Australiaâs largest debt buyer and collector, Credit Corp Group Limited (ASX: CCP) is committed to providing sustainable and responsible financial solutions to its customers.

Over the last one year, the share price of Credit Corp Group has increased significantly by 29.70% (as on 22nd May 2019) with strong YTD return of 30.19%, driven by strong operational and financial performance.

Lately, the group has been seeking ways to enhance its strategic position and improve the financial capability by gaining additional balance sheet flexibility via Share Purchase Plan (SPP) and Institutional placement.

The group recently closed its Share Purchase Plan (Announced on 1 April 2019), under which CCP provided its eligible shareholders with an opportunity to subscribe for up to A$15,000 worth of New Shares (at A$20.45 per share) with an aim to further raise up to A$10 million. The applications received by the group for SPP exceeded the target of A$10 million, by virtue of which Credit Corp Board decided to exercise its discretion under the SPP terms to scale back the SPP applications to a total of A$15 million.

CCP also raised A$125 million via successful institutional placement. The proceeds from the placement and the SPP have been intended to enhance the strategic position of the Group as well as accelerate the execution of its strategic expansion initiatives. Additionally, the proceeds were intended to provide further balance sheet flexibility to the group.

In the first half of FY19, the company reported a 13% increase in Net Profit after Tax (NPAT) at $33.6 million. In addition, the company also reported 18% growth in the consumer loan book, driven by 20% growth in new customer volume.

The group also witnessed a strong performance from its core debt buying business, driven by its uniquely resilient collection approach and focus on continuous improvement, as per companyâs CEO Mr Thomas Baregi.

Credit Corp Group has increased its US investment by securing a $74 million PDL investment pipeline, an increase of 23% compared to the investment of $60 million outlaid in 2018. In H1 FY19, the US collections and revenues increased by more than 70% as compared to pcp.

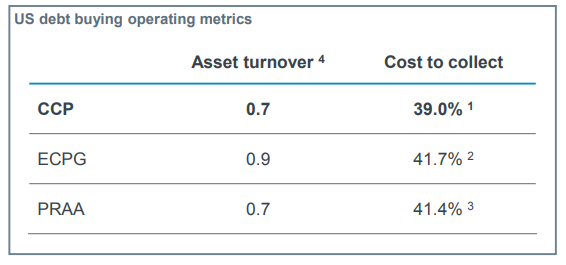

The operating metrics continued to benchmark strongly against publicly traded debt buyers as depicted below:

Source: Company Reports

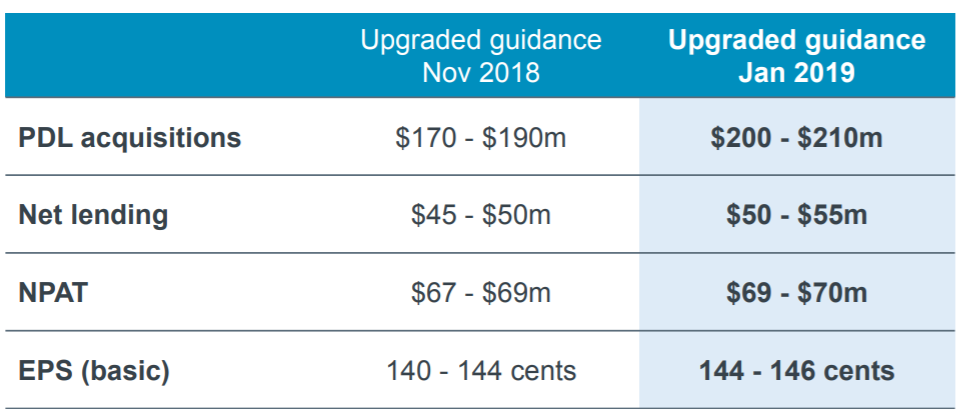

Due to the increased investment in the US and strong consumer lending book growth during the first half of FY19, the group has revised its earnings guidance for 2019, to represent profit growth of 7%-9%..

Improved Full Year Outlook (Source: Company Reports)

Improved Full Year Outlook (Source: Company Reports)

With a strong operational and financial performance, the group is rapidly progressing to become a leading global provider of sustainable and responsible financial services in the credit-impaired consumer segment.

CCPâs stock has yielded a YTD return of 30.19% and also posted a return of 27.07% over the last six months. At the time of writing, i.e., on 23rd May 2019, AEST 2:30 PM, the stock of the company was trading at a price of A$24.610, up 0.819% during the dayâs trade with a market capitalisation of ~A$1.34 billion. The shares are trading at a PE multiple of 17.130x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.