Highlights:

- Raiden Resources (ASX:RDN|DAX:YM4) has unveiled high-grade & broad zones of Ni-Cu-PGE sulphide mineralisation from the last set of drill assays.

- The company completed a total of 39 diamond holes for 4,204m at Mt Sholl.

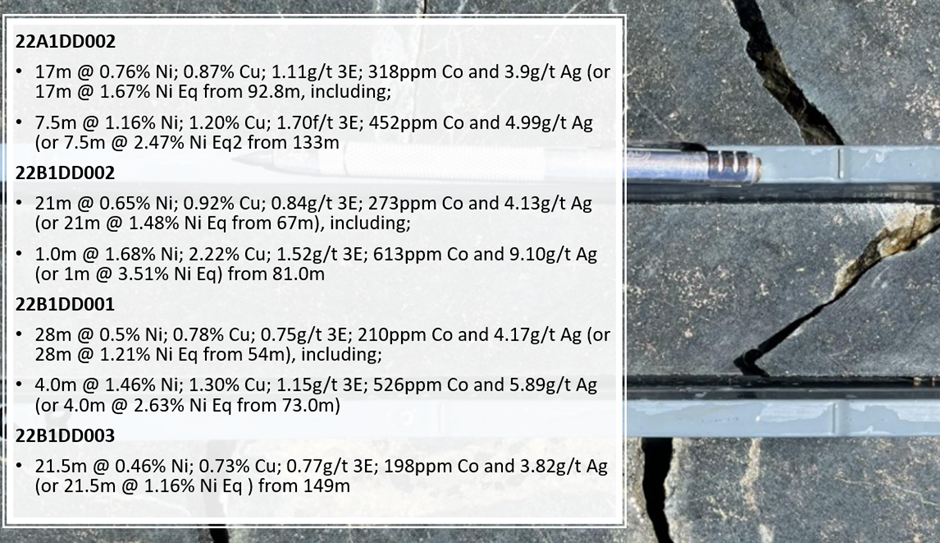

- Significant intercepts include:

- 17m @ 0.76% Ni; 0.87% Cu; 1.11g/t 3E; 318ppm Co and 3.9g/t Ag from 22A1DD002 (or 17m @ 1.67% Ni Eq from 98.2m)

- 21m @ 0.65% Ni; 0.92% Cu; 0.84g/t 3E; 273ppm Co and 4.13g/t Ag from 22B1DD002 (or 21m @ 1.48% Ni Eq from 67m)

- 28m @ 0.5% Ni; 0.78% Cu; 0.75g/t 3E; 210ppm Co and 4.17g/t Ag from 22B1DD001 (or 28m @ 1.21% Ni Eq from 54m)

- 5m @ 0.46% Ni; 0.73% Cu; 0.77g/t 3E; 198ppm Co and 3.82g/t Ag from 22B1DD003 (or 21.5m @ 1.16% Ni Eq from 149m)

- The results continue to correlate with historical drilling and indicate that all deposits remain open in multiple directions.

- RDN expects to finalise the modelling of an updated MRE under JORC (2012) in the first quarter of 2023.

Raiden Resources Limited (ASX:RDN|DAX:YM4) has received the final batch of assay results from the recently concluded maiden drilling program at Mt Sholl. The company has highlighted obtaining high-grade and broad zones of Ni-Cu-PGE sulphide mineralisation in the last batch.

The mineralisation styles included massive, semi-massive, stringer and disseminated mineralisation within a primarily gabbro/dolerite host, bounded by basalt flows above and below the mineralisation.

The data also highlighted that the sulphide mineralisation consisted largely of fine-grained pyrrhotite, chalcopyrite and pentlandite.

A few of the notable intercepts are as follows:

(Image source: Company update, 19 December 2022)

Excellent opportunity to define further, near-surface mineralisation

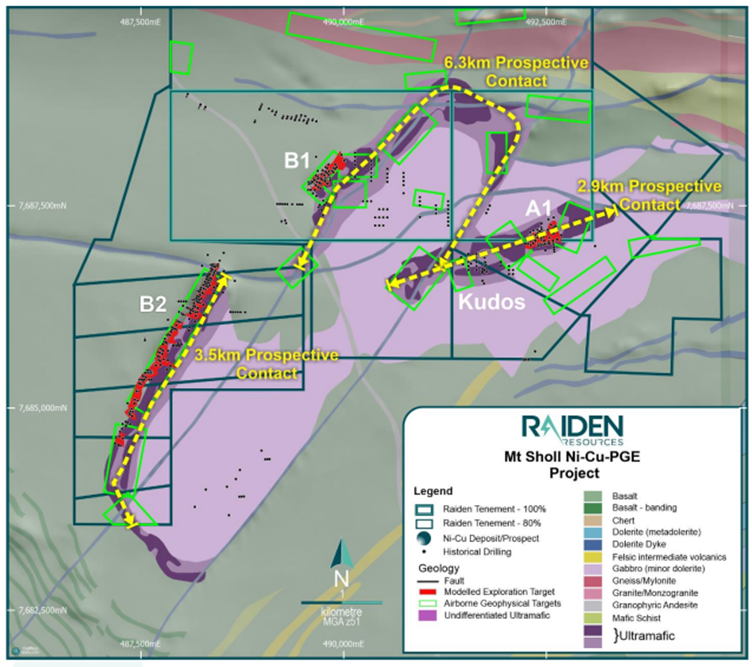

The 2022 drilling campaign, which completed a total of 39 diamond holes for 4,204m, focused on three deposits - A1, B1 and B2 across the project.

As per the company, the mineralisation at the three deposits remains open in multiple strike directions and to depth, with the results continuing to correlate with historical drilling.

The prospective contact between the deposits' layered intrusive host rocks and the surrounding country rock extends for 10.5 kilometres across the project area. However, to date, only approximately 4.3km of this contact that extends out and down from known mineralisation is drill tested.

The company believes that this unexplored nature represents an excellent opportunity for further defining the near surface mineralisation on the project, which covers a total land area of 42km2.

(Image source: Company update, 19 December 2022)

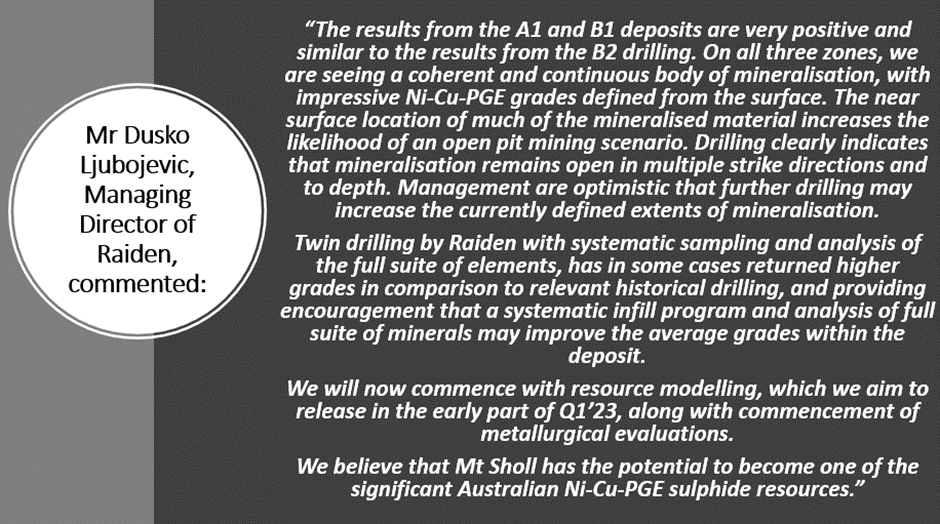

Modelling of an updated mineral resource estimate expected in early Q1

Raiden is currently working on modelling of an updated mineral resource estimate under JORC (2012), which is expected in the early part of the first quarter of 2023.

Moreover, the company plans to commence metallurgical evaluations. The company has already finalised LiDAR survey of the Mt Sholl deposit areas.

This is what Dusko Ljubojevic, Managing Director of Raiden, said among other things:

(Source: © 2022 Kalkine Media®, data source: Company update, 19 December 2022)

RDN shares were trading at AU$0.005 midday on 21 December 2022.