Highlights:

- Haranga Resources (ASX:HAR FRA:65E0) is progressing on schedule with maiden drilling at its Senegal uranium project.

- The company has completed 16 diamond drilling holes for 1,920 m in the northern and southern portions of the Saraya project.

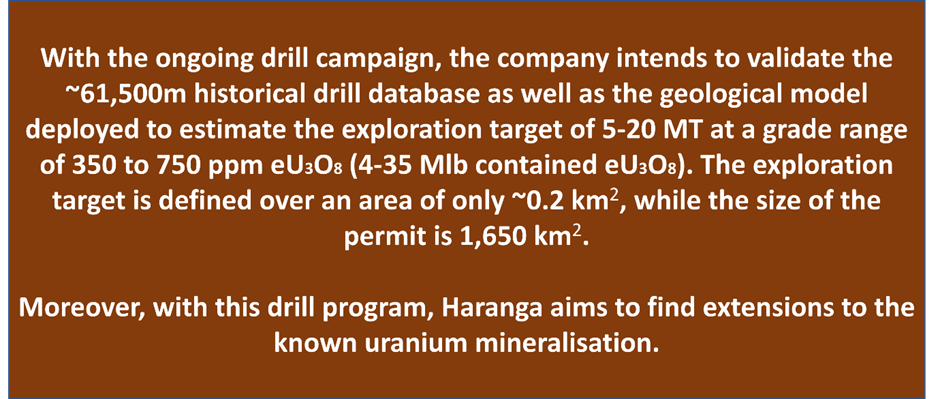

- The drilling campaign aims to validate the historical drill database and to find extensions to the known uranium mineralisation.

- All holes drilled have intersected potential mineralisation zones that correlate well with known historical mineralisation.

- The company is yet to receive assay results for the drill campaign completed.

- HAR intends to convert the exploration target to a maiden Mineral Resource classified under the JORC Code (2012) in Q1 2023.

ASX-listed uranium and gold-focused company, Haranga Resources Limited (ASX:HAR FRA:65E0) has shared an update, that maiden drilling at its Saraya uranium prospect in Senegal is advancing as planned.

The company plans to release the data for its consultants to carry out independent validation of the historical drill database obtained earlier this year following the completion of drilling in the northern and southern areas of the Saraya prospect, and on receipt of results from Terratec.

Data source: HAR update

Haranga eyes maiden mineral resource estimate in Q1

All the planned drill holes have been competed in the northern and southern portions of the Saraya Prospect with the drilling program reaching 2,000 metres.

To date, all holes, drilled and logged in the latest drill program, have hit potential mineralisation zones, aligning well with historical mineralisation. However, the assay results are yet to be received.

The results from down-hole geophysical surveys will be sent for processing to Terratec in Germany. Also, selected intervals of half-core drill samples are being cut for dispatch to an accredited international laboratory for uranium analysis, to regulate the tests used in the geophysical down-hole surveys.

Haranga plans to update on the outcomes once all results are received and processed. Then, the company intends to move forward to establishing a geological domain model supporting a future mineral resource classification as per the JORC Code (2012).

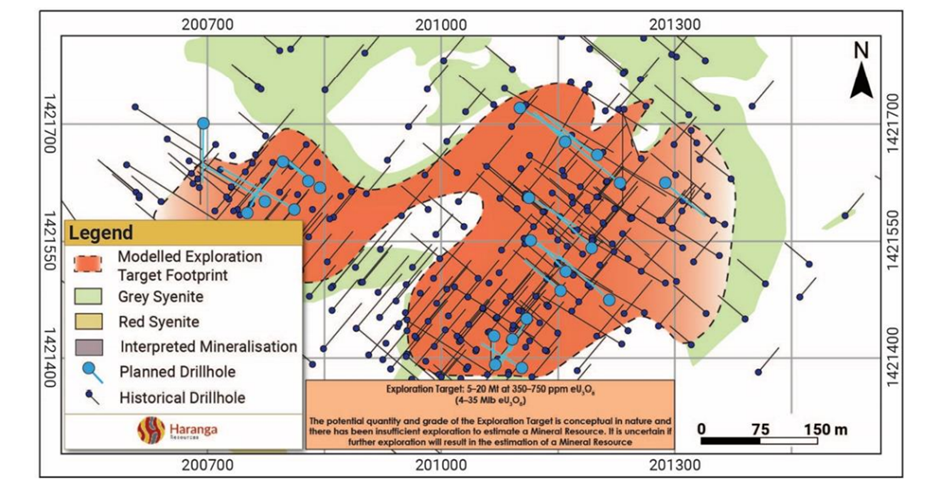

Saraya Prospect – Interpreted Plan Map of Uranium Mineralisation within Syenite and Planned Verification Drillholes

Under the remaining drill campaign, Haranga plans to complete 7 drillholes for 1,050 metres during late-2022 and early 2023. However, this plan is subject to drill rig access. The company has allowed flexibility in the drilling contract to expand the drilling campaign beyond the planned 3,200 metres. The goal is to stretch on the known mineralisation at the Saraya prospect and/or to probe any new targets identified.

Haranga is also progressing well with a permit-wide termite mound sampling program across the entire 1,650km2 permit. The company’s technical team is likely to interpret and infill any delineated uranium anomalies in the large Saraya uranium licence to firm up more drill targets.

After obtaining all the results, the company aims to convert the exploration target to a maiden Mineral Resource classified in accordance with the JORC Code (2012) by late February or early March. However, this depends on timing of receipt of results.

Infill sampling at Ibel South gold project

Haranga is also undertaking infill sampling at its highly prospective Ibel South gold project.

This is what Haranga Non-Executive Chairman Michael Davy said amongst other things