After fluctuating for two days, finally on Wednesday the benchmark index S&P/ASX200 reached a three-month high and finished at 5941.6, up by 1.83 per cent as compared to yesterday's closure of 5,835.1.

The uncertainty factors continue in the market in the wake of widespread pandemic and lack of a substantial treatment or medical breakthrough by now to curb the spread. US-China trade tension adds more to the uncertainty.

It will be interesting to observe how the market proceeds in this challenging time.

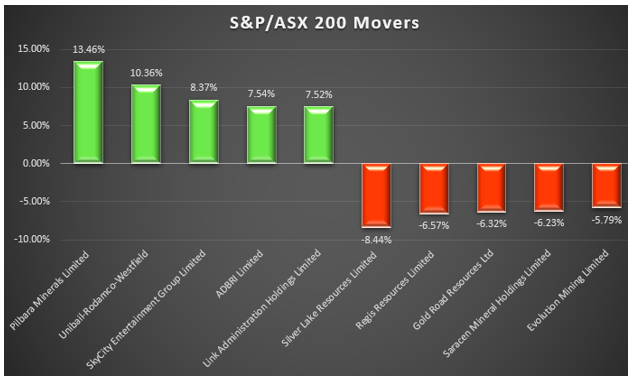

The top 2 gainers for today were-

- Pilbara Minerals Limited (ASX:PLS) which traded at AUD 0.295, up by 13.462 per cent and

- Unibail-Rodamco-Westfield (ASX:URW) which last traded at AUD 4.900, up by 10.36 per cent.

The worst-performing stocks were -

- Silver Lake Resources Limited (ASX:SLR) which traded at AUD 2.060, down by 8.444 per cent and

- Regis Resources Limited (ASX: RRL) which traded at AUD 5.120, down by 6.569 per cent.

Let's see the graph below to view the top five best and worst-performing stocks today: