Highlights

- Raiden (ASX:RDN|DAX:YM4) saw an action-packed September quarter at its flagship Mt Sholl project.

- The quarter saw a heritage survey and maiden drilling over Mt Sholl, as well as divestment of a non-core tenement at Myrnas Hill.

- Initial drilling confirmed high-grade nickel-copper sulphide mineralisation from the initial four drill holes on Mt Sholl.

- The company closed a placement raising AU$1.5 million before costs.

Raiden Resources Limited (ASX:RDN|DAX:YM4) continues to undergo a slew of developments at its flagship Mt Sholl Ni-Cu-Co-PGE Project, with the last quarter brimming with exploration success. The company’s key focus during the quarter ended 30 September 2022 was on a maiden drilling program across the project. The first set of drilling results has confirmed nickel-copper sulphide mineralisation on Mt Sholl.

Moreover, Raiden divested its non-core tenement at Myrnas Hill in a cash and share deal during the reported period, in line with its focus on advancing its flagship Mt Sholl Ni-Cu-Co-PGE and Arrow gold projects. The company is in discussions with potential partners to collaborate or divest other non-core assets within its portfolios in Australia and Europe.

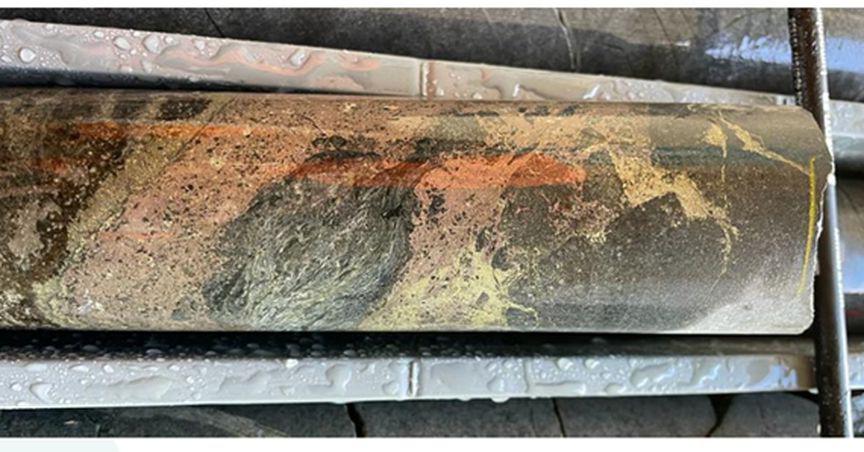

Visual sulphide mineralisation on all drill holes at Mt Sholl

The period saw extensive exploration activities across the company’s flagship Mt Sholl Ni-Cu-Co-PGE project. The company wrapped up a heritage survey for planned drilling targets at Mt Sholl.

Raiden engaged Topdrill as its diamond drilling contractor, and the maiden drilling campaign over three historical deposits, A1, B1, and B2, at Mt Sholl commenced in September.

Drilling program objectives (Image source: RDN update)

Till September, the company received data for the initial four drill holes with all intersecting near-surface, broad zones of nickel-copper sulphide mineralisation at the B2 deposit.

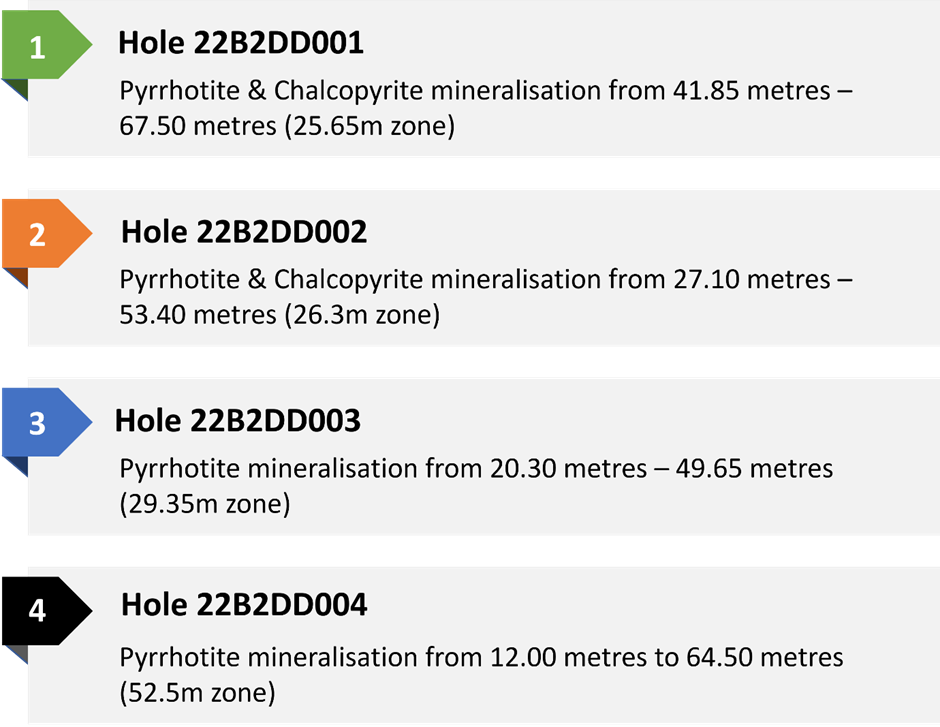

A few of the highlighted results from the initial four drill holes are shown below:

- Massive, semi-massive and disseminated nickel and copper bearing sulphide mineralisation intersected over significant widths and at shallow depths

- The logging results indicated the presence of pentlandite, pyrrhotite, and chalcopyrite.

Mineralised intervals are briefly summarised below:

Data source: RDN quarterly update

Raiden wrapped up the drilling program by October end. The drilling program comprised 39 diamond holes for 4,204 metres across the three deposits: A1, B1 and B2. All these holes have intercepted sulphide mineralisation that is visually massive and exists as disseminated Ni-Cu-bearing sulphide.

The company is expecting assay results from the remaining holes on a consistent basis from the first week of November onwards.

Raiden boosts financial footing

Raiden received strong support for its share placement & underwritten loyalty option placement, designed to raise ~AU$1.83 million.

The share placement comprises two tranches, as highlighted below:

Source: © 2022 Kalkine Media®, data source: RDN update

The placement applicants will also receive one free attaching option for every two and half placement shares subscribe for under the placement. The options, expiring on 30 November 2024, are exercisable at 1.5 cents each.

As per the company, the loyalty option is expected to raise AU$326,488 before costs by offering a one-for-five loyalty option at a price of AU$0.001/option to all eligible shareholders.

The company and its subsidiaries ended the quarter with AU$0.59 million in cash reserves.

RDN shares traded at AU$0.008 on 07 November 2022.