Australia is well-known in the world for its reservoir of resources and minerals. On Australian Securities Exchange, the Energy sector is represented by S&P/ASX 200 Energy index, which is closed in green at 10,904.9, up 10 points or 0.09% (On 20th September 2019). Letâs discuss with examples of some companies and look at how they are performing in the industry:

Liquefied Natural Gas Limited

Liquefied Natural Gas Limited (ASX: LNG) is into the business of natural gas and the portfolio of the company consists of 100% ownership of Magnolia LNG LLC, Bear Head LNG Corporation Inc, Bear Paw Pipeline Corporation Inc and LNG Technology.

Supply Deal to Vietnam

- As per the release dated 16th September 2019, the company in combination with Delta Offshore Energy Pte Ltd announced an alliance for delivering an LNG-to-power project on behalf of the Bac Lieu Provincial Government in Vietnam.

- It was mentioned in the release that the Delta Offshore Energy Pte Ltd led power project, with inclusion of the operation and construction of an LNG import terminal.

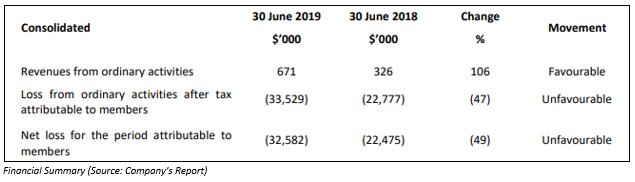

In another update, the company through a release dated 17th September 2019 updated the market with further information on Supply Deal to Vietnam. The company stated that the project is led by Delta Offshore Energy Pte Ltd in fellowship with Magnolia LNG LLC, a wholly owned subsidiary of LNG. The company further added that the announcement of 16th September 2019 has a reference to a term sheet, which is in the form of a memorandum of understanding between Magnolia LNG and Delta Offshore Energy Pte Ltd. The Term Sheet details material terms of the proposed liquefied natural gas sale and purchase agreement having a target commercial start date of no later than 1st January 2024. The following snapshot provides a broad idea of financial performance for the year ended 30th June 2019:

Trading Halt

As per the ASX release dated 16th September 2019, the securities of the company have been under a trading halt until the earlier of the commencement of normal trading operations on 18 September 2019 or when an announcement by the company is released to the market.

When it comes to the price performance of the stock, Liquefied Natural Gas Limited was last traded at a price of A$0.260 per share with a rise of 4% on 20th September 2019. It witnessed a decline of 47.92% in the time frame of six months. On Year to date basis, the stock produced a negative return of 51.46%.

Cooper Energy Limited

Cooper Energy Limited (ASX: COE) secures, finds, develops, produces and sells hydrocarbons. It is also involved in production and exploration of oil & gas.

Offshore exploration permit

- The company through a release dated 17th September 2019, announced that it has been awarded with the offshore exploration permit VIC/P76 in the Otway Basin.

- It was mentioned in the release that the permit for new exploration is being surrounded by gas fields and adjoining Annie-1 gas discovery

- It added that there were no previous wells drilled within the permit area. Good quality 3D seismic identified drill-ready target like Annie

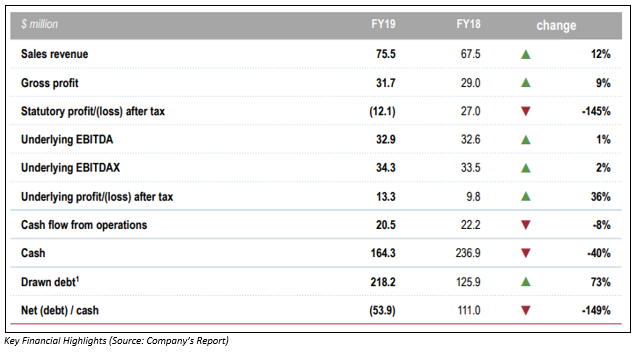

Financial Performance:

- The company has recently released its full year 2019 results, wherein it communicated about the operational and financial performance for the period:

- The company delivered a statutory net loss after tax amounting to $12.1 million, which represents a decline from the net profit after tax of $27.0 million of previous year.

- For the twelve months to 30 June 2019, the underlying profit after tax witnessed a rise of 36% and the figure stood at $13.3 million as compared with $9.8 million in the year-ago period. This growth was the result of increased revenue generation from gas supplies.

- The cash flow from operating activities stood at $20.5 million, reflecting a decline of 8% in comparison to the previous yearâs comparative of $22.2 million.

When it comes to the price performance of the stock, Cooper Energy Limited was last traded at a price of A$0.615 per share with a decline of 1.6% on 20th September 2019. It witnessed a rise of 19.05% in the time frame of six months. On Year to date basis, the stock produced a return of 45.35%.

New Hope Corporation Limited

New Hope Corporation Limited (ASX: NHC) is into exploration of coal as development of Queensland project. It has a market capitalisation of A$2.01 billion as on 20th September 2019.

