It is a no secret that every investor looks for returns post making his or her investments. Returns can be in the form capital appreciation or dividends paid by the company. Capital appreciation means getting return due to the increase of share price over a span of time. On the other hand, a dividend is a mode of return, where the company declares a share of profit, which is payable to the shareholders. However, the dividend is subject to the discretion of the company as it is not an obligation for the company. Because sometimes the company decides to reinvest the profit in order to provide strength to the business.

The below we discuss few dividend stars of Australian Stock Market, that have consistently pleased the shareholders with the decent set of dividend numbers.

Altium Limited

Altium Limited (ASX: ALU) is in the sales as well as the development of computer software for the designing of electronic goods, the company recently announced that Mitsubishi UFJ Financial Group, Inc. has ceased to become a substantial holder in the company on 15th November 2019. The company was scheduled to conduct its 2019 Annual General Meeting on 6th December 2019. Where the company was primarily considering the following business items:

- To receive the Financial Report, Directorsâ Report as well as Auditorâs Report.

- The company will be receiving, considering and adopting the Remuneration Report of the Company for the financial year ended 30th June 2019.

Financial Performance in FY19

- For the financial year ended 30th June 2019, the company achieved outstanding revenue growth throughout all business units as well as all key regions of 23% and the figure stood at US$171.8 million.

- The company expanded profit margins to record levels with a rise of 41% in net profit after tax amounting to US$52.9 million and EPS growth of 41%.

- ALU reported an outstanding performance, where revenue growth of 23% and an EBITDA margin of 36.5% reflects the momentum in its business throughout all key regions as well as all business segments.

Dividend

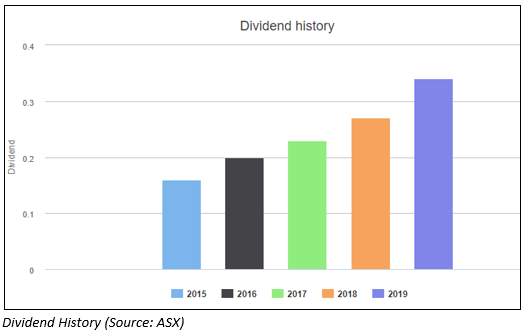

In FY19, the Board of the company has declared a final dividend amounting to $18 cents per share, unfranked, with a rise of 26% in full-year dividends in comparison to the previous year.

However, the dividend has been paid by the company on 25th September 2019. At the current market price of $36 per share, the Annual Dividend Yield of the company stood at 0.94% (as on 7 December 2019).

Also Read A Look At the Electronic Design Software Company, Altium Limited?

The stock of ALU closed the dayâs trading at $36 per share on 6th December 2019, reflecting a rise of 0.139%. The total outstanding shares of the company stood at 130.97 million, and its 52-week low and high is $19.730 and $38.49, respectively. The company has given a total return of -2.8% and 17.49% in the time period of three months and six months, respectively.

Southern Cross Media Group Limited

Southern Cross Media Group Limited (ASX: SXL) is the business of creation and airing of content on free-to-air commercial radio (AM, FM and digital), TV and online media platforms.

Change in Holdings

- The company recently announced that Melanie Willis had made a change to their holdings in the company by acquiring 38,889 fully paid ordinary shares at the consideration of $35,000.10.

- Also, Robert Murray has changed his holdings in the company by acquiring 40,000 fully paid ordinary shares in consideration of $36,100.02.

Highlights of Chairmanâs Speech

- The Chairman stated that during FY19 Southern Cross Austereo delivered a credible result. The company witnessed a rise of 0.5% in revenue, and the figure reached $660.1 million in comparison to the previous year, despite challenging advertising markets.

- Underlying EBITDA witnessed a rise of 0.9% to $159.9 million and underlying net profit after tax was increased by 3.1% to $76.2 million, which was underpinned by disciplined cost control.

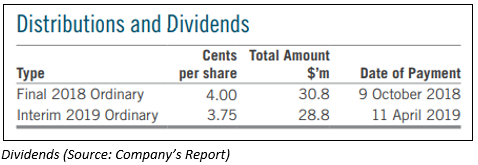

- The Board of the company maintained fully franked dividends amounting to 7.75 cents per share, which is in line with the previous year. This comprises 4.00 cps final dividend and 3.75 cps interim dividend.

Also, Read A Guide to media and advertising industry.

The stock of SXL closed the dayâs trading at $0.875 per share on 6th December 2019, reflecting a drop of 1.68%. The total outstanding shares of the company stood at 684.42 million, and its 52-week low and high is $0.805 and $1.43, respectively. The company has given a total return of -28.57% and 28.28% in the time period of three months and six months, respectively.

