The travel and tourism is one of the largest industries in Australia and has marked the success in tourism growth. This has two major categories of tourism expenditure: Spending by Australian residents within Australia and spending by foreign visitors to Australia. Tourism is distinctive amongst the class of industries as the output is determined by the expenditure in order to measure the GDP growth. Another important aspect to measure the GDP growth is to differentiate between the expenditure evidently.

Let us now have a look at some travel stocks!

Qantas Airways Limited (ASX: QAN)

Qantas Airways Limited (ASX: QAN) is engaged in services related to global and domestic air transportation, the sale of international and domestic holiday tours, along with the related support activities comprising of catering, information technology, ground handling and engineering and maintenance work.

Qantas Group Trading Update Q1 2020

- During the first quarter of FY20, total group revenue went up by 1.8% to $4.56 billion, which was largely driven by the strong Qantas International performance. The group capacity declined by 0.2% which was mainly due to 0.6% fall in Group International, offsetted by the increase in 0.5% growth in the resources market.

- During the quarter, overall travel demand was unexciting and slow demand was seen in the travel sector but a rise in shares were observed in the shares of Qantas. Since the leisure market weakened, Jetstarâs Unit Revenue fell by 2.6% and accounted for most of the RASK decline in Group Domestic.

- The Group profit was affected by the walkout in Honk Kong and deterioration in global trade conditions by $25-$30 million but the continuing capacity reduction will help to minimise its impact in the second half.

- The company has also declared a fully franked dividend of 13 cents per share on 23 September 2019 representing a return of $204 million. Qantas will buy back7 million shares on November 4, 2019 returning shareholders more than $600 million.

Foreign Relevant Interest in Qantas Shares:

Recently, Qantas announced that the foreign persons hold 35.78% in the issued share capital of Qantas and hence meets the MSCI requirement of foreign room of 25%, therefore, it is in a position to qualify for inclusion in the MSCI Global Investable Market Indexes.

Outlook

- The Group has fully hedged its fuel for FY20 with the potential to benefit from substantial price falls. Qantas full year fuel cost is expected to be $3.98 billion based on the jet fuel forward market price of $109 per barrel.

- The company is also expecting an increase in the capacity between 0.5% to 1.0% in both domestic and international flying.

- It is also focusing on dropping the cost and is on path to deliver the $400 million in transformation benefits in FY20.

Stock Performance:

The stock of Qantas last traded at $6.280, slipping by 3.681% from its last close, on 24 October 2019. It is up by 16.22% in the past 6 months. In terms of valuation, the stock traded at a P/E multiple of 11.940x and earned an annual dividend yield of 3.83%.

Flight Centre Travel Group Limited (ASX: FLT)

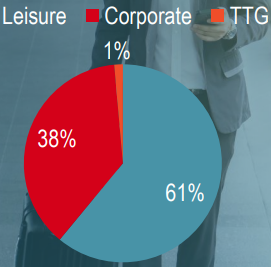

Flight Centre Travel Group Limited (ASX: FLT) is in the business of travel retailing in both leisure and corporate sectors plus in destination travel experience in businesses including tour operators, hotel management, destination management companies and wholesaling.

Full ownership of Ignite travel group:

FLT has boosted its Australian leisure business with the 100% acquisition of the Ignite Travel Group allowing deployment and integration of Igniteâs product suite through FLTâs leisure network.

FCTG Outlines Likely FY20 Trading Patterns

- FLT has logged a robust growth in online leisure sales in Australia during the first quarter of 2020. The top management of the company revealed that online leisure sales in the country had expanded during the three months to September 30, 2019, despite a relatively tricky trading climate, generating a total transaction value of $1.3 billion from its leisure branded websites and dedicated online travel agency brands.

- The management also emphasised the presence in ready-made sector by taking 100% possession of Gold Coast-based Ignite Travel and has revealed plans to export the Ignite model to other FLT geographies.

FY19 TTV contribution

FY20 Outlook

- FLT will release the detailed gross profit in its annual general meeting to be held on November 7, 2019 but mentioned that although the TTV was high, gross profit would be lower than the previous period.

- The company expects strong results in Q2 as trading conditions weakened considerably in Australia, especially within the leisure business.

- Since the company launched a new wage model in October 2018 and paid an additional $4.2 million in wages and witnessed increased consultancy costs, increased costs are expected in the early 2020.

- FLT anticipates lower profits and interest earnings indicating lower yields in Australia, and greater interest repayments since it has used debt to fund new acquisitions.

Stock Performance:

The stock of FLT last traded at $43.470, falling by 0.979 percent compared to its previous close, as on 24 October 2019. It has given a return of -8.20% in the past 30 days. The market cap of the company is $4.44 billion, and the stock traded at a P/E multiple of 16.780x.

Webjet Limited (ASX: WEB)

Webjet Limited (ASX: WEB) is in the business of online sales of travel products including flight and hotel rooms. WEB launched WebBeds in 2013, which is the fastest-growing accommodation supplier to the travel industry.

Impact of Thomas Cook entering Compulsory Liquidation

- Webjet suggested that strong organic growth was being experienced and it projected the WebBeds business to earn an added $27 to $33 million of EBITDA in FY20 from a range of drivers including Thomas Cook. The effect of Thomas Cookâs downfall is anticipated to decrease this prospect by $7 million in EBITDA.

- Thomas Cook will influence the performance of Webjetâs FY20 results as Webjet earlier indicated that it expected to earn $150 to $200 million in Total Transactional Value from Thomas Cook in FY20 and Thomas Cook owed Webjet approximately EUR 27 million in outstanding receivables.

Dividend/Distribution and the notice of AGM:

The Company declared a dividend of 13.5 cents per share on WEB - ORDINARY FULLY PAID which was paid on October 10, 2019 resulting in a full year dividend of 22 cents per share, up by 10% on the prior year.

Also, 2019 Annual General Meeting of Webjet will be held on 20 November 2019 in order to discuss the Financial statements and reports, Remuneration Report, Election of Director etc.

Financial Highlights

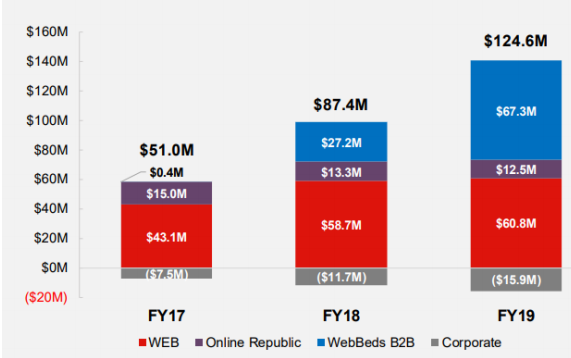

- During the FY19, revenue went up 26% to $366.4 million, EBITDA by 43% to $124.6 million and NPAT up by 46% to $81.3 million.

- WebBeds bookings grew by 51% to over 3.4 million and Webjet OTA flights bookings were over 1.5 million, growing at around two times the Australian travel market in a subdued economy.

WebBeds Highlights:

WebBeds delivered a total of $2.2 billion TTV in FY19 and an EBITDA of $67.3 million. It is a multi service app in China with market cap of USD65Bn and the largest air ticket and hotel provider in India.

EBITDA by business (Source: Companyâs Presentation)

Stock Performance: The Stock of Webjet last traded at $11.030, moving up by 4.057 percent from the last close, as on 24 October 2019, which is close to its 52-week low of $9.980. In terms of valuation, the stock traded at a P/E multiple of 22.550x and earning an annual dividend yield of 2.08%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.