Highlights

- Jindalee is boosting its project portfolio with an 80% interest in the Deep Well Project in Western Australia.

- Dynamic Metals, a spinoff entity, is acquiring the stake from M61 Holdings for AU$270,000.

- The project will be part of Dynamic’s existing strong battery metals pipeline after its proposed listing on the ASX.

- The project holds prospects for mafic intrusive related nickel, copper, and platinum group elements with a rock chip anomaly exceeding 6km.

Jindalee Resources Limited (ASX: JRL), an exploration company committed to repositioning itself as a pure-play US lithium developer, has upped its battery metals game.

The company’s 100%-owned subsidiary Dynamic Metals Limited has signed a binding term sheet in order to purchase an 80% interest in the Deep Well Project from M61 Holdings Pty Ltd.

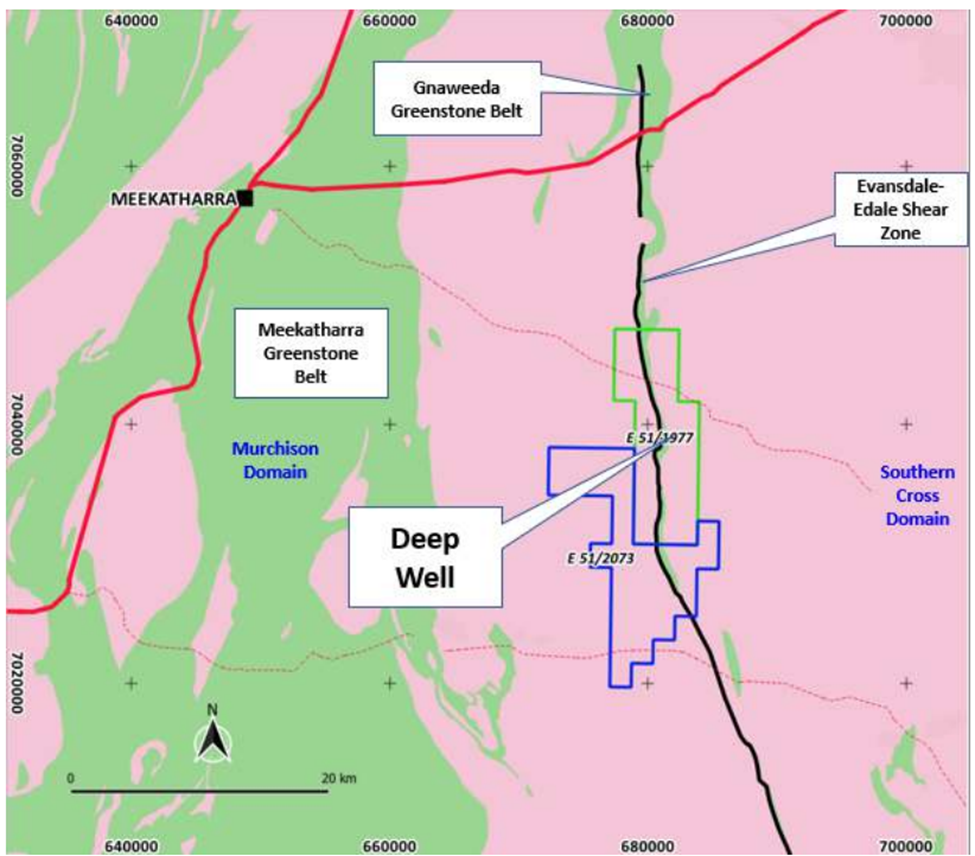

The project sits within the Murchison Province of the Eastern Goldfields of Western Australia, nearly 35km ESE of Meekatharra. The company opines that Deep Well is complementary to its Widgiemooltha and Lake Percy nickel, lithium, and gold projects.

Key details of the option agreement

The total consideration is valued at AU$270,000, of which AU$70,000 is payable in cash and AU$200,000 in Dynamic shares (based on the issue price of Dynamic’s listing on ASX and 12‑month escrow).

It is to be noted that the official listing of Dynamic Metals on the ASX is conditional on and subject to ASX’s satisfaction that Dynamic has a structure and operations suitable for a listed entity and ASX’s absolute discretion.

As part of the agreement, Dynamic will be funding and managing exploration at Deep Well with M61 Holdings’ interest carried to the completion of a definitive feasibility study.

Early-stage exploration results from the project have demonstrated geochemical indicators from gossans that

- hold prospects for massive sulphide nickel, and

- have never been drill tested.

Jindalee to transfer its Australian assets to Dynamic

For the separation of its Australian assets, Jindalee’s plans to transfer its Australian assets into Dynamic which is planned to list via an initial public offering of securities.

