The three stocks CSL, COH and RMD with higher PE multiple have yielded positive YTD returns. The large cap stocks have performed well in the space to produce a decent financial performance in their respective last reported results. The stocks have performed well in the short-term with positive returns to its shareholders. Let us have a detailed look at the financial performance of these companies.

CSL Limited

CSL Limited (ASX: CSL) operates under the health care segment. The company is engaged in the development, research, manufacturing and marketing of cell culture media, human plasma fractions and pharmaceutical and diagnostic products.

Turning to the half yearly financials. The company continued its double-digit profit growth against the prior comparative period, primarily driven by a remarkable performance from its franchises, including Immunoglobulin, Influenza Vaccines and Specialty Products.

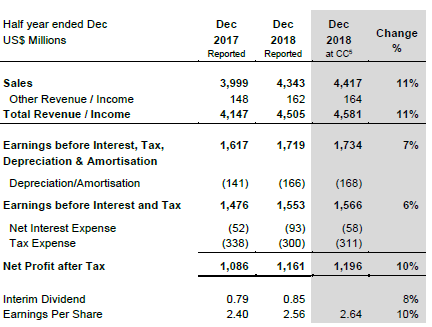

Group Results 1HFY19 (Source: Company Reports)

The reported net profit after tax for the company stood at $1,161 million for 1HFY19, an increase of 7 per cent or 10 per cent on a constant currency basis. The reported sales revenue stood at $4,505 million, up by 11 per cent on a constant currency basis on the back of increased usage of immunoglobulin products for chronic therapies, sales of transformational Hereditary Angioedema (HAE) product and increased sales of adjuvanted influenza vaccine.

The net profit after tax guidance for FY19 will be at the upper end of the range of $1,880 million to $1,950 million a constant currency basis. The demand for the companyâs plasma and recombinant products remains strong. Going forward, the company is expected to outpace the market in the growing plasma collections. The companyâs intentions to open 30 to 35 new collection centres in FY19 is on course.

The total revenue for Seqirus stood at US$949 million, an increase of 21% at constant currency due to increased sales of seasonal influenza vaccines. The seasonal nature of influenza prompted the sales to be heavily skewed towards the first half of the fiscal year in support of northern hemisphere demand, hence given the seasonality of the Seqirus business, the company anticipates a loss in the second half of the fiscal year in this segment. However, the expenses are spread more evenly over the whole year for the Seqirus segment.

At market close, the stock of CSL Limited was trading at a price of $207.670, down 2.273% during the dayâs trade with a market capitalisation of $96.29 billion (as on 12th June 2019). The stock has yielded a YTD return of 14.63% and exhibited returns of 17.81%, 6.85% and 6.22% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $232.69 and a 52-week low price at $173.0, with an average volume of 801,304. The stock is trading at a PE multiple of 37.140x with an EPS of $5.721. The stock has an annual dividend yield of 1.17%.

Cochlear Limited

Cochlear Limited (ASX: COH) is involved in the healthcare business. Cochlear is a dynamic, performance-focused company with a spectrum of implantable hearing solutions. The group operates through segments extending across Americas, EMEA and the Asia Pacific regions.

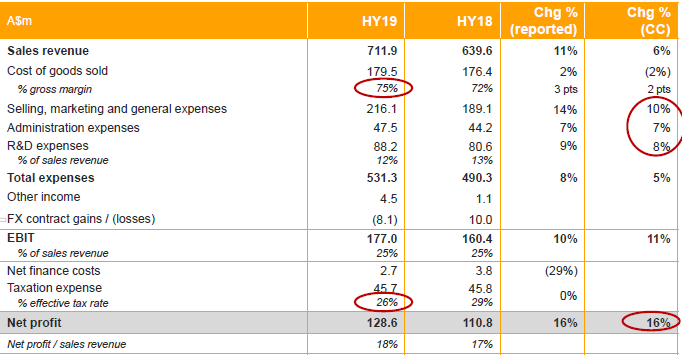

Turning to the financials of the company. The business delivered sales revenue growth of 11% or 6% in the constant currency basis for the half-yearly period. The company delivered a net profit of $128.6 million, an increase of 16% on HY18 (16% in constant currency basis).