As on 6th December 2019 closing price, the shares were trading with a dividend yield of 8.86%.

Whitehaven Coal Limited

Whitehaven Coal Limited (ASX: WHC) is in the development and operation of coal mines in New South Wales with its controlled entities.

The company welcomed FY20 with Decent Numbers

- The company witnessed a rise in safety performance with TRIFR at 5.14 for the twelve months ended September 2019;

- It reported ROM coal production of 4.4Mt, reflecting a rise of 22% as compared to the previous corresponding period. In addition, saleable coal production stood at 4.9Mt, reflecting a rise of 23% during September 2019 quarter;

- The company also executed an agreement with EDF in order to acquire a 7.5% interest of EDF in the Narrabri underground longwall mine which, when completed would increase the companyâs equity ownership level to 77.5%.

Dividends Paid

The company declared an interim dividend of 20 cps in FY19, and totaling to $198 million, which was paid in March 2019. Also, the company declared final dividend amounting to 30 cps totaling to $298 million, which was paid on 19th September 2019.

At the current market price of $2.630 per share, the Annual Dividend Yield of the company stood at 10.65%.

Also Read: How Whitehaven is eying on Asian Thermal Market?

The stock of WHC closed the dayâs trading at $2.63 per share on 6th December 2019, reflecting a drop of 2.23%. The total outstanding shares of the company stood at 1.03 billion, and its 52-week low and high is $2.583 and $4.698, respectively. The company has given a total return of -19.82% and -28.05% in the time period of three months and six months, respectively.

Harvey Norman Holdings Limited

Harvey Norman Holdings Limited (ASX: HVN) principal activities primarily consist of an integrated retail, property, franchise etc.

Aggregated Sales

- The company through a release dated 27th November 2019 reported aggregated sales from 1st July 2019 to 31st October 2019. It was mentioned that sales from wholly-owned company-operated stores in New Zealand, Slovenia, Croatia, Ireland and Northern Ireland, majority-owned controlled company-operated stores in Singapore and Malaysia, and from independent Harvey Norman ®, Domayne ® and Joyce Mayne® branded franchised complexes stood at $2.44 billion, reflecting a rise of 2.0% in comparison to 1 July 2018 to 31 October 2018.

- The company also stated that the amount of aggregated sales had been positively affected by an appreciation of 1.6% in the Euro, a 5.9% appreciation in the Singaporean dollar, a 1.0% appreciation in the UK Pound, a 3.0% appreciation in the New Zealand dollar as well as a 4.5% appreciation in the Malaysian Ringgit for the period as compared to the period 1 July 2018 to 31 October 2018.

Shareholders Return

The Board of directors of the company declared a final dividend amounting to 21.0 cents per share, fully franked, which was paid on 1st November 2019. This took the total dividend for the year ended 30 June 2019 to 33.0 cps, reflecting 96.77% of profit after tax and non-controlling interests.

The stock of HVN closed the dayâs trading at $4.270 per share on 6th December 2019, reflecting a rise of 0.235%. The total outstanding shares of the company stood at 1.25 billion, and its 52-week low and high is $2.984 and $4.667, respectively. The company has given a total return of -1.92% and 4.17% in the time period of three months and six months, respectively.

Spark Infrastructure Group

Spark Infrastructure Group (ASX: SKI) owns a differentiated portfolio of essential service infrastructure businesses.

Debt facility of TransGrid Services

- TransGrid Service, in which Spark Infrastructure Limited holds 15% interest has wrapped up its inaugural debt financing of $355 million.

- BNP Paribas, ANZ, RBC Capital Markets, Société Générale and Mizuho on highly competitive financing terms have provided this 5-year debt facility. TransGridâs advisor for the transaction was RBC Capital Markets.

A look on DRP

- The company mentioned in its half-yearly results release that it has declared an interim distribution for 2019 amounting to 7.5 cents per share.

- This interim distribution was paid on 13th September 2019 and consists of 3.5 cents per share interest on Loan Notes for the 1H FY19 and capital distribution amounting to 4.0 cps.

- The DRP would be used to partially finance the equity component of the acquisition as well as construction of the Bomen Solar Farm.

- In addition, the participating security holders would be issued stapled securities of SKI at a discount of 2.0% to the price, which was specified under the DRP rules

The stock of SKI closed the dayâs trading at $2.050 per share on 6th December 2019, reflecting a rise of 0.49%. The total outstanding shares of the company stood at 1.7 billion, and its 52-week low and high is $2.0 and $2.55, respectively. The company has given a total return of -4.65% and -15.98% in the time period of three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.