Afterpay Touch Group Limited (ASX: APT) is involved in the information technology industry. The company has a retail payment platform, which helps in connecting customers smoothly to their retailers for easy transactions. The company currently has approximately 3.5 million active customers, along with more than 25,000 active retail merchants.

(Source: Company Website)

(Source: Company Website)

The stock of Afterpay Touch Group Limited is currently trading at $24.070, a decrease of ~3.912% during the dayâs trade, with a market capitalisation of $5.98 billion (AEST 2:00 PM, 30th May 2019).

Recently, the company has signed a contract to avail US$300 million receivables funding facility with Citi primarily for the expansion of the companyâs US business. APTâs US business will have access to external funding so that it can support in excess of US$4 billion in annual underlying US sales from the facility.

The existing $500 million Australian receivables funding facility of the company along with NZ$20 million facility and strong corporate balance sheet and liquidity position are key elements of APT's near-term capital management strategy, which is complemented by the new US facility.

Stock Information:

APT stock has provided a YTD return of 108.75% and exhibited returns of 80.61%, 28.0% and 0.52% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $28.70, and the 52-week low price stands at $7.38, with an average trading volume of ~1,904,454.

Premier Investments Limited (ASX: PMV) operates in retail, consumer products and wholesale businesses.

The consumer discretionary stock is currently trading at $17.140, a decrease of ~3.109% during the day's trade, with a market capitalisation of $2.8 billion (AEST 02:00 PM, 30th May 2019).

The company has recently announced that the director, Mr Mark Mcinnes, has increased his direct interest through the acquisition of 245,300 ordinary shares in the company and 4,700 lapsed performance rights. Post the changes, the ordinary shares held were 732,100 and performance rights were 250,000.

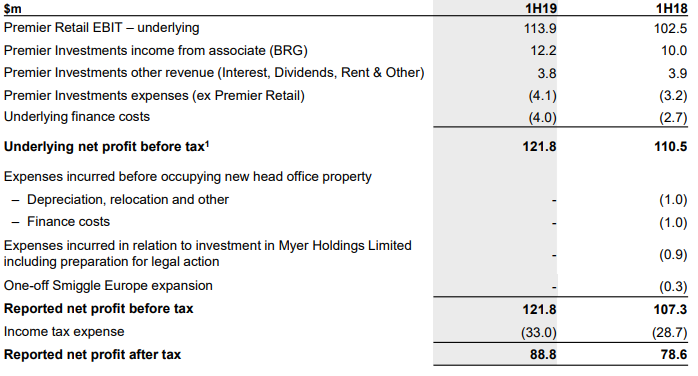

On the financial front, the company reported a net profit after tax of $88.8 million in 1H FY19, up 13.0% on 1H18 and a record 1H19 sales of $680.2 million, up 8.0% on the previous corresponding period.

Summarized Consolidated Income Statement (Source: Company Reports)

Summarized Consolidated Income Statement (Source: Company Reports)

Stock Information:

PMV stock has provided a YTD return of 22.68% and exhibited returns of 4.74%, 7.67% and 3.57% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $20.160, and the 52-week low price stands at $13.610, with an average trading volume of 303,646.

GUD Holdings Limited (ASX: GUD) operates under the consumer discretionary sector. The company is a distributor of automotive filtration and other service parts, electrical appliances, cleaning products, water pumps, locking systems and other security products, etc.

The stock of GUD is currently trading at $10.540, a decrease of ~3.92% during the day's trade, with a market capitalisation of $948.75 million (AEST 02:00 PM, 30th May 2019).

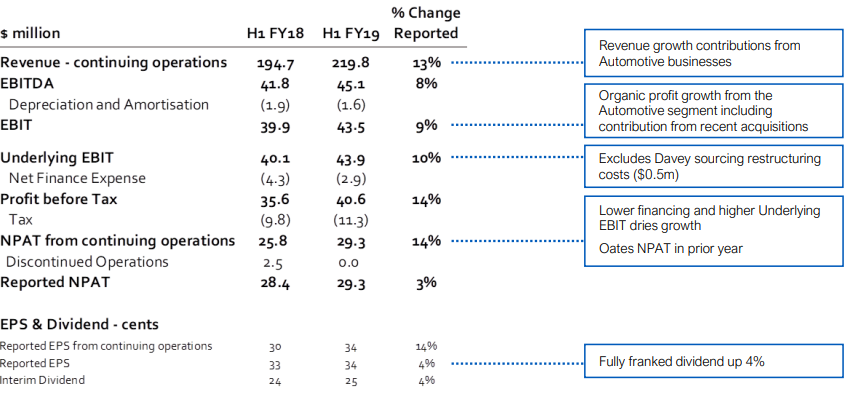

In another announcement, GUD reported that Vanguard Group recently became a substantial holder of the company with 5.076% voting power. The company, in its latest presentation, stated that the NPAT from continuing operations stood at $29.3 million, up 14% on the prior corresponding period and the revenue from continuing operations was up 13% to $220 million in 1H FY19.

Financial Summary 1HFY19 (Source: Company Reports)

Financial Summary 1HFY19 (Source: Company Reports)

Stock Information:

It has delivered a negative YTD return of 3.01% and exhibited negative returns of 11.39%, 14.10% and 7.27% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $15.550, and 52-week low price stands at $10.365, with an average trading volume of 262,076.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.