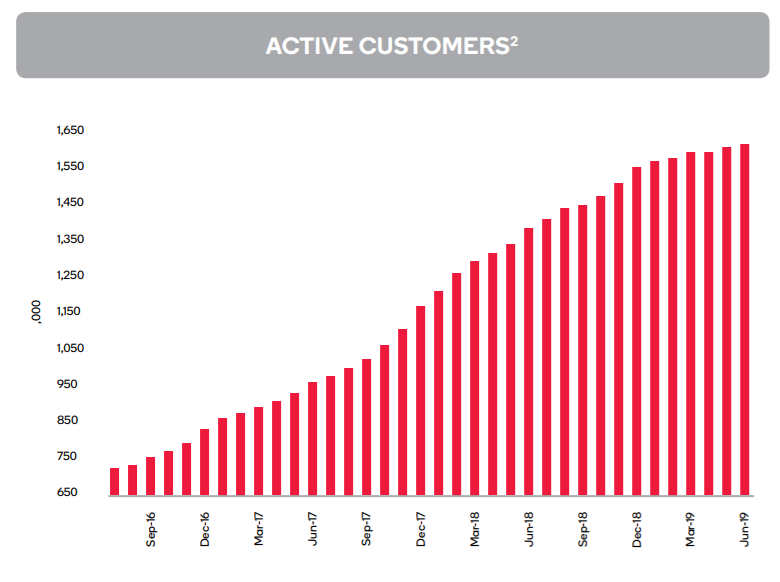

During the year, Exclusive Brands witnessed a growth of 41.6%, and it now represents 49.7% of overall gross profit in FY19. The company ended FY19 with a strong balance sheet, with cash of $27.5 million and an undrawn bank facility of $30.0 million. During the year, the company achieved growth of 221,000 Active Customers, and by the end of FY19, the company had 1,609,000 active customers.

Active Customers Growth over the years (Source: Company Reports)

Active Customers Growth over the years (Source: Company Reports)

Kogan Mobile Active Customers increased by 24.4% during FY19, while Kogan Internet Active Customers grew by 273.2% in FY19. Commission-based revenues from Kogan Mobile grew by 9.8% in FY19 as compared to pcp.

During the year, the company implemented a new proprietary marketing bidding system, which helped in improving the ROI on marketing expenditure. As a consequence of this, the company saw a year-on-year decline in marketing costs in FY19. In FY19, the company invested in expanding its warehousing footprint to 13 fulfillment centres, which is helping the company in providing consumers with faster and cheaper fulfilment to more locations.

In FY19, the company launched Kogan Marketplace, which reported strong business. The growth of Kogan Marketplace is expected to result in a reduced requirement for ThirdParty Brand inventory, which will allow Kogan.com to transition towards a more capital-light business over time.

While announcing FY19 Results, the companyâs founder & CEO Ruslan Kogan highlighted that during the year, the company made significant investments in its improved customer offering and also expanded its product range, giving its customers more choice and driving more competition on its platform.

The company has declared a final dividend of 8.2 cents per share (100% franked), taking the total dividend for FY19 to 14.3 cents per share. The dividend has a record date of 27 August 2019 and a payment date of 14 October 2019.

The company is committed to grow its existing businesses and to expand its portfolio of businesses. The company has adviced that the first half of FY2020 has started well. The July 2019 unaudited management accounts showing YoY:

- Gross Sales growth of 18.3%

- Gross Profit growth of 32.0%

- Kogan Marketplace Gross Sales of $7.1 million.

Stock Performance: In the last six months, the companyâs stock has provided a return of 25.06% as on 19th August 2019. On year to date (YTD) basis, the companyâs stock has gained 50.14%. The stock has a 52 weeks high price of $7.290 and 52 weeks low price of $2.610 with an average volume of ~640,133. The stock is trading at a PE multiple of 37.160 and an annual dividend yield of 2.33%.

At market close on 20 August 2019, KGNâs stock was trading at a price of $5.640 with a market capitalisation of circa $491.14 million.

SEEK Limited (ASX:SEK)

Leading workforce solutions company, SEEK Limited (ASX: SEK) intends to become a market leader in online employment by matching more people with job opportunities than any other organization. Throughout SEEKâs history, the companyâs business has continued to evolve and expand.

