The Australian stock market has rebounded today after three days of substantial loss of points. All sectors had been ending in the red zone since Thursday, 11 June 2020 amid the Federal Reserve's gloomy predictions on the US economy. However, today the benchmark index S&P/ASX200 has surged by 3.89 per cent and finished at 5942.3 when compared with yesterday closing point of 5719.8. Also, all sectors ended in the green zone.

It seems that the market has overcome the fear of the second virus wave in the US, as, on Monday, the Dallas Federal Reserve President Robert Kaplan said that the US economy would witness a significant, historic contraction in the second quarter before starting to rebound.

He also added that if consumers and businesses take sufficient precautions to curb the virus infection, the economy can recover quickly. However, the unemployment rate would remain high until the end of 2020.

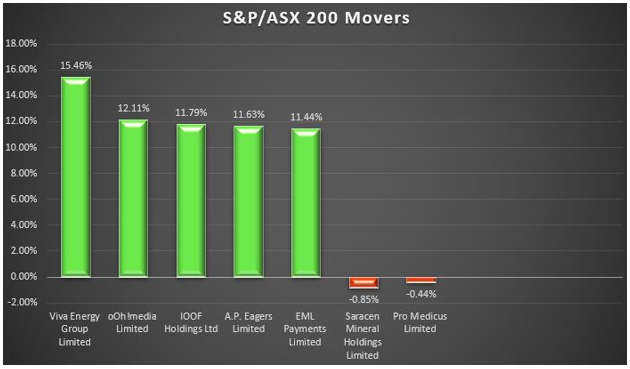

The best performing stocks for today's market are:

- Viva Energy Group Limited (ASX:VEA),up by 15.461 per cent and traded at AUD 1.755, and

- oOh!media Limited (ASX:OML) which was up by 12.105 per cent and traded at AUD 1.065.

The worst-performing stocks for today were –

- Saracen Mineral Holdings Limited (ASX:SAR) which traded at AUD 4.640, down by 0.855 per cent, and

- Pro Medicus Limited (ASX:PME) which traded at AUD 27.150, down by 0.44 per cent.

Let's see the graph below to view the top five best and only two worst-performing stocks today: