Market analysts are closely monitoring and discussing the growth prospects of Buy-Now-Pay-Later, Australiaâs leading fintech player, Afterpay Touch. To answer the question, it's imperative that we first understand the business model of the company.

Afterpay Touch Group Limited (ASX:APT) proffers an operation that can replace the credit card facility. it allows retailers to offer a service called âbuy now, receive now, and pay laterâ helping the end customer to buy the product without entering into a loan agreement, or paying any upfront fee, or interest. The difference between credit card and Afterpay is that post the payment due date, in case of a credit card, the user is charged a high rate of interest on the outstanding amount and the user of the credit card could further buy more items if they wish to. While, in case of Afterpay, if the user does not pay by the due date, the customer is charged a late payment fine which is capped at $68, and the customer can't make new purchase till the bill is settled in full. Afterpay provides their merchants a" platform" to meet its customers and similarly customers a platform to meet its merchants. Afterpay allows the user to borrow money from it for no charge to buy product or service registered with Afterpay. Hence, we must see Afterpay as a platform business and not as a finance business.

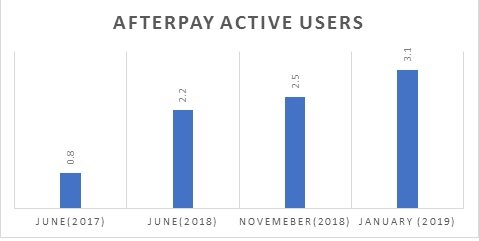

Active User growth:

In November 2018, Afterpay had 2.5 million registered users, and as of Jan 2019, the company had 3.1 million active users, showing a growth of 24%.

Afterpay was the #1 downloaded app in Australia on Black Friday with the total download of 8.5k in a single day. Afterpay added over 19k new US customers on Black Friday. The company in its latest business update release indicated that 7,500 new customers are added per day over Q2 FY19.

Afterpayâs Active Users Trend (in Mn) (Source: ASX)

Afterpay continues to expand its customer base. As of 30 June 2017, Afterpay had approximately 800,000 total active customers. In a span of one year, the number of users increased more than 2.8x times to 2.2m total active customers and the active user count has risen again to over 2.5m total active customers as on November 2018. As on Jan 2019, the total active customers were reported to be 3.1m. This kind of growth draws the attention of retail partners.

Merchant Growth:

In November 2018, the number of retail partners registered with Afterpay was 20,000, and as on Jan 2019 the company has 23,000 retail partners, this translates to 15% increase in retail partners.

Risks Management:

The quality of sales growth is vital for sustainable long-term growth. Quality of sales is determined by the kind of risks that the company takes to acquire a customer and retail partners. The company is cognizant of the importance of risk mitigation, and that is reflected in the kind of measures taken;

- Customers are suspended if a single payment is late - that means bad debt cannot revolve late fees â if charged, are minimal, capped and don't accumulate, should keep the regulators happy.

- Strict spending caps, maximum individual purchase limit is capped at $1,500.

- These measures are yielding results for example 95% of payments received in FY18 did not attract a late fee, i.e. outstanding amount paid before the due date.

- Over 90% of monthly transaction volume comes from returning Afterpay customers.

- Average balance outstanding is just over $121, compared to average Australian credit card debt of over $4,000 and more than 75% balance is less $350.

Financial highlights:

- For the combined Afterpay Touch Group, revenue and other income increased by an exceptional 390% to $142.3m in FY18.

- Underlying merchant sales of over $2.18 billion in FY18, up 289% on FY17 as well as a stable merchant margin.

- On profitability metrics, EBITDA for the group grew by 468% to $33.8m in FY18 (Net of significant items).

Is Afterpay Touch Group set to smash all the previous records?

The company has been able to grow its user base at a fast pace as seen above chart (a), from 8,00,000 users in 2017 to 3.1 million users as on Jan 2019, adding 7,500 new customers a day.

Considering the nature of the business, it is possible to see a further rise in user base on the following drivers:

- Afterpay is entering news verticals like healthcare, personal grooming, Entertainment like Luna Park (Sydney), etc which might support volume growth of the company.

- The user profile is improving, one in four millennials in Australia have now used Afterpay

- The platform business model lends itself to scalability and Afterpay is already scaling its business via entering into the overseas market.

US Market:

In the first half of FY 2019 over A$260 million of underlying sales have been processed through Afterpay. The rate of growth in the US has been very strong, for reference consider this; it took 28 months for the Australian business to deliver $260 million in underlying sales against 8 months in the US.

The future looks decent for the Afterpay touch on the back of its strategic approach towards its business platform such as enhancing footprint into the overseas market, innovation, scalability, etc.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.