Freedom Foods Group Limited (ASX:FNP) is involved in the manufacturing, selling, marketing and distribution of specialty cereal, snacks and dairy beverages along with canned specialty seafood.

On 23rd May 2019, FNP announced $130 million equity raising, which is comprised of a pro rata accelerated non-renounceable entitlement offer of one fully paid ordinary share in Freedom Foods for every existing 18 Freedom Foods shares held as on May 27, 2019, by eligible shareholders at an offer price of $4.80 per new share to raise approximately $65 million; and an institutional placement of new shares at an offer price of $4.80 per new share to raise around $65 million as per the required regulatory compliances. The offer price represents a 5.5% discount to the volume weighted average share price (VWAP) of Freedom Foods over the past 20 trading days.

The process is being supported by the cornerstone investor, Arrovest Pty Limited, which has committed to take up its full allocation under the entitlement offer and has agreed to sub-underwrite part of the entitlement offer. Veritas Securities Limited and UBS AG, Australia Branch, have fully underwritten the equity raising process. Citigroup Global Markets Australia Pty Limited will be the third Joint Lead Manager along with Veritas and UBS.

The capital raised will be utilised to accelerate Freedom Foodsâ growth strategy, including accelerated capital expenditure programs worth $100 million in nutritional ingredients through 2019 and 2020 and $30 million to support increased working capital requirements to meet demand growth.

FNPâs newly established nutritional ingredients capability, for its unique capabilities, is experiencing strong customer demand. The company is committed to achieving the sale of all of its available capacity in FY2020 for Native WPI (Powder), Micellar Casein (Liquid) and Lactoferrin (Powder).

The organisation has strong demand beyond FY2020 for an additional supply of these key ingredients. Significant incremental revenue and profitability is available through accessing protein streams from increased UHT diary milk flows along with expanding into new proteins such as Alpha-Lactalbumin, Immunoglobulin, and Beta-lactoglobulin. As per the release, dairy milk flows in excess of 400 million litres in FY2020 will offer additional protein streams.

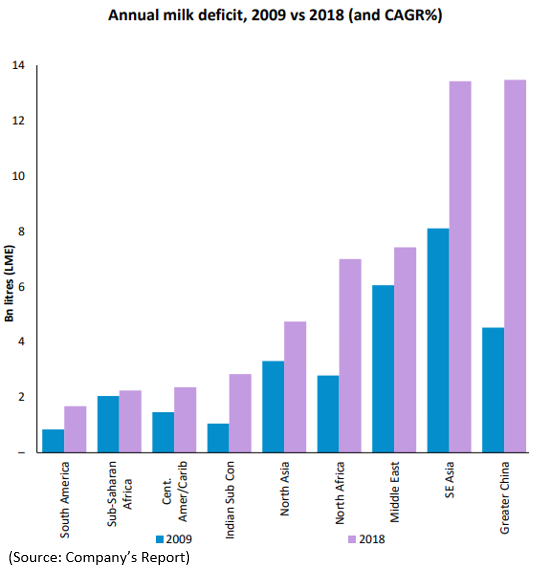

As per the companyâs outlook, FNP is witnessing strong demand from its business activities in Australia, Southeast Asia and China, with extreme demands in cereal and snacks, dairy and plant-based beverage. Its vital brands âAustraliaâs Ownâ and âFreedom Foodsâ, with its innovation and manufacturing competences in Australia and international markets, is expected to drive better returns and yield value for shareholders.

Timetable of Key Events

Timetable of Key Events

On the stock information front, FNPâs shares have been placed in halt at the companyâs request until it releases an announcement about the outcome of institutional component of the entitlement offer.

The stock of Freedom Foods last traded at $4.800, with a market capitalisation of $1.18 billion (As on 22 May 2019). Its current PE multiple stands at 79.60x, and its last EPS was noted at $0.060. Its 52 weeks high price stands at $7.00, with an average volume of 287,542 (yearly). Its absolute returns for the past one year, six months and three months are -13.82%, -2.04%, and 3.67%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.