The below-mentioned three stocks have released some price-sensitive updates today (i.e., 16th August 2019). Letâs take a quick look at these stocks and their updates.

Austal Limited (ASX:ASB)

Australian shipbuilding company, Austal Limited (ASX: ASB) has signed a contract with Government of the Republic of Trinidad & Tobago (GORTT) to build two Cape Class Patrol Boats (CCPB). As per the companyâs announcement made on 16th August 2019, this contract is worth A$126 million.

While announcing the contract, the companyâs Chief Executive Officer David Singleton highlighted that this contract is confirming an important defence export opportunity for Austal and consequent workflow for the companyâs Henderson operations. He further acknowledged that the Royal Australian Navy (RAN) and the Australian Government were instrumental in the success of this defence export program.

As per Mr. David Singleton, the proven capabilities of Austalâs Cape Class Patrol Boats has attracted attention from a number of export markets, including Trinidad & Tobago.

This is the second contract the company has announced in the past two days. On 15th August 2019, the company announced that it has been awarded a contract worth around US$23 million (~A$34million) by United States Department of Defense for support activities, including dry docking, on the USS Tulsa.

The company has significantly expanded its operations in US and globally to meet continuing sustainment requirements of naval customers. Till now, the company has delivered 10 LCS vessels with a further nine vessels on order.

All of these vessels will be going under regular maintenance and dry docking activities, which will provide regular earnings for Austal for many years, even decades.

In July 2019, the company provided its earnings guidance for FY19 and FY20. For FY19, the company is expecting to earn EBIT of around $92 million. The group revenue for FY19 is expected to be in the range of $1.8 billion â $1.9 billion.

The improvement in Austalâs shipyards business and strong performance of its two major vessel programs for the US Navy has allowed the company to expand its EBIT guidance for FY20 to $105 million.

Recently on 2nd August 2019, Mitsubishi UFJ Financial Group, Inc. became a substantial holder of the company by holding 18,017,410 fully paid ordinary shares of Austal with 5.11% voting power.

In the past six months, ASBâs stock has provided a return of 61.40% as on 15th August 2019. At the time of writing i.e., 16 August 2019 (AEST: 1:34 PM), ASBâs stock was trading at a price of $3.780, up by 2.717% intraday, with a market capitalisation of circa $1.3 billion.

ASB Six Months price chart (Source: ASX)

Lynas Corporation Limited (ASX:LYC)

Rare earths producer, Lynas Corporation Limited (ASX: LYC) has announced that the Malaysian Government will renew the Lynas Malaysia operating licence for an initial period of 6 months. The licence will be renewed by the due date of 3 September 2019.

Lynas Corporation CEO and Managing Director, Amanda Lacaze thanked the Malaysian Government and assured that the company will continue to make a positive contribution to the Malaysian economy and to Malaysiaâs Industry 4.0 vision.

The company has also reaffirmed that it will relocate Cracking & Leaching, the first stage of its operations currently located in Malaysia, to Western Australia. Following this transition, WLP residue will no longer be produced in Malaysia.

As per the terms of the new operating licence, the company is required to complete the relocation in 4 years. The company still needs to obtain consent for the location of a Permanent Deposit Facility (PDF) for WLP residue.

In the last seven years, the company has shown that its operations are safe, and it is an excellent Foreign Direct Investor. Lynas had created more than over 1,000 direct jobs, 90% of which are skilled or semi-skilled.