A look at financial performance:

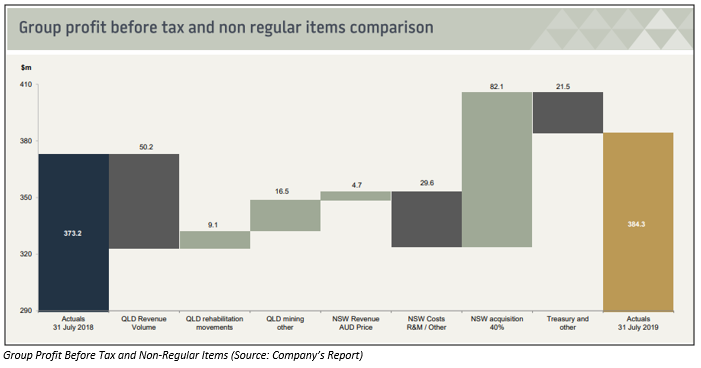

The company recently announced its full year 2019 financial results, wherein it discussed about its operational and financial performance for the period:

- The company stated that it has reported best full-year profit before non-regular items in its history amounting to $384 million, reflecting a rise of 3% on previous comparable period.

- It generated revenue from operations totaling to $1,306 million with a rise of 21% on previous corresponding period.

- It added that these results have been possible as the company witnessed improved share of coal sales from the Bengalla Joint Venture.

- The net cash generated from operating activities stood at $510 million.

Operational Performance

- The company stated that it was having a major focus on the integration of Bengalla into the New Hope business during 2H FY19.

- The company recognised opportunities for learning and continuous improvement and actioned through a range of cross functional teams and forums.

The Board of directors of the company have declared a final dividend amounting to 9.0 cents per share, fully franked, reflecting a rise of 13% on final dividend paid last year. This brings the full year dividends to increase of 21% as compared to 2018 and the figure stood at 17.0 cents per share.

Debt Facility

- During financial year 2019, New Hope Corporation Limited entered an amortising secured loan facility with a syndicate of Australian and international banks, which was amounted to $600 million. NHC added that it was debt free since 2006 prior to the draw down for the Bengalla acquisition.

- As at 31st July 2019, the net debt of the company stood at $301.2 million.

When it comes to the price performance of the stock, New Hope Corporation Limited was last traded at a price of A$2.350 per share with a decline of 2.893% on 20th September 2019. It witnessed a decline of 37.79% in the time frame of six months. On year to date basis, the stock generated negative return of 26.44%.

Whitehaven Coal Limited

Whitehaven Coal Limited (ASX: WHC) operates of coal mines in New South Wales (NSW) It also develops coal mines in the same region. The company recently announced that Prudential Plc and its subsidiary companies have ceased to become a substantial holder in the company on 12th September 2019. In another update, the company announced that it will be conducting its 2019 Annual General Meeting on 17th October 2019.

Acquisition of 7.5% Interest

- On 22nd August 2019, the company announced that it has entered into an agreement in order to acquire a 7.5% interest in the company-operated Narrabri Mine.

- It was mentioned in the release that as a result the company would own 77.5% of the mine, which is subject to other joint venture partners in the mine not exercising their pre-emptive rights.

- The consideration for the acquisition stood at US$72 million, with US$17 million payable on completion of the transaction and the pending amount of US$55 million will be payable over five years.

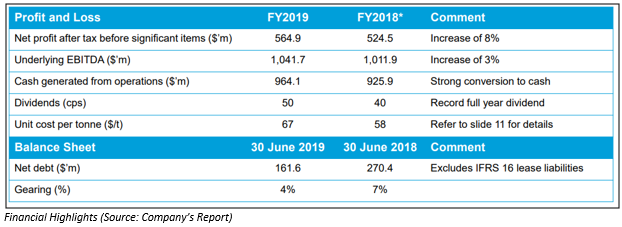

Consolidated Financial Performance

- When it comes to the financial side of things, the company delivered a record net profit after tax (NPAT) before significant items amounting to $564.9 million for FY19.

- The sales revenue of the company stood at $2,487.9 million, reflecting an increase of 10.2% year over year.

- The company witnessed a rise of 3% in underlying EBITDA and the figure stood at $1,041.7 million.

Operational Performance

- In the financial year 2019, the company produced a record 23.2Mt of ROM coal on a managed basis.

- The company added that this record production has been achieved with an improved total recordable injury frequency rate of 6.2 for the same period.

The Board of the company has proposed a dividend of 30 cents per share to shareholders. This was comprised of an ordinary dividend of 13 cents per share, franked to fifty per cent as well as a unfranked special dividend of 17 cps

The company reported gross margin and EBITDA margin of 54.6% and 59.1% in FY19 as compared to the industry median of 50.4% and 38.4%, respectively. The return on equity of the company stood at 15.1% in FY19 against the industry median of 13.4%. The current ratio of the company stood at 1.25x with Y-o-Y growth of 33.5%. This implies that the company is in a sound position to meet its short-term obligations.

When it comes to the price performance of the stock, Whitehaven Coal Limited was last traded at a price of A$3.260 per share with a decline of 1.807% on 20th September 2019. It witnessed a decline of 15.75% in the time frame of six months. On Year to date basis, the stock generated negative return of 17.03%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.