Alkane Resources Limited (ASX: ALK) is engaged in the business of mining, production and exploration of gold and other minerals. In the release dated 17th May 2019, ALK mentioned about the confirmation of the significant gold mineralisation, which is located at the southern part of El Paso prospect with additional RC and diamond core drilling over a strike length of 480 metres.

The El Paso prospect, which is located 7 km to the south of Tomingley Gold Operations processing facility. Alkane also pointed out that together with the Roswell and San Antonio prospects, there is a cumulative strike length of 2,500 metres of gold mineralisation within 8 km of Tomingley Gold Operations.

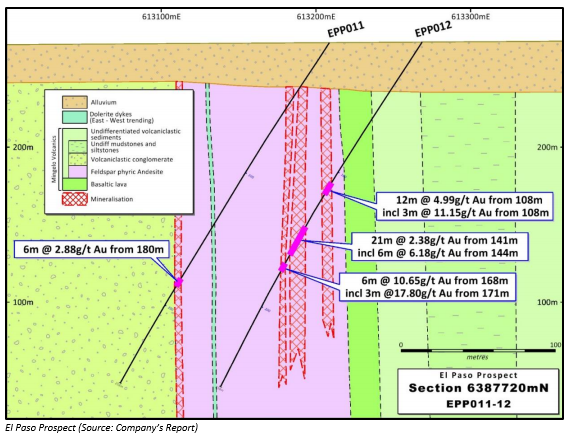

The RC drilling results for the El Paso prospect, which intersected significant gold mineralisation, include intercepts of EPP012 12 metres grading 4.99g/t Au from 108 metres, including 3 metres grading 11.15g/t Au from 108 metres; 21 metres grading 2.38g/t Au from 141 metres, including 6 metres grading 6.18g/t Au from 144 metres; and 6 metres grading 10.65g/t Au from 168 metres, including 3 metres grading 17.80g/t Au from 171 metres.

ALK highlighted the significant broad high-grade results reported for the Roswell and San Antonio prospects, which are located at 3 to 4 km south of the Tomingley Gold Operations. Part of the recent program assay results were received from 10 RC drill holes completed at El Paso prospect, which is ~7km from TGO.

El Paso prospect has been predominantly tested by nominal 200 metre spaced air core drilling traverses and four diamond core drill holes with mineralisation. The mineralised bedrock has been covered to the south by 25 metres thick cover.

In another update, ALK stated that Calidus (ASX: CAI) has raised $2.16 million by strategic placement at a premium to the market price. CAI also reported the strategic placement of 80 million shares at an issue price of 2.7c per share. Additionally, the new shares have been priced at 13% premium to the closing price of 2.4c as on 29th April 2019.

The funds by capital raise, along with CAIâs current cash position, provided enough funding for the company to complete the pre-feasibility study. Additionally, the proceeds also allowed drilling of regional targets and resource infill and extensional areas.

In Q1 FY19 update, ALKâs cash, bullion and listed investment stood at $78.8 million, which includes $72.4 million in cash, bullion on hand at the fair value of $1.8 million and $4.6 million of listed investments (at market value).

On the price-performance front, at market close on 17th May 2019, the stock of Alkane Resources was trading at $0.220, up 4.762% with a market capitalisation of $106.28 million. The stock has yielded a YTD return of 5.00% and exhibited negative returns of 8.70% and 10.64% over the past six months and one-month period, respectively. Its 52-week high price stands at $0.310 with a 52-week low price of $0.180.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.