This process is well advanced, and subject to final board and regulatory approvals, the company intends to seek shareholder approval for the transfer of its Australian assets to Dynamic at its forthcoming annual general meeting.

Deep Well Ni, Cu, and PGE Project

Deep Well, which is an exploration project, holds prospects for mafic intrusive nickel, copper, and platinum group elements (PGEs). The project covers granted exploration licence E 51/1977 and a contiguous exploration licence application E 51/2073 (tenements) 35km ESE of Meekatharra.

The tenements span across the southern extension of the Gnaweeda greenstone belt (GGB), located east of the Meekatharra greenstone belt of the Murchison Province. The GGB comprises several mapped greenstone enclaves spanning over a strike of more than 30km along the Evansdale-Edale Shear Zone (EESZ).

The EESZ is a crustal-scale structural break with a strike length of several hundred kilometres between the Murchison and Southern Cross Domains within the Youanmi Terrane. The GGB is up to 10km wide in the northern part of the belt, and it decreases to a width of less than 1km towards the south and within the area covered by the tenements. The surface geology is highly weathered and concealed by transported cover in places. The following image shows the regional geology of the project:

Source: Company update

In E51/1977, several mafic-ultramafic bodies with surrounding sedimentary rocks are entrained within the EESZ and are associated with high-amplitude magnetic anomalies.

Reconnaissance work in the past by M61 Holdings

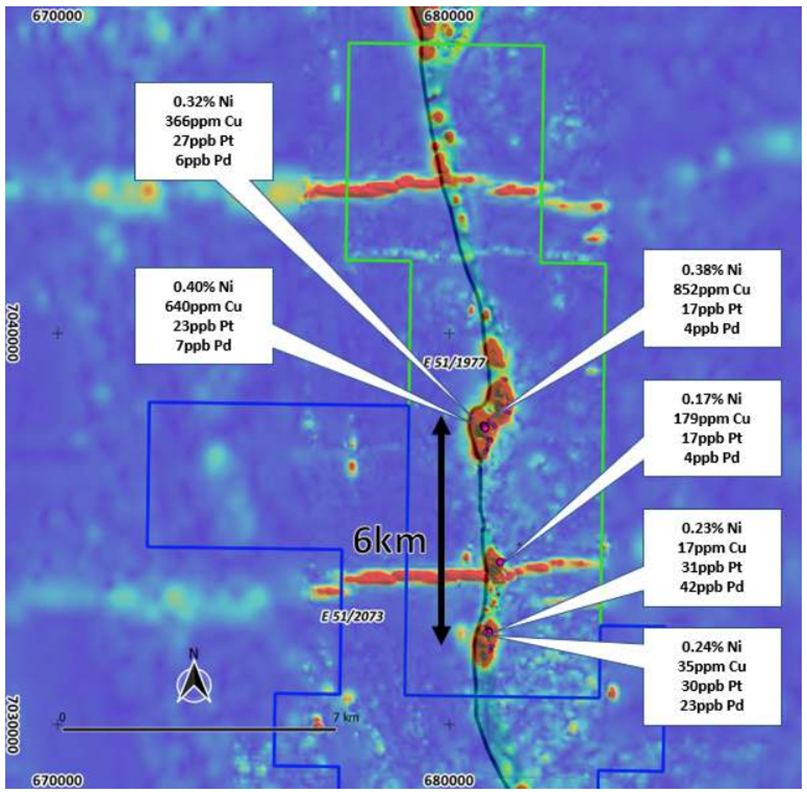

In 2021, M61 completed reconnaissance work involving the collection of 63 gossan, laterite, saprolite, and drill chip spoil pile samples in areas that were coincident with these magnetic anomalies. Upon being analysed for precious metals and a multi-element suite, the rock chip samples returned a series of strongly anomalous nickel, copper, platinum, and palladium results associated with gossanous material over a 6km strike length.

Some of highlights from the sampling are shown in the following image:

Source: Company update

In addition to that, upon examining 10 samples for whole-rock geochemistry, results with up to 30% MgO were obtained, thereby indicating an ultramafic protolith.

Jindalee believes that the initial geochemical results from the sampled gossans

- have been highly encouraging, and

- could be the surface expression of a mafic intrusive related nickel, copper, and PGE sulphide system that has never been drill-tested.

The way ahead

As mentioned earlier, Jindalee says Deep Well is complementary to its already existing Western Australian battery metals exploration target pipeline. In addition, the company says that the project will progress further upon the successful proposed listing of Dynamic Metals Limited on the ASX.

JRL shares were trading at AU$2.240 midday on 21 October 2022.