Highlights

- CHM Board and management team have committed to the placement of AU$1.04 million, with over 22.6 million new shares (fully paid) to be issued

- Eligible shareholders of CHM can partake in the share purchase plan, which closes on 2 June 2023

- Chimeric intends to use the funds to continue advancing on its cell therapy development programs

Australia's listed cell therapy company Chimeric Therapeutics (ASX: CHM) has announced capital raising, with AU$1.04 million through a placement and AU$5.25 million intended via a share purchase plan. For the former, CHM has received commitments from its board and management team. In the share purchase plan (SPP), Chimeric's eligible shareholders (in Australia and New Zealand) can participate.

The price of new shares under the placement is AU$0.046 per share and this is equal to CHM share’s last close price on ASX on 12 May 2023. The SPP would be at AU$0.04 or 5% discount to the 5-day Volume-Weighted Average Price (VWAP) up to the SPP closing date, whichever is lower.

Source: Company update

Placement

Here, over 22.6 million new shares will be issued at AU$0.046 per share to raise AU$1.04 million (board and management team have committed to this capital raising). The share price of AU$0.046 matches CHM share's closing price on 12 May 2023. Chimeric has said that the placement is subject to approval of shareholders at an Extraordinary General Meeting. The notice of the meeting would be released soon by CHM.

SPP

An additional sum of AU$5.25 million is intended to be raised under the share purchase plan, with shares to be offered to eligible shareholders at AU$0.04 (13% discount to CHM's last traded price, 16.8% discount to 5-day VWAP, and ~25% discount to 10-day VWAP) or at a 5% discount to 5-day VWAP up to and including 2 June 2023 (closing date of SPP). Shareholders in Australia and New Zealand can participate, with application capped at maximum of AU$30,000 per eligible shareholder.

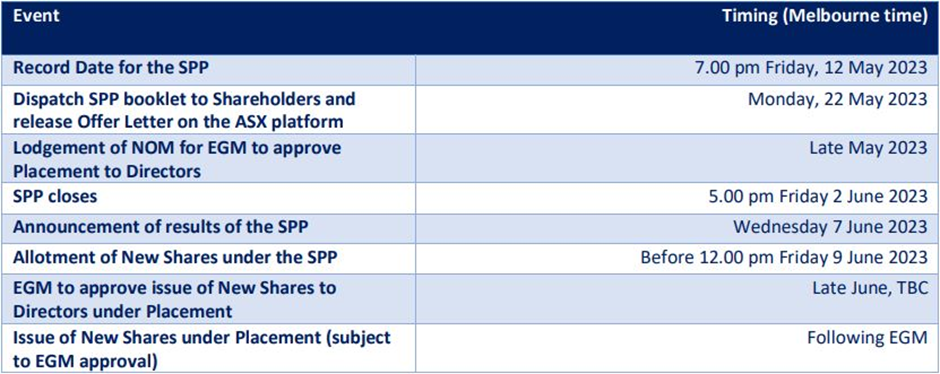

Chimeric has Bell Potter Securities Limited as the Lead Manager for its fund raising exercise. The key dates are in the below picture.

Source: Company update

About Chimeric

The clinical-stage cell therapy company is focused on developing therapies for the treatment of cancer, and its portfolio consists of autologous CART cell therapies and an allogeneic NK cell therapy platform.

Over the past six months, the company has progressed on its CLTX CAR T clinical trial (Phase 1A) in glioblastoma, besides getting the ethics approval for starting the multi-site glioblastoma clinical trial (Phase 1B), completing viral vector manufacturing for CDH17 CAR T and other developments.

Executive Chairman Paul Hooper has said the new capital raising is an “indication of the confidence and potential” in Chimeric’s technologies.