Australia And New Zealand Banking Group Limited (ASX: ANZ) has unveiled its FY19 results today. While presenting the results, ANZâs CEO Shayne Elliott informed about the growing improvement in the housing market and warned regarding the challenging trading conditions that are expecting to continue for the foreseeable future.

ANZ FY19 Results

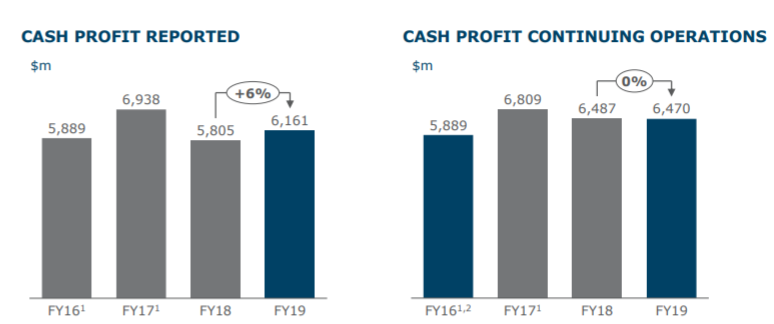

ANZ reported stable earnings for FY19 with 2% growth in earnings per share and 6% growth in net tangible assets per share. ANZâs continuing cash profit was flat at $6.5 billion while its revenue in Australian retail and commercial business was down by $590 million, reflecting margin and fee pressures and some execution challenges.

ANZ witnessed benefits of disciplined growth in Institutional, with cash profit up by 11% and ROE almost 100 basis points higher. During the year, ANZ strengthened its balance sheet by returning $5.6 billion to shareholders while still increasing its capital. ANZâs Common Equity Tier 1 Capital Ratio was stable at 11.4%.

(Source: Company Reports)

Costs of the group were well managed, and even with higher investment, they were down by 1.6% FX adjusted. Credit losses remained low, benefiting from significant work in recent years to de-risk the business. ANZâs mortgage portfolio was down $7 billion for the full year, almost all in interest only loans. In the second half of the year, ANZ significantly improved its home loan assessment times, with better clarity and consistency on policy and risk settings for the front line.

The bank declared a final Dividend of 80 cents per share, partially franked at 70%, taking the full year dividend to 160 cents per share, flat on last year. In making its dividend decision, the Board considered a range of options and the interests of all shareholders, including retail.

As per ANZ Chief Executive Officer Shayne Elliott, despite facing slow economic growth, increased competition, regulatory change and global uncertainty, ANZ was able to deliver ANZ maintained focus on improving customer experience, balance sheet strength and improving its culture and capability.

During the year ANZ took several business initiatives, which include:

- Operational improvements and a targeted marketing campaign which resulted in a greater than 30% increase in average applications for Australian home loans in the most recent half;

- Capital benefits of $2.7 billion through completed sales of OnePath Life to Zurich Financial Services Australia, a 55% stake in ANZâs Cambodian joint-venture to J-Trust, the retail and small business franchise in Papua New Guinea to Kina Bank, and OnePath Life (NZ) to Cigna Corporation;

- During the year, ANZ migrated over 60,000 users onto a new Institutional customer self-service platform, providing access to all transaction accounts, payments and foreign exchange in one place

- Investment spend increased $185 million targeting improvements to customer experience and origination systems, along with meeting increased regulatory and compliance obligations

- New ventures arm, ANZi, invested ~$65 million in emerging growth companies that can help create long-term strategic value.

ANZ is now focused on simplifying key customer and support function processes that represent around 70% of that cost base. The work is coordinated with other priorities, particularly the investment in Australia and while some is already underway, the major execution will start in the new year.

While discussing the results, ANZâs CEO highlighted the bankâs 6 Point Plan, which include:

- Running the business well

- Maintaining discipline within Institutional

- Resolving ANZ challenges in NZ

- Investing to prepare Australia for growth

- Driving further simplification

- Building the teamâs resilience and capability

Outlook

While commenting on the outlook, Mr. Elliott highlighted that although the Australian housing market is slowly recovering, challenging trading conditions are expected to continue for the foreseeable future. She also highlighted that the low interest rates and the weaker global economy mean that growing revenue will be difficult.

ANZ Bank New Zealand Results

ANZ Bank New Zealand reported a statutory net profit after tax of NZ$1,825 million for FY19, down by 8% on last year. ANZ New Zealand Acting Chief Executive Officer Antonia Watson commented that despite the difficult year ANZ New Zealand performed well during the period.

In New Zealand, the Reserve Bank has two major changes on the table: BS11 and the proposed new capital regime. Preparation for BS11 is well advanced but it comes at a cost, which is expected at around $350 million over three years. ANZ NZ has already invested $42 million in FY19, which explains the increase in New Zealand operating expense. BS11 investment is not called out as a large and notable item.

ANZ NZ Results Highlights

- Cash profit up 2% at NZ$1,933 million including impact of one-off items;

- Revenue up 3% including impact of one-off items;

- Customer deposits up 5% and gross lending up 4%

- Expenses increased 5% due to higher regulatory compliance spend;

- KiwiSaver funds under management grew 14% to $14.8 billion

- Ordinary dividend of NZ$375 million paid in March 2019.

At market close on 31 October 2019, ANZ stock was trading at a price of $26.740, down by 3.256% intraday. ANZ has a market cap of around $78.35 billion and total outstanding shares of 2.83 billion. ANZ has a 52 weeks high price of $29.300 and 52 weeks low price of 22.980 with an average volume of 4,662,857. In the last one year, ANZ stock has provided a return of 7.72%.

Peer Analyses

All major four banks of Australia (in terms of market cap) witnessed a fall in the share prices during todayâs trading session.

At market close on 31 October, Westpac Banking Corporationâs (ASX: WBC) stock was trading at $28.210, down by 1.191% intraday. WBC has a market cap of around $99.64 billion and outstanding share of around 3.49 billion. In the past one year, WBC stock has provided a return of 6.37%.

At market close on 31 October 2019, National Australia Bank Limitedâs (ASX: NAB) stock was trading at $28.610, down by 1.106% intraday. In the past six months, NAB stock provided a return of 14.43%.

At market close on 31 October 2019, Commonwealth Bank of Australiaâs (ASX: CBA) stock was trading at $78.660, down by 1.293% intraday, with a market cap of around $141.07 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.