Profit & Loss 1HFY19 (Source: Company Reports)

Adjusting for the impact of the deferred tax asset revaluation in HY18, the net profit increased by 11 per cent on a constant currency basis. COH declared an interim dividend of $1.55, a rise of 11 per cent on the previous year.

The company maintained a strong balance sheet and cash flow generation growth, which has enabled it to fund the market growth activities, increased CapEx and increased dividends while reducing debt. The operating cash flow remained higher than the net profit during 1H FY19 and increased by $71.4 million to $164.1 million.

COH continued its investment towards driving growth. Furthermore, the strong upgrade cycle has improved the gross margin and lowered the US tax rates fund investment in market growth activities. The company continued investment in the longer-term initiatives, including market access, the standard of care and clinical trials.

The company strategically maintained its priorities to retain market leadership, grow the hearing implant market and deliver consistent revenue and earnings growth. The company is investing in operating cash flows to drive growth. It is investing in building awareness and access to its products, which requires multi-year investment in sales, marketing and R&D activities. The company aims to maintain a strong balance sheet position and continue to target a dividend pay-out ratio of around 70.0% of the net profit of the company.

At market close, the stock of Cochlear Limited was trading at $201.730, down 2.258% during the dayâs trade, with a market capitalisation of $11.91 billion on 12th June 2019. The stock has yielded a YTD return of 18.0% and exhibited returns of 21.06%, 16.92% and 6.75% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $221.440 and a 52-week low price at $155.220, with an average volume of 204,969. The stock is trading at a PE multiple of 45.090x, with an EPS of $4.577. The stock has an annual dividend yield of 1.53%.

ResMed Inc.

ResMed Inc. (ASX: RMD) is engaged in the health care business. The company is involved in the manufacturing of medical devices and is a pioneer of innovative solutions that treat and keep people out of the hospital to live healthier higher-quality lives. Patients with sleep apnea, COPD and other chronic diseases are benefitted from the cloud-connected medical devices of the company.

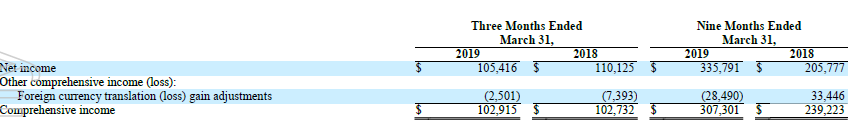

As per the last updated quarterly report of the company, for the quarter ended 31st March 2019, the net revenue for the three months ended 31st March 2019, increased to $662.2 million from $591.6 million for the three months ended 31st March 2018, an increase of $70.6 million or 12%, or a 15% on a constant currency basis.

Net Income for Quarter Ended March 2019 (Source: Company Reports)

The gross margin of the company for the period was 59.2% compared to 58.2% for the three months ended 31st March 2018. The diluted earnings per share for the period was $0.73 per share as compared to $0.76 per share.

During the three months ended 31st March 2019, the company invested $47.6 million on research and development activities with its continued focus on the development and commercialisation of new, innovative products and solutions that improves the patient outcome, create efficiencies for its customers and help physicians and reduce the chronic disease impact with lower healthcare costs.

At market close, the stock of ResMed was trading at $16.940, down 0.994% during the dayâs trade with a market capitalisation of $24.53 billion on 12th June 2019. The stock has yielded a YTD return of 6.67% and exhibited returns of 9.68%, 19.32% and 6.74% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $17.135 and a 52-week low price at $12.650, with an average volume of ~1.41 million. The stock is trading at a PE multiple of 38.740x, with an EPS of $0.442. The stock has an annual dividend yield of 0.85%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.