In a country like Australia, where interest rates are kept at record low rates, dividend stocks are viewed as one of the best investments that investors can make to earn steady earnings. Many investors put dividend stocks in their retirement portfolio so that they can enjoy the regular cash streams after their retirement.

We have screened few stocks which have been paying regular dividends to their shareholders. Let’s take a look at these stocks and their recent updates.

Telstra Corporation Limited (ASX: TLS)

A telecommunication technology leader, Telstra Corporation Limited is engaged in the provisioning of telecommunication and information services, which include mobiles, internet and pay television.

The company recently via a release announced that during FY19, the company made a one-off issue of 13,245,705 ‘retention rights’ to eligible employees and 5,115,570 of those ‘retention rights’ has been vested on 31st December 2019.

In November 2019, the company released its Investor Day presentation, wherein it informed that it expects its total operating expenses - excluding restructuring costs and impairments - to decline, with reductions in underlying fixed costs to offset increased NBN (National Broadband Network) network payments and other variable costs and expect additional restructuring costs of around $300 million associated with T22 in FY20. Telstra also expects to decrease its underlying fixed costs by a cumulative $2.5 bn by FY22, relative to FY16.

During FY19, the company declared a total fully franked dividend amounting to 16 cents per share. This implies that the company has returned $1.9 billion to shareholders in the form of returns.

The stock currently has an annual dividend yield of 2.59%. At market close on 31 January 2020, TLS stock was trading at $3.840, near to its 52 weeks high price of $3.978.

Stockland (ASX: SGP)

Australia’s leading diversified property group, Stockland intends to pay distribution of 3.5 cents per ordinary stapled security for the six months to 31 December 2019. This is in line with the market guidance issued in the company’s FY19 results and 1Q20 update, being a forecast total distribution per security of 27.6 cents per ordinary stapled security for the 12 months to 30 June 2020, assuming no material change in market conditions. The distribution payment is expected to happen on Friday 28 February 2020.

Last year, the company made good progress executing its strategic priorities to deliver sustainable and growing returns through community creation, leading retail town centres and growing workplace and logistics, positioning the business for sustainable long-term growth.

The company established a strategic capital partnership at Aura, a $5 billion masterplanned community on the Sunshine Coast, at a 30 per cent premium to book value, with Capital Property Group. Further, the company made good progress divesting its non-core retail town centres with $505 million of transactions, six to twelve months sooner than forecast.

The company continues to reallocate capital into its workplace and logistics pipeline and re-stock its residential landbank with expected returns on investment well above its weighted average cost of capital, positioning it for sustainable profit growth.

The company is confident that the residential market has bottomed and the pace of recovery is improving, particularly in Sydney and Melbourne. The default rate, while still high, is expected to reduce over the balance of FY20 to normalised levels.

In the last one year, SGP stock provided a return of 29.09% to its shareholders. At market close on 31 January 2020, SGP stock trading at $4.920, close to its 52 weeks high price of $5.240.

Transurban Group (ASX: TCL)

World’s leading toll road operator, Transurban Group recently appointed Fiona Last as Company Secretary of Transurban Group effective immediately. Under this role, Ms. Last will be responsible for communcations with the ASX under Listing Rule 12.6.

The company has also announced the appointment of Mr. Terence Bowen to the Transurban Board as a Nonexecutive Director, effective 1 February 2020.

For the six months ending 31 December 2019, the company indents to pay a distribution of $ 0.31 on 14 February 2019. The distribution is comprised of 29.0 cent distribution from Transurban Holding Trust and controlled entities and a 2.0 cent fully franked dividend from Transurban Holdings Limited and controlled entities.

In the last one-year TCL stock has provided a return of 30.68% to its shareholders. At market close on 31 December 2019, TCL stock was trading at $15.700 with a market cap of $43.07 billion.

Washington H. Soul Pattinson and Company Limited (ASX: SOL)

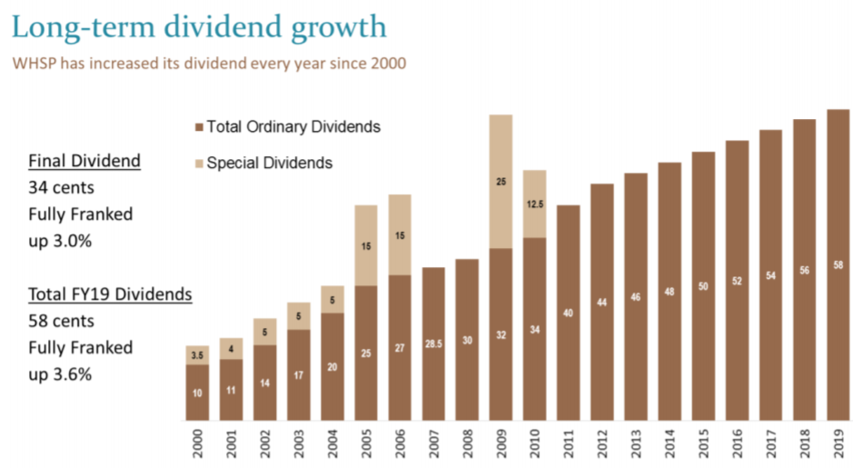

The primary activities of Washington H. Soul Pattinson and Company Limited includes Investment, coal mining, pharmaceutical, telecommunications, building materials. At the recently held 2019 Annual General Meeting, the company highlighted that that it has an excellent track record of paying dividends and actively manages its portfolio to achieve its goal of paying a steady and increasing dividend over time. Every year since 2000, the company has increased both its interim dividend and final dividend.

The company has claimed that it is one of only two companies to do this of the 500 odd companies in the All Ordinaries Index. For FY19 (year ended 31 July 20190, the company declared total dividend of 58 cents, up 3.6% on last year. In FY20, the company intends to pay out 82% of the net regular cash inflows from operations as dividends.

(Source: Company Reports)

At market close on 31 January 2020, SOL stock was trading at $21.550, close to its 52 weeks low price of $19.7.

Sydney Airport (ASX: SYD)

Sydney Airport delivered a solid traffic performance across the calendar year 2019 despite of tough trading conditions. In December 2019, the company witnessed domestic passengers growth of 1.3%.

For six months ending 31 December 2019, SYD airport intends to pay dividend of $0.195 per each share on 14 February 2019.

How is Sydney Airport revolving?

- Identifying areas where Sydney Airport could play a greater role

- Growing the overall value pool through collaboration

- Initiatives to improve customer experience and deliver business benefits

- Data insights and machine-learning to improve performance

- Reinvigorating approach to culture and building capability

At market close on 31 January 2020, SYD stock was trading at $8.390 with a market cap of ~$18.77 billion.

_09_03_2024_01_03_36_873870.jpg)