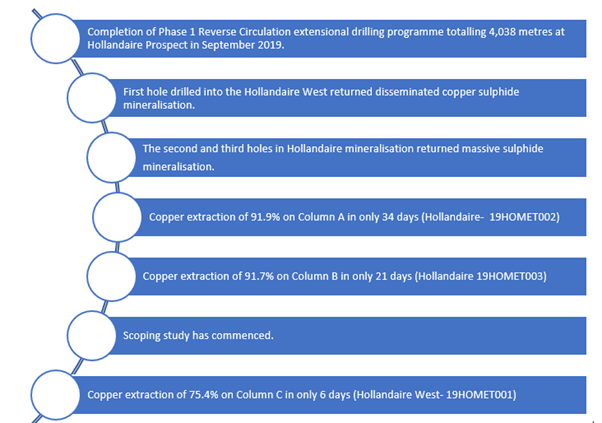

Cyprium Metals Limited, which is a partner to the gold focussed explorer Musgrave Minerals Limited (ASX:MGV) in a joint venture, has taken a step forward in its endeavour for mineral exploration at the Cue Copper Project. Cyprium has today informed about the outstanding copper leaching results from column test-work carried out on the Hollandaire and Hollandaire West prospects.

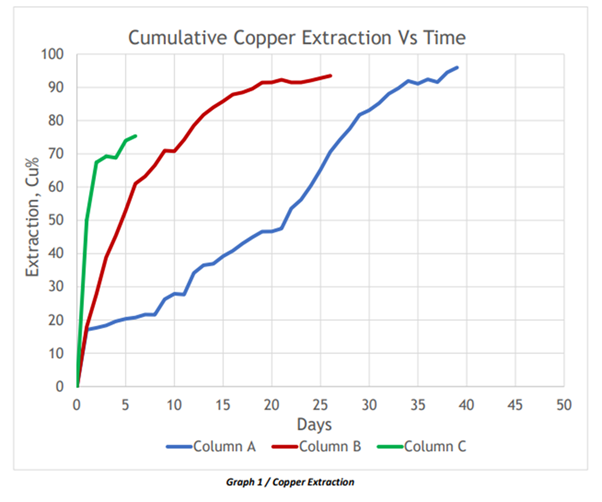

The results include the Copper extraction of 75.4% on Column C in only 6 days.

The test-work that leached copper rapidly into solution is being conducted in order to evaluate the viability of the Cyprium’s optimal copper extraction method.

The results to date highlight the accelerated leach time for the copper extraction into solution. Test-work conducted on Column C notably showcased more rapid extraction compared to that carried on Column A and Column B.

The ongoing metallurgical test work programme is pursued on the three columns along with the other test-works for other materials as well.

The resulting copper recovery over time from the different columns in the composite leaching process is highlighted in Graph 1 (Source: CYM’s ASX update)

Metallurgical Drill Holes

The metallurgical column test-work is being conducted on the samples of the massive and semi-massive sulphides. The results for the metallurgical Diamond Drilling programme, consisting of three holes for 320 metres into the mineralised envelope, carried out at the Hollandaire Prospect at Cue Copper Project includes the following:

- 10.4m @ 14.9% Cu in drill hole 19HOMET003 from 84.5m downhole including:

- 4.5m @ 21.9% Cu from 90.4m

- 19.1m @ 1.3% Cu in drill hole 19HOMET002 from 85.9m downhole including:

- 6.4m @ 2.1% Cu from 98.6m

- 27.9m @ 1.1% Cu in drill hole 19HOMET001 from 45.7m downhole including:

- 9.0m @ 1.6% Cu from 63.2m

Key Updates on Mineralisation and Metallurgical Test Work at Hollandaire Prospect

ALSO READ: Musgrave’s JV Partner Identifies Significant High-Grade Extension at Cue Copper Project; Stock Soars

Test-Work Process Details

Following the drilling, the core sample that was received from the Cue prospect was crushed, split and assayed to check multi-element grades. The column samples A and B was created through compositing Hollandaire samples from holes 19HOMET002 and 19HOMET003, with copper grades of 5.10% and 5.24% respectively.

Likewise, the third column C was used for metallurgically testing the drill core from Hollandaire West which was obtained from drill hole 19HOMET001, with an average grade of just 0.76% copper.

Why are Results Important?

The rapid leaching of the composites proves to be a positive prospect for the project. The short leach times reduce the size of the heap leach pads, which further leads to a lessened requirement of capital and operating cost over the project life.

The project is close to achieving the critical mass of the copper alongside the successful extensional resource drilling at Hollandaire that is required for project development.

About Cue Project

Musgrave Minerals through its flagship Cue Gold Project located in the Murchison Province of Western Australia is focussed at the gold exploration via Break of Day, Lena, Mainland and Lake Austin.

ALSO READ: Musgrave Minerals Reported 112% growth in Mineral Resources at Lena; Stock Soars

The Cue Copper Project incorporates Hollandaire Copper northern area and Moyagee Gold southern area. Musgrave Minerals has granted an option agreement that provides Cyprium Metals (CYM) with an 80% interest in the non-gold rights. As per the option, the Musgrave Minerals would retain 100% interest in the gold rights and on the non-gold rights, free carried interest of 20%.

Silver Lake Resources Limited in 2011 discovered the copper project that is centric to Hollandaire and Hollandaire West VMS deposits. A JORC (2004) compliant, the project hosts the following total Mineral Resource:

- 2.7Mt @ 5.8g/t Ag for ~495,000oz

- 2.0Mt @ 1.9% Cu of ~38,800t

- 0.52Mt @ 1.35g/t Au for 22,500oz

By the end of the trading session on 24 February 2020, MGV stock closed at $0.112, up by 6.667% intraday. MGV, with the market capitalisation of $42.6 million, has witnessed share price appreciation of 50% and 40% in the past three months and six months respectively.