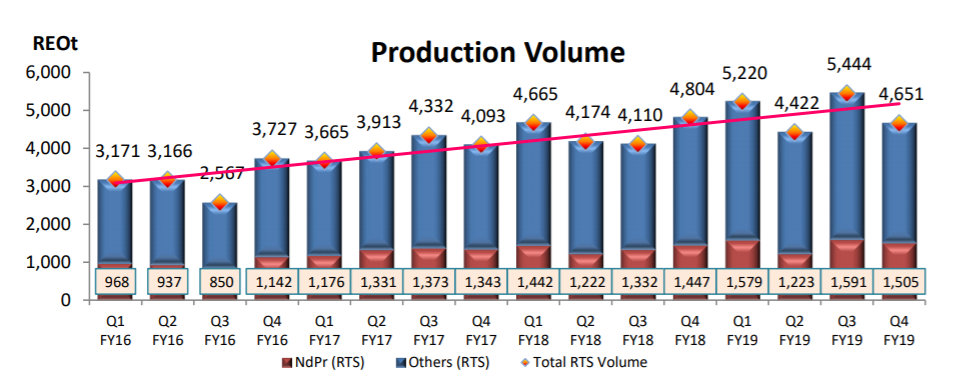

In the June quarter, Lynas produced around 1,500 tonnes of NdPr products. Ready for sale production volume total for the June quarter was 4651 REOt. In the June quarter, NdPr prices increased by up to 50%, driven by US-China trade tensions.

June Quarter Production (Source: Company Reports)

In the June quarter, the company reported total operating cashflow of A$37 million. At the end of June quarter, the company had a cash balance of $89.7 million.

In the past six months, LYCâs stock has provided a return of 46.05% as on 15th August 2019. The stock has a 52 weeks high price of $3.160 and 52 weeks low price of $1.480 with an average volume of ~8,765,301. At the time of writing i.e., 16 August 2019 (AEST: 1:34 PM), LYCâs stock was trading at a price of $2.640, down by 1.493% intraday, with a market capitalisation of circa $1.85 billion.

CIMIC Group (ASX:CIM)

NSW government has selected CPB Contractors, a construction business of CIMIC Group (ASX: CIM), to deliver the Campbelltown Hospital Redevelopment Stage 2 project. It is expected that CPB Contractors will earn revenue of around $424 million from this contract.

The Campbelltown Hospital Redevelopment Stage 2 expands key clinical and support services and integrates and expands mental health facilities and paediatric facilities. The works include:

- A new clinical services building with modern wards and patient facilities;

- Modern, centrally-located mental health units;

- Enhanced medical and surgical childrenâs services;

- Enhanced womenâs health services, including a birthing and maternity ward;

- State of the art operating theatres and intensive care unit; and

- Emergency department with more treatment spaces.

CPB Contractors was recently awarded NZ$221 million Auckland International Airport works which included the construction of an additional taxiway, six remote stands with in-ground jet fuel reticulation and extension of an existing taxiway.

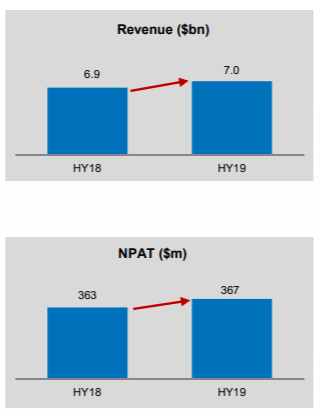

In the first half of FY19, CIMIC Group reported revenue of $6,955.1 million, up 0.3% on pcp. The company earned PBT of $504 million in H1 FY19. During the half year period, the company was awarded $8.3 billion of new work.

Revenue and NPAT (Source: Company Reports)

For the half year period, the company determined an interim dividend of 71 cents per share (100% franked), up 1.4% YOY, representing a payout ratio of 62.8%. In FY19, the company is expecting NPAT to be in the range of $790 million to $840 million.

On the stock performance front, CIMâs stock has provided a negative return of 38.35% as on 15 August 2019. CIMâs stock is trading at a PE multiple of 12.700 with an annual dividend yield of 5.11%. At the time of writing i.e., 16 August 2019 (AEST: 1:34 PM), CIMâs stock was trading at a price of $30.790, up by 0.261% intraday, with a market capitalization of 9.96 billion. It is to be noted that CIMâs stock is trading near to its 52 weeks low of $30.360.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_02_05_2025_05_53_40_418159.jpg)