The incalculable tragedy that COVID 19 has inflicted upon the human race continues to grow. Not only this novel coronavirus is a public health crisis, claiming lives, but is also wreaking havoc on industries and businesses. With country lockdowns, quarantine measures and social distancing an everyday jargon for the world, stabilisation seems to be a bit far away.

However, not all is grim- government stimulus packages and medicine trials underway are the silver linings that aim to hit the silver bullet- eradicate the virus and bring normalcy back!

Meanwhile, let us gather some insights on how this pandemic is impacting IT companies and players in the cloud computing space. We will also screen through 4 ASX-listed stocks and try to gauge if there are any pockets of opportunity in them amid the ongoing market, economic and financial crunch.

COVID 19 & IT Companies

Have you been working from home due to your country being in a lockdown state? Or are you a student back home taking classes online? If yes, you will understand the pressure that your respective IT technicians are currently facing, to facilitate smooth work from home for your organisation!

Be it stress-testing of infrastructure, activating pandemic-specific resiliency testing procedures or adhering to pandemic response policies and procedures- cloud service providers are doing it all. A result of this has been a sudden surge in online videos/audio calls on IT platforms.

Undoubtedly, cloud companies have suddenly become the backbone of a global virtual learning and collaboration experiment on a scale that has not ever been experienced. What this translates into is the fact that these are true testing times for these companies.

To leverage the maximum from these self-isolated times, cloud computing players have been offering free collaboration and conferencing services. But one needs to be wary of the fact that besides the coronavirus, protection against malware and viruses of the computer variety is also paramount, especially when we are using it a lot. Ransomware attacks, cyberattacks and other cybersecurity incidents should regularly be monitored.

In this backdrop, let us look at 4 ASX-listed companies and gauge their stance amid the pandemic.

Megaport Limited (ASX:MP1)- Business in Great Shape, Says Chairman!

Offering scalable bandwidth for public and private cloud connections, metro ethernet, and data centre backhaul as well as Internet Exchange Services, MP1 serves its customers with network connectivity they deserve, well backed by global availability, right-sized bandwidth, and on-demand consumption.

During mid-March 2020, Chairman Bevan Slattery addressed the media and shareholders, acknowledging the fact that there is current market uncertainty due to the continued spread of COVID-19 throughout the world.

The Company proactively initiated a protocol of staged travel and event restrictions, designed to ensure the safety and wellbeing of its team. It also activated a company-wide work from home trial day, which saw the team and systems perform well, post which staff across the world have been working from home.

MP1 has luckily not witnessed any material change to either the existing business or sales pipeline for the quarter to date. On the contrary, the number of VXC services was up 11% QoQ and ports were up 7% (for the quarter till mid-March 2020).

The Company had also pre-ordered approximately 6 months’ supply of consumables and equipment for the planned rollouts for the financial year from China. And, most of these orders received were dispatched to the country of planned installation, thus little impact from any potential supply-chain issues is expected in the near term.

With companies shifting to a more “cloud-enabled” environment, MP1 is bound to leverage. There are significant traffic increases across the network, and it is working with various videoconferencing organisations and their clients- a trend bound to grow.

On the corporate end, MP1 has over $100 million in cash. The Company is fully funded and will continue to drive global expansion. It continues to sell additional services even amid the pandemic.

NEXTDC Limited (ASX:NXT)- Equity Raising Amid Pandemic

Asia’s most innovative Data Centre-as-a-Service provider, NXT was being gauged by investors and IT sector enthusiasts ever since its securities were placed in a trading halt on 2 April 2020, pending the release of an announcement, which turned out to be equity raising.

Funds raised from capital raising will be targeted towards

- Supporting NEXTDC’s growth agenda and the proposed development of a new data centre in Sydney

- Balance sheet flexibility

- Growth initiatives

Interestingly, the Company has witnessed recent and expected material customer contract wins too and is experiencing strong demand, especially for its data centre services particularly from its hyperscale cloud computing customers during the turbulent market environment.

According to NEXTDC CEO and Managing Director Craig Scroggie, NXT has decided to prudently equity fund growth opportunities in the near-term in these uncertain times, aimed towards –

- Providing continued support to customer demand

- Ensuring there is no loss in the momentum of the Company’s overall development

The capital raising program is likely to raise ~$672 million and will fund S3 initial investment worth $350 million, growth driven initiatives worth $307 million and transaction costs worth $15 million.

Further, NXT re-affirmed its FY20 earnings guidance, wherein-

- Revenue is likely to be in the range of $200 million to $206 million

- Underlying EBITDA is likely to be in the range of $100 million to $105 million

- Capex on existing facilities is likely to be in the range of $320 million to $340m

Dubber Corporation Limited (ASX:DUB)- Equity Raising Amid Pandemic

The world’s most scalable cloud call recording service and partner of 123 telecommunications service providers, globally, DUB announced on 1 April 2020 that it has received commitments to raise $10 million via a placement to existing institutional and sophisticated investors.

In the capital raising, DUB will issue over 15 million new fully paid ordinary shares at an issue price of $0.60. A placement of further 1.6 million shares will be made to CEO and MD Steve McGovern and Peter Pawlowitsch (who will subscribe to the placement subject to shareholder approval).

Funds raised are expected to pace up growth and meet increased demand related to a global shift to working from home, support increased pipeline activity in international markets, evaluate potential acquisition opportunities and strengthen the balance sheet.

What should also be noticed is the fact that DUB has recently expanded its operations in Asia-Pacific, North America and Europe.

CEO Steve McGovern opines that once the current COVID-19 crisis stabilises, the adoption of cloud-based UC services will accelerate as the business sector seeks to implement sustainable Business Continuity Planning programs.

Data# 3 Limited (ASX:DTL)- No Material Change in Sales Pipeline

A leading Australian IT services and solutions provider, DTL aims to aid customers solve complex business challenges via innovative technology solutions. Recently, amid the COVID 19 pandemic, the Company intimated that its highest priority is safeguarding the wellbeing of staff and customers, while ensuring continuity of service for customers. DTL is in a prime position to help the public sector and large commercial enterprises amid the crisis.

A pandemic response plan is in place and remote working models have been implemented. The risk of any material supply chain effect on the hardware vendor partners has been managed effectively while risk to operations is considered low with infrastructure availability generally improving.

DTL reported no material change to its overall sales pipeline, though there has been a shift to immediate remote working, cloud and security requirements. It affirmed that the performance to-date and the current pipeline of opportunities for the balance of the year will help it achieve the full-year financial objective to deliver sustainable earnings growth over time.

Stock Price Information

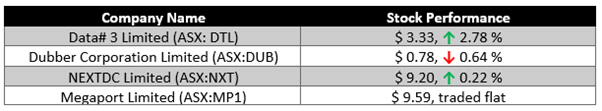

Post close of the market on 3 April 2020, the discussed companies’ performance on the ASX was as highlighted in the table below –