Highlights

- VRX Silica Limited (ASX:VRX) is committed to operating its business in a low carbon manner.

- The Company intends to contribute to a net-zero future via supply of the ultra-clear glass market for use in solar panels.

- VRX Silica is investigating different ways to reduce GHG emissions from its projects.

Australia-based VRX Silica Limited (ASX:VRX) aims to reduce risk, build resilience in its operations, and drive long-term, sustainable value for its stakeholders. Towards this end, the Company has committed to operating its business in a low carbon manner and in line with high standards of environmental, social and governance (ESG).

VRX Silica plans to use all available opportunities to lessen emissions and greenhouse gases produced from operating its projects. The Company’s intention is to reduce net greenhouse gas emissions to minimise the risk of environmental harm associated with climate change and maintain air quality so that local environmental values are protected.

Reaching net-zero

Although VRX Silica has planned to sell silica for a variety of different uses, it will contribute to a net-zero future via supply of the ultra-clear glass market for use in solar panels. To reach net-zero emissions, a rapid scale-up of already commercial clean energy technologies, such as solar and wind, is required.

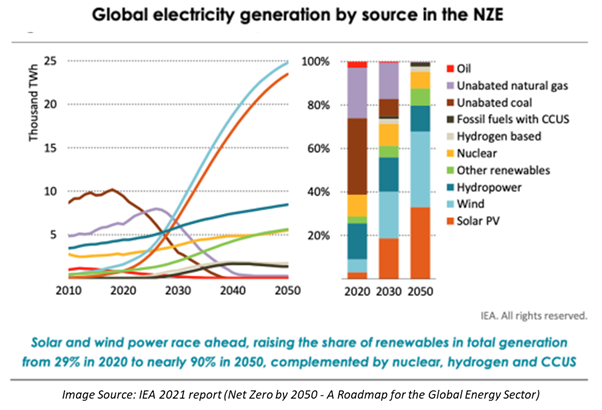

In its Net-Zero Emissions by 2050 Scenario (NZE), the International Energy Agency (IEA) outlined that the global energy sector will need to be based largely on renewables, with solar the single largest source of supply to reach net-zero by 2050. IEA further highlighted that solar technologies – solar photovoltaic (PV) electricity and concentrating solar power (CSP) - need to contribute over 30 per cent of global energy to reach net-zero.

As competitiveness continues to improve, solar technology is expected to require an average annual growth of 15% between 2020 and 2030. The net-zero pathway calls for annual additions of solar PV to reach 630 gigawatts by 2030 (134GW was added in 2020), which is equivalent to installing the world’s current largest solar park roughly every day. Achieving this cleaner, healthier future will rely on quality, reliable and affordable sources of silica and glass for solar panel production.

VRX Silica believes that the grain size and quality of the Muchea project’s sand is suitable for the ultra-clear glass market for use in solar panels.

Related Read: VRX Silica tapping solar panel market via high-grade Muchea project

Reducing greenhouse gas emissions

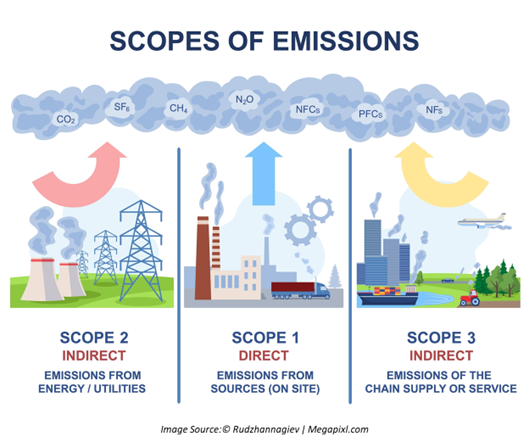

VRX Silica is focused on reducing its carbon footprint by cutting emissions at its mine sites. It is investigating several ways of doing this to ensure it can lessen Scope 1, 2 and 3 emissions where possible. The Company conducted a carbon lifecycle analysis for estimated greenhouse gas (GHG) emissions at its Arrowsmith North project in FY 2021.

In 2021, the silica sand explorer engaged Preston Consulting Pty Ltd to assist with project approval processes at Arrowsmith North. In August 2021, Preston commissioned Kewan Bond Pty Ltd to calculate the estimated GHG emissions associated with the project.

The assessment showed that the project will generate an average of 19,444 tonnes and 56,708 tonnes of carbon dioxide equivalent (tCO2-e) of Scope 1 and Scope 3 emissions each year, respectively. This was based on the assumption that the project will produce 1 million tonnes of silica per annum (Mtpa) for the first three years and then rise to 2 Mtpa during its 30-year lifespan.

Good Read: What is VRX Silica (ASX:VRX) doing to include sustainability in its operations?

While Scope 3 emissions are expected to be predominately from shipping product to Asia, the primary sources of Scope 1 emissions are anticipated to be the consumption of electricity and diesel to operate the plant and machinery. No Scope 2 emissions are expected from the consumption of grid-sourced electricity.

To reduce GHG emissions further, VRX Silica is investigating the potential for deploying a hybrid on-site gas-fired, solar and wind power plant and short-term battery storage.

All in all, VRX Silica is incorporating forward-thinking approaches to sustainability into its operations to ensure the Company leverages the opportunities associated with the transition to a low carbon future. It is making significant progress towards sustainable development while operating in line with relevant sustainability policies.

As of 11:09 AM AEST, VRX Silica shares are trading at A$0.162.

Must Read: VRX Silica (ASX:VRX) achieves several milestones in March 2022 quarter