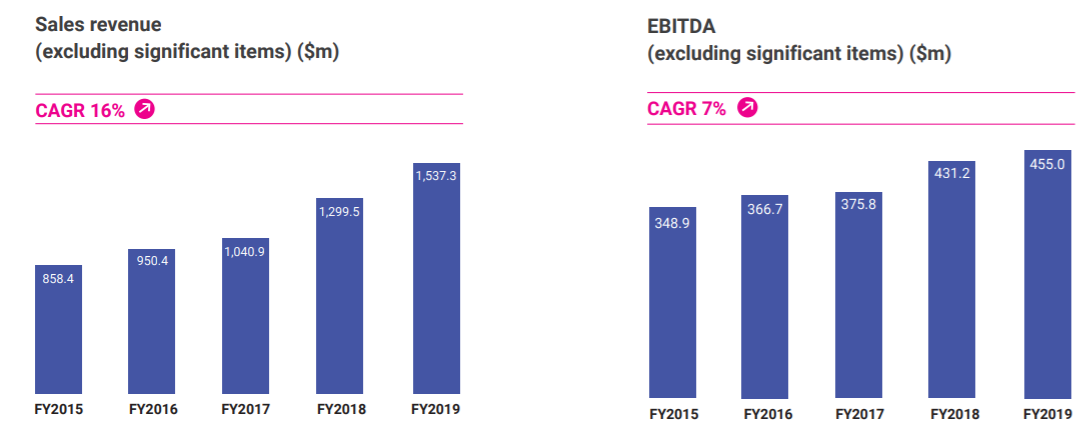

Strong FY19 Financial Performance: On 20th August 2019, SEEK Limited announced its results for year ended 30 June 2019 (FY19). In FY19, the company reported 18% growth in sales revenue and 6% growth in EBITDA compared to the period ended 30 June 2018 (FY18). The company has earned a revenue of A$1,537.3 million and EBITDA of A$455.0 million.

Following the release of the FY19 results, the companyâs shares witnessed an increase of 4.814% in its share price during the intraday trade.

SEEKâs revenue growth organically driven against a backdrop of easing macro-economic conditions. The key drivers of growth were Zhaopinâs online and offline divisions; ANZâs increasing depth revenue penetration and solid revenue growth in SEEK Asia, particularly in Hong Kong and Singapore.

In FY19, the company was more focussed on investments and made significant investment in Zhaopin, Latin America, Early Stage Ventures (ESVs) and OES. This is major reason why the growth in EBITDA was lesser than the growth in revenues.

From FY15 to FY19, the company has experienced a CAGR growth of 16% in its sales revenue. Further, the company has reported a CAGR growth of 7% in its EBITDA from FY15 to FY19.

CAGR Growth in Revenue and EBITDA (Source: Company Reports)

CAGR Growth in Revenue and EBITDA (Source: Company Reports)

The companyâs Asia Pacific and Americas (AP&A) segment comprises:

- The Australia and New Zealand (ANZ) business

- SEEK Asia

- The Latin America businesses of Brasil Online and OCC

- Other entities including Jora, GradConnection and Digitary.

In FY19, AP&A contributed 47% of Group sales revenue and 77% of EBITDA in FY2019. The AP&A segment witnessed a growth of 6% in its revenue and a growth of 4% in its EBITDA, driven by increased penetration of depth products and the easing macroeconomic conditions.

While releasing the results of FY19, the companyâs CEO and Co-Founder Andrew Bassat highlighted that that the company is pursuing an aspirational revenue opportunity of around A$5 billion by FY25 and it has made strong progress towards it in FY19.

During FY19, Zhaopin witnessed strong growth in its revenue and market share. It produced record results with strong revenue growth of 34%5 (constant currency). Zhaopin also reported strong revenue growth across core and adjacent businesses.

Outlook: In FY2020, the company is expecting its revenue growth to be in the range of 15% to 18% as compared to FY19. The company expects its FY2020 EBITDA growth to be in between 8% to 11%. The reported NPAT in FY2020 is expected to be in the range of $145 million -$155 million. Andrew Bassat has advised that the volatile economic conditions may impact the companyâs near-term results and assured that it would not impact the companyâs focus on investing to grow long-term shareholder value.

Dividend: The company has declared H2 19 dividend of 22 cents per share (cps) in line with the previous corresponding period (pcp). The dividend has a record date of 12 September 2019 and a payment date of 3 October 2019. The company has advised that it will revise its Dividend pay-out ratio in FY20 to better align with its growth aspirations.

Stock Performance: In the last six months, the companyâs stock has provided a return of 12.48% as on 19th August 2019. On year to date (YTD) basis, the companyâs stock has gained 16.24%. The stock has a 52 weeks high price of $22.940 and 52 weeks low price of $16.270 with an average volume of ~1,107,205. The stock is trading at a very high PE multiple of 132.710 and an annual dividend yield of 2.41%. At market close on 20 August 2019, SEKâs stock was trading at a price of $20.030 with a market capitalisation of circa $6.73 Billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.